Dogecoin Sees 7% Gain, But Retail Trader Interest Is Losing Steam — Here’s Why

Jakarta, Pintu News – Over the past year, Dogecoin (DOGE) has grown from a meme coin to an increasingly recognized reserve asset. However, going into 2026, a number of indicators suggest that the DOGE price has the potential to continue to weaken and possibly hit a new low.

What are these signals, and what can investors anticipate for DOGE’s movement in 2026?

Dogecoin Price Rises 7.10% in 24 Hours

On January 2, 2026, Dogecoin saw a 7.10% gain over a 24-hour period, with the price rising to $0.1267, or approximately IDR 2,128. During that time, DOGE traded within a range of IDR 1,978 to IDR 2,132.

At the time of writing, Dogecoin holds a market capitalization of around IDR 354.82 trillion, with a 24-hour trading volume of approximately IDR 29.88 trillion.

Read also: 3 Meme Coins to Watch Out for in January 2026, What Happens?

Low Interest in DOGE ETF, Majority of Trading Day with No Net Inflows

Towards the end of 2025, the price of Dogecoin (DOGE) fell below $0.12, closing the year down more than 70% from its highest peak. Weak buying pressure hampered any potential immediate price recovery. In the early trading days of 2026, the DOGE price remained below $0.12.

The spot Dogecoin ETF launched in the United States at the end of November 2025 appears to be struggling to attract investor interest.

Based on data from SoSoValue, since trading began on November 24, most days have seen zero net inflows into the DOGE ETF. The current total net assets recorded are only around $5.07 million-the lowest of all US-listed crypto ETFs.

This trend reflects the lack of interest from both institutional and retail investors in DOGE. This situation is in stark contrast to the much stronger performance of XRP and SOL ETFs.

With no new fund flows from ETFs, DOGE lost its upward impetus. Continued selling pressure continues to weigh on the price. If this condition persists until 2026, DOGE will likely find it difficult to recover in the near future.

“Weak demand for ETFs as well as declining open interest in futures contracts further reinforces the ongoing selling trend,” said investor Marzell.

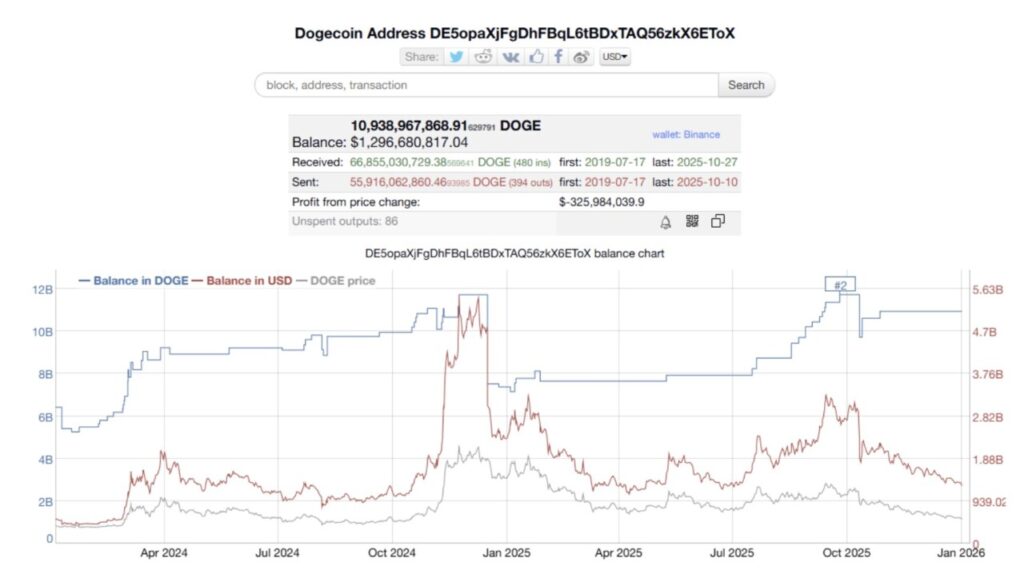

Selling Pressure Potentially Increases as DOGE Reserves on Binance Remain High

The second factor signaling selling pressure is the rising Dogecoin balance on the Binance wallet (address DE5…ToX), which is one of the largest holders of DOGE. This wallet balance rose again in the second half of 2025, indicating potential selling pressure in the near future.

