Solana’s Price Now Rests in the Hands of Its Current Holders — Here’s Why

Jakarta, Pintu News – Solana (SOL) is still struggling to recover after its recent price drop, with SOL remaining stuck below the $130 resistance level. The altcoin did show attempts to stabilize, but its momentum is still fragile.

Unlike the previous rally which was driven by new capital flows, the next move is likely to depend more on Solana’s existing holders than new investors coming into the market.

Some Solana Holders Show Resilience

On-chain data shows early signs of stabilization. The Chaikin Money Flow (CMF) indicator recorded a sharp increase in recent days. Although the indicator is still below the zero line, this upward movement indicates that capital outflows are beginning to slow down.

Read also: Signs of Recovery Appear, 3 Altcoins Ready to End Distribution Phase and Rise?

This change is crucial to Solana’s recovery prospects. A decrease in outflows is often the first sign of a shift towards inflows. When buying pressure begins to outpace selling pressure, SOL prices have the potential to respond quickly. A sustained increase in CMF would be a signal that confidence among current holders is starting to return.

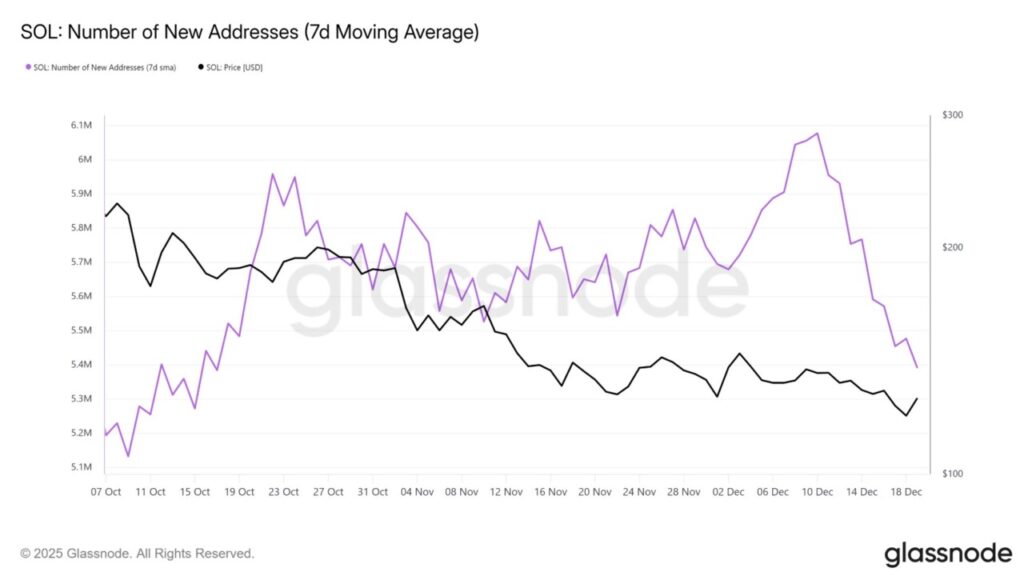

However, macro indicators show a more cautious picture. The number of new addresses on the Solana network declined sharply in the last few sessions. Total new addresses dropped from 6.077 million to 5.390 million, or a decline of about 11.3% in ten days.

This decline in network participation suggests weakening speculative interest. New investors appear hesitant to enter, citing limited short-term incentives. This lack of new demand makes the role of incumbents even more important to maintain price stability and support recovery efforts.

SOL Price Recovery Still Possible

Solana was trading at around $126, still below the $130 resistance level. The price movement shows a consolidation phase, not a breakout. The short-term goal for SOL is to break the $130 level again, which would signal a change in momentum direction in the short term.

Read also: AI Tokens Dominate Crypto Market-But Data Shows a Different Story

A decrease in capital outflows increases the chances of a rebound. If the current holders continue to accumulate and new inflows appear, the buying pressure could push the SOL towards the $130 level.

However, a sustained move above those levels requires consistent market support, not just a momentary speculative surge.

However, downside risks remain if market sentiment worsens. Renewed selling pressure could push Solana prices down below the $123 support level. If this level is broken, then $118 becomes the next downside target. Losing this support would invalidate the bullish outlook and reaffirm Solana’s short-term weakness.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Solana Price Depends On Existing SOL Holders, Here’s Why. Accessed on December 22, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.