Midnight (NIGHT) Token Price Plummets, But Big Investors Keep Hunting!

Jakarta, Pintu News – Cardano’s Midnight (NIGHT) token had a very strong performance, but now the momentum is no longer one-sided. NIGHT’s price is still up nearly 300% from its post-launch low.

In the last seven days, the value is also still up about 70%. However, the market direction started to change rapidly. As of December 23, the price of NIGHT has dropped by about 10%, and is now trading around $0.095.

This drop is notable because it comes with mixed signals behind the market movement. Some data points to continued accumulation by large investors, while other data points to increased selling pressure, especially from token inflows to exchanges possibly related to airdrops.

As January 2026 approaches, subsequent price movements are likely to be influenced more by the actions of large investors rather than simply euphoric market sentiment.

Big Wallets Start Accumulating Midnight, but Supply on Exchanges Continues to Rise

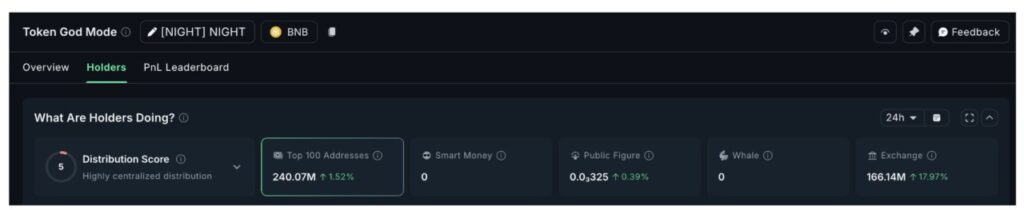

On-chain data shows a clear difference in the behavior of NIGHT token holders.

Read also: BlackRock Sets Bitcoin ETF as One of Its Key Investments Amid Price Uncertainty

NIGHT’s balance on the exchange saw a sharp spike in the last 24 hours. Exchange holdings rose by 17.97%, bringing the total NIGHT tokens held on the exchange to approximately 166.14 million. This increase is indicative of increased selling activity.

Given the context of the airdrop and the gradual distribution of Midnight tokens, it is likely that this token flow came from early recipients who moved the tokens to exchanges to take advantage.

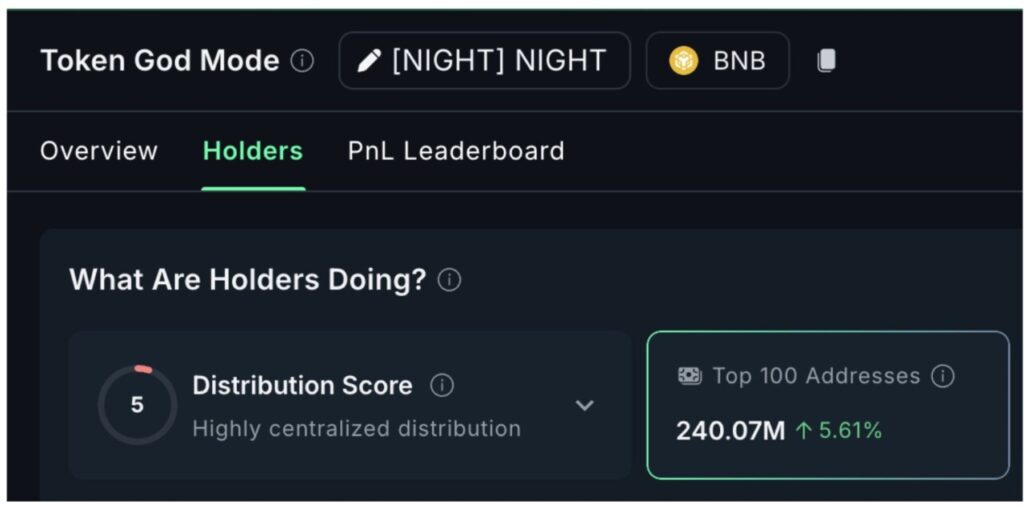

However, on the other hand, the big whales are doing exactly the opposite. The top 100 addresses increased their holdings by 1.52% in the last 24 hours, despite the price drop. This equates to about 3.6 million additional NIGHT tokens on a day when the price was weakening.

In the past seven days, the mega whales have increased their holdings by more than 5.6%, continuing to buy both on the downside and upside, while the token price increased by almost 70%.

This difference in direction is very important. The inflow of tokens to exchanges reflects short-term selling pressure, usually from retail investors, whereas accumulation by large whales indicates a long-term strategy.

By January 2026, the balance between these two market forces will be a more decisive factor than short-term price movements.

Capital flows and momentum show that “big money” still plays the biggest role

The whale activity data doesn’t stand alone – the results are in line with what the capital flow and momentum indicators on the price chart show.

We start with the On-Balance Volume (OBV) indicator. OBV is used to track whether trading volume is flowing in or out of an asset. On the 4-hour chart, the OBV has decreased as the price has fallen in the last 24 hours.

This signals that short-term buying pressure is starting to weaken. For now, the continuation of NIGHT’s price movement depends on the OBV’s ability to stay above the trend line.

