Oil Prices Dip Following U.S. Military Operation in Venezuela

Jakarta, Pintu News – As reported by CNA, oil prices fell on Monday (January 5) after a US military operation led to the arrest of Venezuela’s leader, Nicolas Maduro – a country with the world’s largest proven crude oil reserves.

Oil prices weaken after US attack on Venezuela

The entry of larger volumes of Venezuelan oil into the market is expected to add to oversupply concerns and further depress oil prices, which have been falling in recent months.

Read also: 3 Altcoins that Catch Investors’ Attention in Early Week 2026

In morning trading in Asia, Brent Crude prices fell 0.21% to $60.62 per barrel, while West Texas Intermediate (WTI) lost 0.35% to $57.12, although still higher than its previous low.

US forces invaded Caracas in the early hours of Saturday, bombing military targets and taking Maduro and his wife away to face federal drug charges in New York.

US President Donald Trump stated that the United States will now “manage” Venezuela and send US companies to repair the country’s severely damaged oil infrastructure.

Oil prices pressured by oversupply

After years of underinvestment and sanctions, Venezuela is now only able to pump around one million barrels of oil per day, down from around 3.5 million barrels per day in 1999.

However, analysts assess that significantly increasing Venezuela’s oil production will not be easy and cannot be done in a short time, amid great uncertainties about the country’s future.

“Any recovery in production will require huge investments, given the infrastructure devastated by years of mismanagement and underinvestment,” UBS analyst Giovanni Staunovo told AFP.

In addition, investing at this time is also less attractive: oil prices are pressured by oversupply and are set to decline through 2025, despite major economic pressures such as Trump’s tariff wars and the continuing conflict in Ukraine.

Read also: Weekly Crypto Price Forecast: Bitcoin, Ethereum, and XRP Continue Steady Gains

Then, How is the Crypto Market Movement?

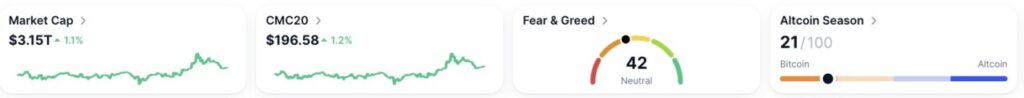

On the other hand, according to CoinMarketCap data, the crypto market showed positive movement with the global market capitalization reaching $3.15 trillion, up 1.1% in the last 24 hours. The CMC20 index, which represents the performance of the top 20 crypto assets, also saw an increase of 1.2% to $196.58, reflecting the positive sentiment among major assets in the market.

However, the Fear & Greed Index indicator stands at 42, reflecting a neutral sentiment from market participants – not overly optimistic, but also not showing extreme fear.

Meanwhile, the Altcoin Season score stands at 21 out of 100, indicating that the current dominance is still in the hands of Bitcoin (BTC), and has not yet entered the altcoin season phase, where altcoins usually outperform Bitcoin to a large extent.

Overall, although the market is showing positive daily growth, investor sentiment is still cautious, and altcoins have yet to take center stage.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CNA. Oil prices fall after US ousts Venezuela’s Maduro. Accessed on January 5, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.