7 facts about the BTC to ETH swaps surge by crypto whales: here’s how it affected them!

Jakarta, Pintu News – Swap activity between Bitcoin (BTC) and Ethereum (ETH) has been in the spotlight in the cryptocurrency market recently, after it was observed that large whales swapped large amounts of BTC to ETH, indicating a change in risk appetite amid a prolonged market downtrend.

On-chain data observed by network analysts characterized this phenomenon as a signal that large crypto players are reallocating capital from BTC to ETH as a form of higher risk strategy.

1. Big Whale Swaps 1,969 BTC to 58,149 ETH

According to on-chain data, one whale decided to swap 1,969 BTC into 58,149 ETH worth approximately $181.4 million (±Rp3,021,681,200,000), a phenomenon that has been discussed by market participants. Actions like this reflect higher risk appetite in ETH, despite BTC still being the dominant crypto asset.

This large swap is part of several whale transactions that have continued to take place in recent days, with the same whale also doing another swap of 502.8 BTC into 14,500 ETH.

Large capital movements from BTC to ETH by whales are generally considered an important indicator of changing market sentiment, which can affect the direction of the altcoin season more broadly.

Also Read: Charles Hoskinson Shares Cardano 2026 Big Plan: It’s the Future of ADA!

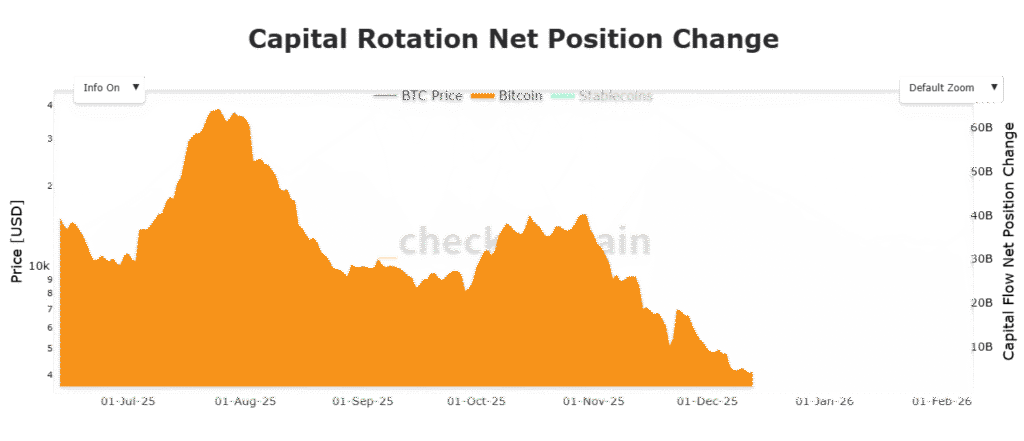

2. BTC Capitalization Shift Declines vs ETH Increases

The capitalization invested in BTC has dropped drastically from its peak of around $62 billion to only around $4 billion, indicating a decline in interest in new capital inflows. At the same time, ETH became the top crypto that large investors chose as an alternative.

This phenomenon may reflect that market participants are now observing higher risk and potential return opportunities in ETH rather than keeping all capital in BTC. This kind of capital rotation often appears in market phases when the main trend is weakening, and large traders are looking for assets that have sharper rebound potential.

3. Changes in Trading Patterns Contribute to Risk Appetite

This large swap is considered a signal that whales and institutions are taking more aggressive positions in ETH, despite the general crypto market still showing a downtrend. The movement of capital from BTC to ETH is often suspected to be a response to a decrease in relative volatility in ETH or expectations of potential medium-term appreciation.

In the broader market context, increased risk appetite is usually accompanied by a rise in trading volumes and sharper price movements in the altcoins of interest such as ETH. This kind of swap activity can also trigger reactions from other crypto market names, with retail and institutional investors adjusting their asset allocations.