However, the weakness of the OBV alone does not describe the whole situation. The Chaikin Money Flow (CMF) indicator provides an important additional layer of analysis. The CMF measures whether large capital is entering or exiting the market.

The CMF broke the zero line on December 20 and has since remained in the positive area. Despite being flat in the past day, the CMF has not reversed downwards. More interestingly, between December 22 and 23, when NIGHT prices were falling on the 4-hour chart, the CMF was actually rising – signaling a bullish divergence.

Read also: Solana Price Prediction: SOL Faces Neutral – Bearish Pressure across Key Indicators

This means that even though prices are weakening, big wallets are still absorbing supply behind the scenes.

These findings reinforce data from Nansen, which shows that mega whales continue to add to their holdings during price drops, despite increasing token balances on exchanges.

One Metric that Shows the Important Role of “Big Money”

The VWAP (Volume-Weighted Average Price) indicator helps connect various market signals. VWAP shows the average buying price adjusted for trading volume, and is often used as a short-term trend guide.

On December 22, the price of NIGHT briefly dropped below the VWAP and has yet to break back out. This suggests short-term weakness, which also explains why price momentum has started to slow down.

However, this kind of pattern has happened before. On December 15, NIGHT was also trading below VWAP, while the CMF back then started to rise from negative territory – signaling increased capital inflows.

As the CMF continues to strengthen, the prices manage to quickly break back through the VWAP and continue rising. In fact, the price increase becomes even stronger when the CMF moves above the zero line.

This history is important, especially for new tokens. In the early distribution phase, dips below VWAP are common. What is most decisive is not simply positioning against VWAP, but whether capital flows support a price recovery as before.

In simple terms, short-term traders appear to be pulling back (likely due to profit-taking), but the big players are not out of the market yet. As long as the CMF remains positive and whales continue to buy as prices fall, the current weakness points more towards consolidation, rather than a complete trend reversal.

As such, the movement of big money remains a key determining factor ahead of January 2026.

Derivatives and Price Action NIGHT Defines January 2026 Risk Zones

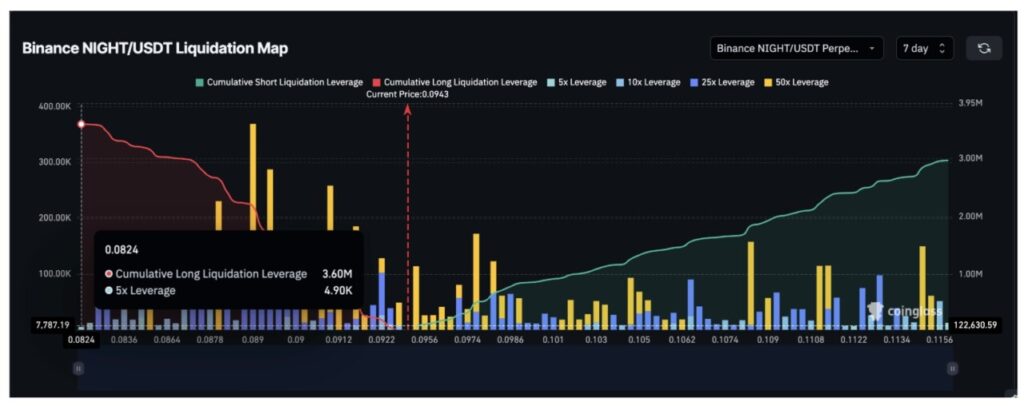

With capital flows starting to slow down, derivative positions are now a crucial factor ahead of January 2026.

Read also: Shiba Inu Price Prediction: SHIB Thwarts Bullish Signal, Upside Momentum Still Delayed?

Liquidation data for the next seven days shows that the market still has a long position bias. On Binance, the long liquidation exposure was recorded at around $3.6 million, compared to around $2.9 million on the short side. This imbalance did narrow after the recent price drop, but long positions still dominate.

This creates a fragile market situation. If NIGHT prices continue to weaken and remain below VWAP, long positions will become increasingly vulnerable. A drop towards $0.08 could potentially trigger forced liquidation, which could accelerate selling pressure. This scenario is in line with the OBV weakening and CMF starting to stagnate.

Important price levels on the 12-hour chart provide a clear picture for the period leading into January:

- $0.101 → The first level to be recaptured by NIGHT. A net increase above this level would alleviate the short-term pressure.

- $0.120 → Key confirmation level. A daily close above this point would signal NIGHT’s return to the price discovery phase and negate the current weakness.

- $0.071 → Major support on the downside. If this level is broken to the downside, the market risks a further decline towards $0.057 and even $0.040.

The direction for January 2026 is now quite clear: If whales continue to accumulate, CMF strengthens again, and the price manages to break VWAP, then NIGHT has the potential to stabilize and enter a new expansion phase.

However, if large capital support weakens while leverage remains heavy on the long side, the market risks a sharp correction due to liquidation, before a sustainable uptrend can be re-established.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Midnight (NIGHT) Price is Plummeting – But Big Holders Are Still Buying. Accessed on December 24, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.