According to data from Bitinfocharts, the amount of DOGE stored in the wallet rose from 7.9 billion to 10.9 billion throughout 2025. Based on historical trends, when the balance exceeds 11 billion DOGE, the price tends to peak.

In strong market conditions, increasing balances on exchanges can support the redistribution of assets to new investors. However, amid low demand, high DOGE reserves on exchanges like Binance create persistent supply-side selling risk.

Read also: Ethereum Struggles to Break $3,000 — Could a 20% Rally Be Ahead?

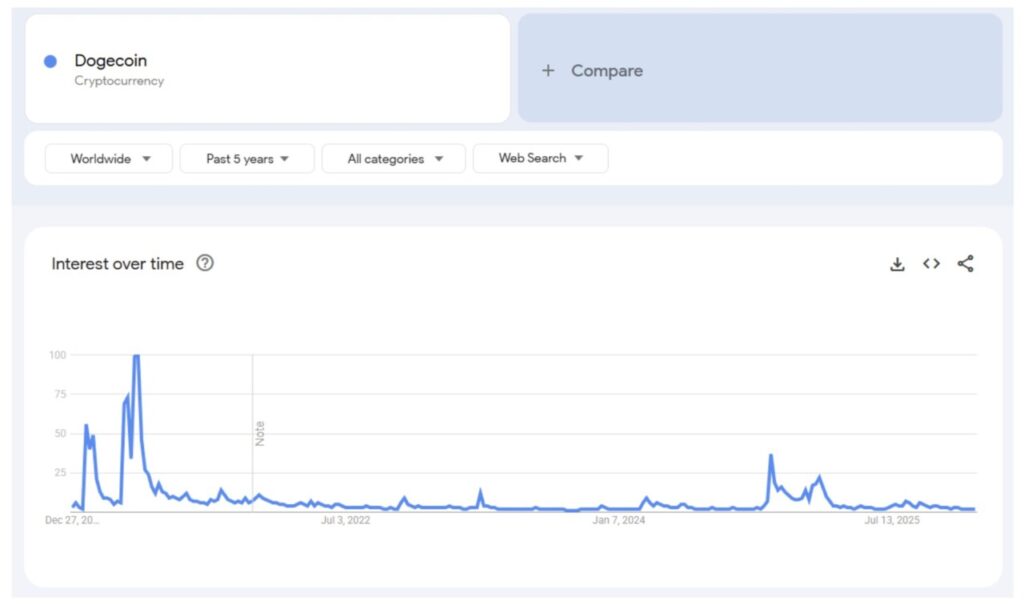

Retail Interest Weakens, DOGE Holding Company Experiences Loss Pressure

A third factor adding to the pressure on Dogecoin is the declining interest from retail investors. According to Google Trends data, search interest in Dogecoin is at a five-year low-a trend that is also reflected in many other altcoins.

DOGE has been known as a popular coin among retail investors. However, declining interest means fewer new participations. As a result, liquidity has decreased and prices have become more prone to sharp fluctuations.

Some companies such as CleanCore Solutions and BitOrigin are known to hold DOGE as a backup asset. However, current market conditions are putting their positions under pressure.

BitOrigin is known to buy DOGE at a price range of $0.22. Meanwhile, CleanCore Solutions reported on October 6, 2025 that it owned more than 710 million DOGE, with unrealized gains worth more than $20 million at the time. But since October, the price of DOGE has fallen by more than 50%. CleanCore Solutions’ own shares plummeted 90%, suggesting that the strategy of holding DOGE as a backup asset has not convinced investors.

“CleanCore Solutions (ZONE) shares are now down 95% in the last three months. This tarnishes the Dogecoin name,” said investor KrissPax.

Although negative signals continue to emerge, a report from BeInCrypto states that long-term holders are actually starting to show signs of accumulation. For this group, the current price drop is considered a buying opportunity, not a sign of giving up.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Why Could Dogecoin (DOGE) Set a New Low in Early 2026? Accessed on January 2, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.