3 High-Risk Altcoins Trigger Liquidation Pressure in Early January 2026

Jakarta, Pintu News – The cryptocurrency market is always full of unexpected dynamics. As we enter the beginning of the year, several altcoins are showing the potential to trigger massive liquidations. Recent analysis reveals that Solana (SOL), Zcash (ZEC), and Chainlink (LINK) are on the verge of conditions that could significantly affect investors and traders.

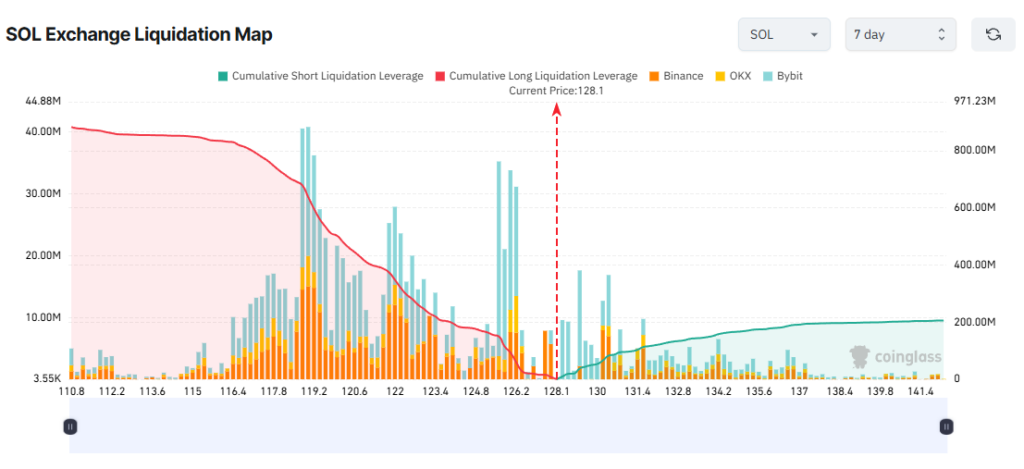

Solana (SOL)

Solana (SOL) has shown a significant imbalance in the last seven days’ liquidation map. The liquidation of long positions is much greater compared to short positions. Although a report from BeInCrypto mentioned that January is usually a strong month for Solana (SOL) price performance, the bullish RSI indicator supports recovery expectations.

However, the latest data from SoSoValue shows that funds pouring into the Solana ETF (SOL) have just recorded their weakest weekly inflow since launch. Last week’s net inflow stood at just $13.14 million, down by more than 93% from nearly $200 million in the week of launch. If the Solana (SOL) price drops to $110, the accumulative liquidation of long positions could surpass $880 million.

Read also: 3 Signals from the Gold Market Indicating Bitcoin (BTC) is Nearing its ‘Bottom’

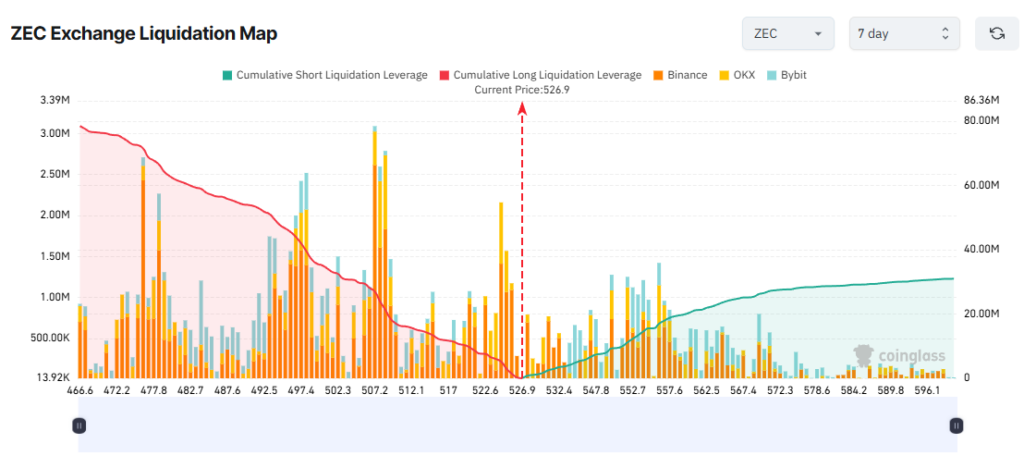

Zcash (ZEC)

Zcash (ZEC) also showed a similar pattern to Solana (SOL) where traders allocated a lot of capital and leverage to long positions. The volume of Zcash (ZEC) locked in Shielded Pools increased in late December, and the price of Zcash (ZEC) also saw a significant rise from around $300 to over $500 during the month.

However, potential profit-taking by early December buyers could trigger a correction. This selling pressure risks causing a large liquidation of long positions. If the price of Zcash (ZEC) drops to the $466 zone in early January, the liquidation of long positions could exceed $78 million.

Read also: Where will Ripple (XRP) Price Movement Go in 2026?

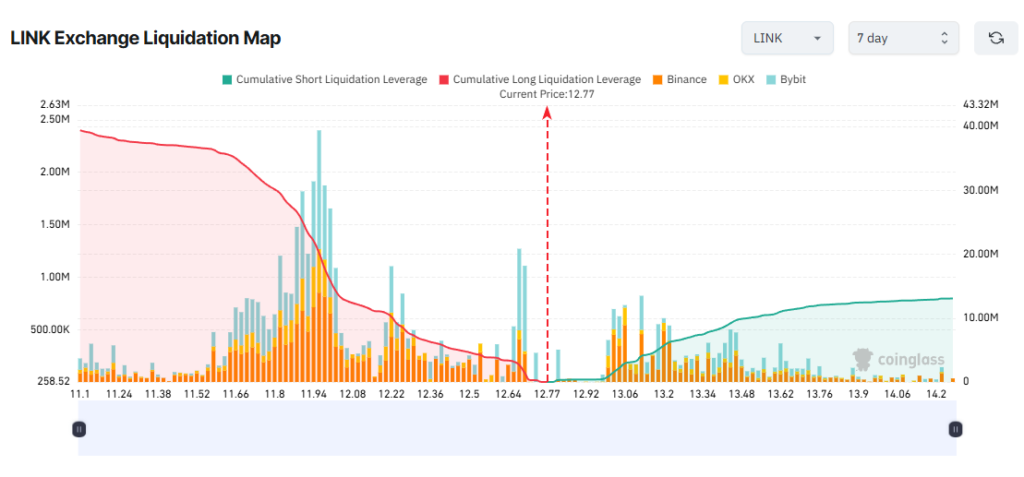

Chainlink (LINK)

Many traders seem to be convinced that Chainlink (LINK) will soon recover from its current level of $12. They have invested significant capital and leverage into long positions. However, there is a critical signal that needs attention: Chainlink (LINK) reserves on Binance increased throughout December.

This increase suggests that Chainlink (LINK) holders may be preparing to sell when prices begin to recover. The liquidation map shows that if Chainlink (LINK) prices drop to $11, the accumulative liquidation for long positions could reach around $40 million.

Conclusion

Investors and traders in the cryptocurrency market should be extremely cautious at the beginning of this year, especially for those investing in Solana (SOL), Zcash (ZEC), and Chainlink (LINK). Actively monitoring market movements and managing risks wisely will be key to avoiding huge losses due to possible liquidations.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. 3 Altcoins That Could Trigger Liquidations in Early January. Accessed on January 4, 2025

- Featured Image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.