4. Swaps as a Method of Asset Reallocation

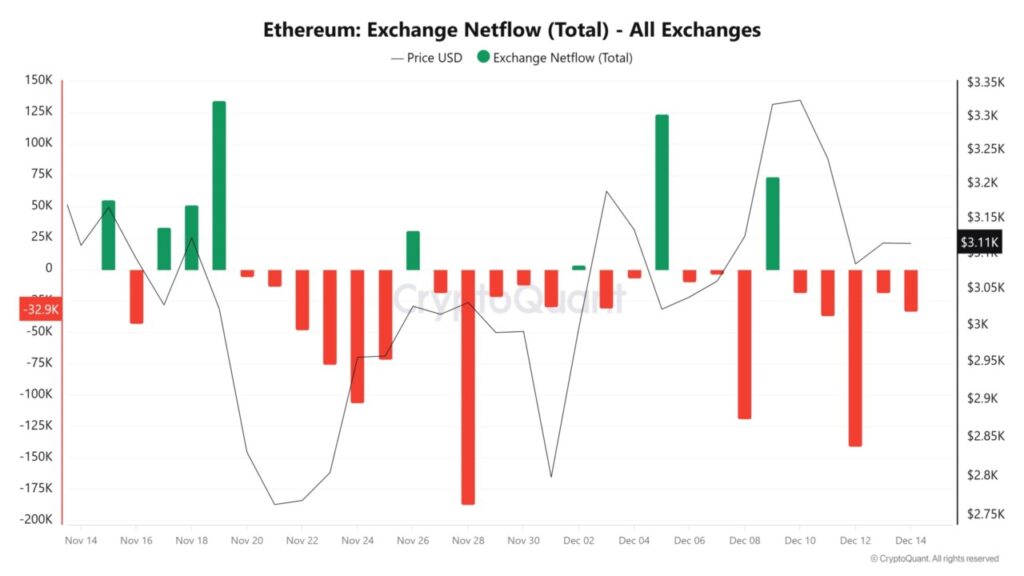

The BTC to ETH exchange is done through an on-chain mechanism that mirrors real market activity without the need to go through traditional derivatives markets, demonstrating how crypto assets can be switched quickly according to the intended risk strategy.

Large swaps by whales often impact order books and can create short-term pressure on BTC or ETH prices depending on the direction of capital allocation. This kind of activity sparks conversations about capital flow dynamics in the crypto market, especially among large traders who use data like this as a metric of market sentiment.

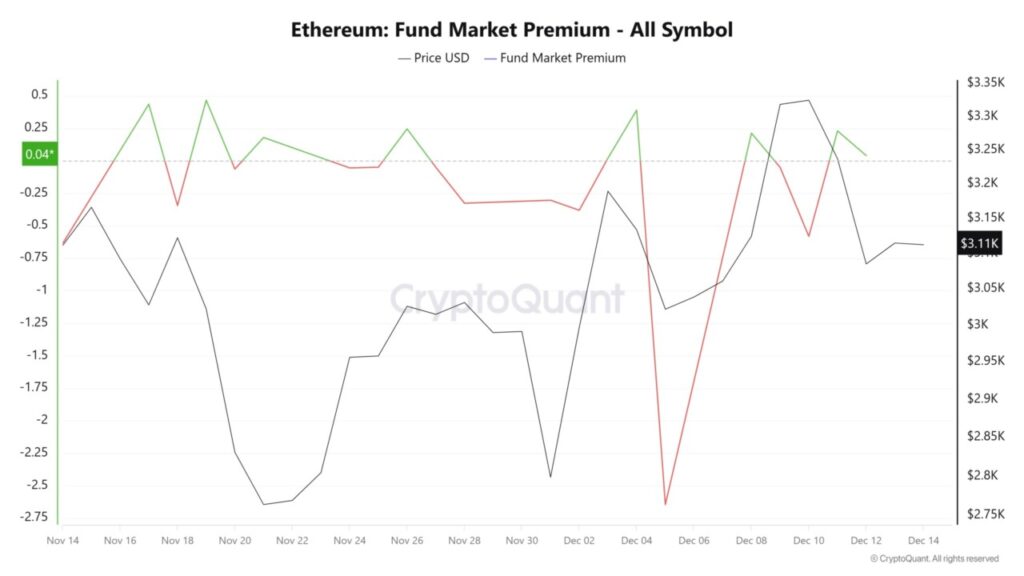

5. BTC and ETH Price Movement Related to Risk Appetite

Along with the large swap report, market sentiment indicators showed a reversal in investor psychology from extreme fear to slightly more risk-tolerant. This kind of phenomenon often occurs after a period of prolonged price declines.

The change in investor sentiment could help accelerate the upward momentum for ETH if swap activity and capital flows continue. The correlation between the price movements of majors like BTC and ETH is often referenced by analysts to infer whether altcoin season is approaching.

6. The Impact of Swaps on Trader and Investor Strategies

Traders usually consider these swap and capital flow metrics as part of risk management, especially when markets fluctuate sharply. Large activity reports such as BTC to ETH swaps are often interpreted as a signal that the crypto market is paying attention to opportunities beyond BTC alone, especially in the growing ETH ecosystem.

The implications for long-term holders can be seen in the trading volume, liquidity, and perceived risk of investing in both cryptocurrencies.

7. Contingencies for Further Movements are Still Being Monitored

While large swaps reflect risk appetite, short-term market direction is still highly dependent on external factors such as macro data, global trading volumes, and institutional trading dynamics.

Technical analysis of market conditions suggests the need for confirmation of a clear breakout or trend reversal before a major market direction change in BTC or ETH can occur. Investors and traders continue to monitor on-chain metrics and market psychology to assess the next step in capital rotation.

Also Read: Bitcoin Outlook 2026: Will it Reach $150,000?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What does a large BTC to ETH swap mean?

Large swaps indicate a re-allocation of capital from Bitcoin to Ethereum, which is often considered to signal a change in market risk appetite.

Why do whales swap BTC to ETH?

Whales execute such swaps to expose capital to assets that are viewed as having different potential relative to market trends or volatility.

Are big swaps altcoin season guaranteed?

Large swaps are not a guarantee of altcoin season, but it is one indicator that is often monitored to see changes in market psychology.

Reference

– AMBCrypto. Bitcoin-to-Ethereum swaps rise amid surging risk appetite – What now?. Accessed December 15, 2025.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.