3 Fatal Crypto Futures Trading Mistakes Uncovered Throughout 2025

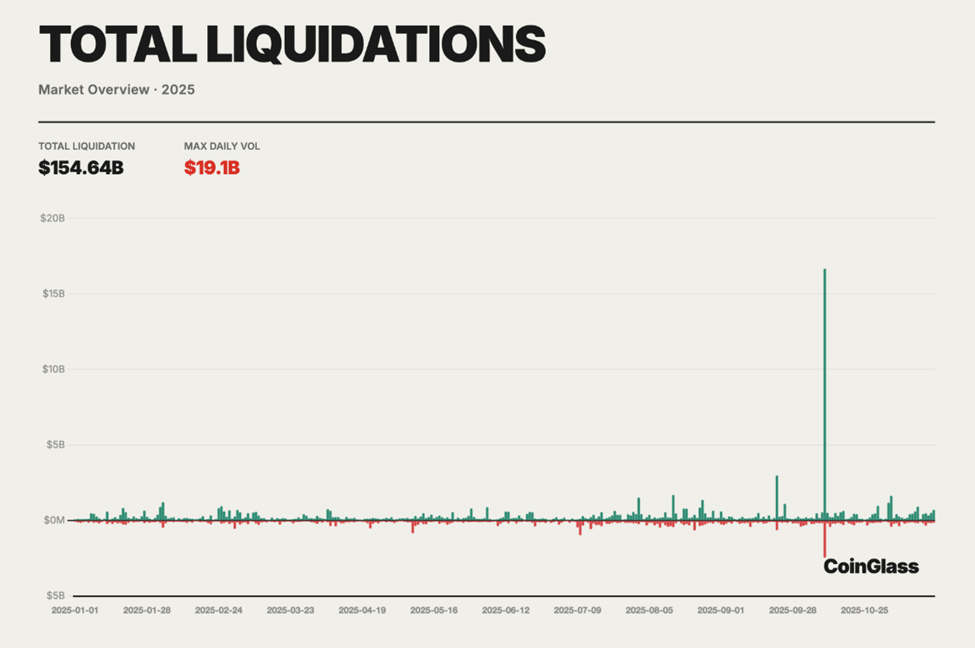

Jakarta, Pintu News – In 2025, the cryptocurrency futures trading world experienced significant systemic losses, with liquidations totaling $154 billion. This failure highlighted risks that were previously only considered theoretical in crypto derivatives trading. As reported by BeInCrypto, three key mistakes have been identified as the main cause of this massive loss, providing important lessons for market participants in 2026!

Mistake 1: Over-reliance on Extreme Leverage

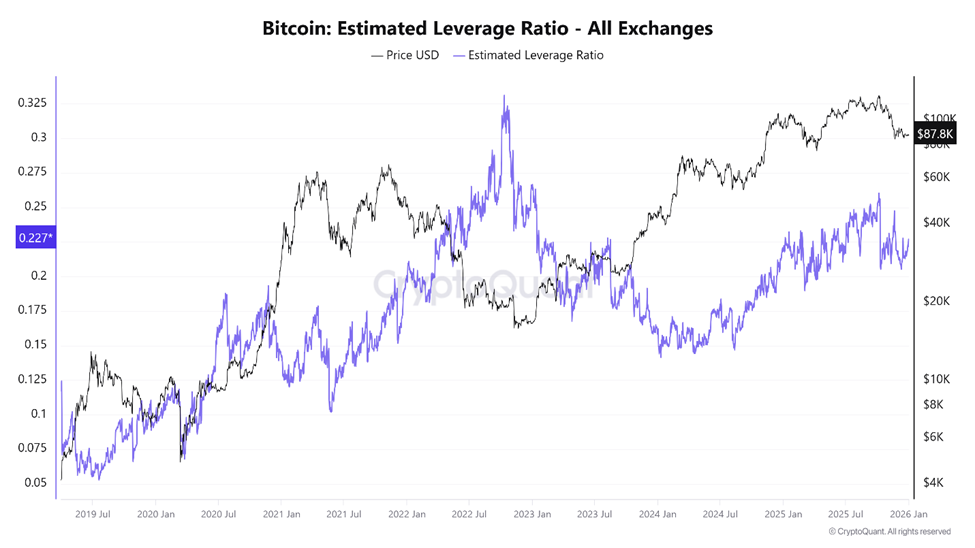

Leverage was the main trigger for the liquidation crisis in 2025. Data from CryptoQuant shows that the Bitcoin (BTC) Forecast Leverage Ratio reached its highest point before the market collapse in early October. At the same time, the total open interest futures surpassed $220 billion, indicating a market saturated with loan exposure.

On major exchanges, leverage ratios for Bitcoin (BTC) and Ethereum (ETH) often exceed 10x, with most retail traders operating at 50x and even 100x. This high leverage, while improving capital efficiency, has turned into market destabilization.

When the market experiences a sudden reversal, these highly leveraged positions become prime targets for liquidation, causing huge losses for traders.

Read also: Trump’s Tariffs 2026: The Impact on Bitcoin, Ethereum, and Altcoins

Mistake 2: Ignoring Funding Rate Dynamics

Funding rates, which are designed to keep perpetual futures prices tied to the spot market, are often overlooked by traders. During prolonged bullish phases, funding rates for Bitcoin (BTC) and Ethereum (ETH) remain positive, gradually eroding long positions through recurring payments.

This imbalance is not resolved because perpetual futures contracts have no expiration date, leaving the funding rate as the only balancing mechanism. Failure to pay attention to these signals leaves many traders unprepared when the market reverses, resulting in large and unexpected losses.

Read also: Ethereum (ETH) Rebound Signals Appear, Analysts Aim for Price to Break $4,000

Mistake 3: Trusting ADLs too much instead of using Stop Loss

Auto-deleveraging (ADL) is a mechanism designed as a last resort, triggered when the exchange’s insurance fund is exhausted and liquidation leaves residual losses. In 2025, ADL is no longer a theory. During the October liquidation cascade, insurance funds in various places ran out, triggering ADL en masse.

It often closes traders’ profitable positions first, even when overall market conditions are still unfavorable. Traders who run hedged or pair strategies are hit hard, showing that relying too much on ADL without using stop loss is a risky strategy.

Conclusion

The events of 2025 have confirmed that a deep understanding of market mechanisms is more important than faith alone. The $154 billion lost was no accident, but the cost of ignoring market dynamics. Whether this lesson will be repeated in 2026 depends on whether traders choose to learn from past mistakes.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Crypto Futures Trading Mistakes to Avoid in 2025. Accessed on January 2, 2026

- Featured Image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.