Trump’s Venezuela Conflict Fuels Rally in World Liberty Financial Token

Jakarta, Pintu News – The price of World Liberty Financial (WLFI) has extended its rally that started in mid-December 2025, registering fresh gains in the past week.

The token, which is associated with the Trump family, reacted sharply after former President Donald Trump launched an attack on Venezuela and arrested Nicolás Maduro. The geopolitical development triggered market volatility, pushing WLFI to its recent highs.

WLFI Holders Record Huge Profits

On-chain data shows a rapid increase in the profitability of WLFI holders. WLFI profits jumped from around 25% to 40% in just 24 hours after the news of the US military action.

Read also: Oil Prices Dip Following U.S. Military Operation in Venezuela

Along with the acceleration in prices, the proportion of total WLFI supply that was in profit rose to the highest level in four months, signaling a broad recovery across various wallet groups.

This development benefits the early participants who have been accumulating WLFI since the initial launch phase. Many of these investors had previously experienced large price falls, and are now starting to see their investment positions return to the profit zone.

Increased profitability usually has a positive impact on market sentiment, but it can also encourage sell-offs as holders look to realize profits.

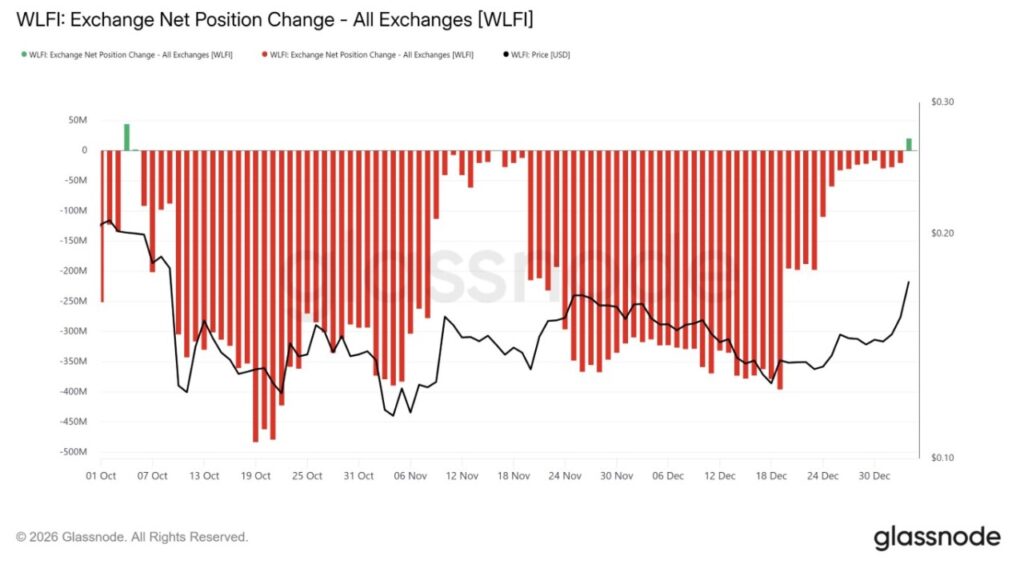

Despite rising profits, macro behavior suggests that WLFI holders tend to be impatient. Data on changes in net position on exchanges showed a green bar-the first in almost three months-signaling WLFI inflows to exchanges. This usually indicates distribution rather than accumulation.

Selling pressure tends to emerge quickly as profits rise after a prolonged price decline. WLFI holders seem ready to exit their positions at the first signs of recovery.

This behavior could limit further gains, as an increase in WLFI balances on the exchange adds to the available supply and absorbs demand from new buyers.

WLFI price awaits breakout signs from pattern

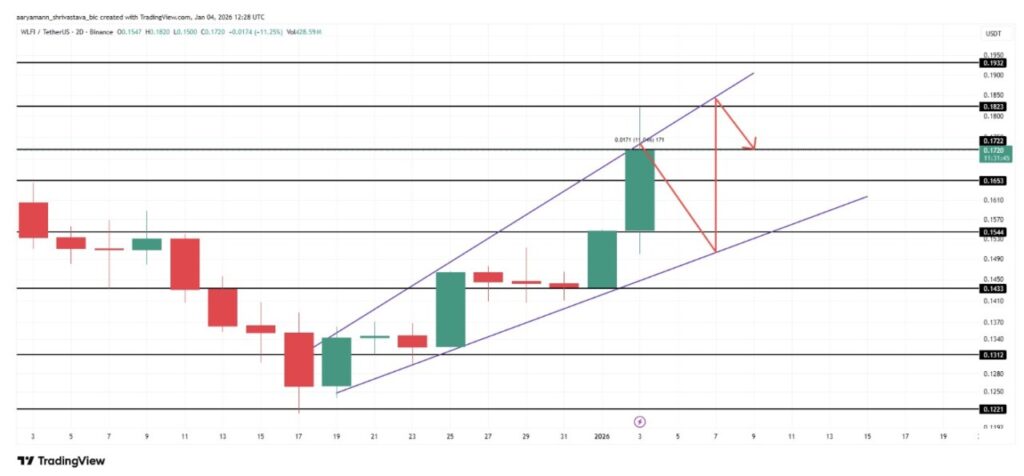

On January 4, 2026, WLFI was trading at around $0.172 after bouncing back from $0.143 earlier in the week. Within 24 hours, the token had recorded a gain of around 11% and is now at the upper limit of an ascending broadening wedge pattern-astructure that reflects increasing volatility with no clear sense of direction.

Read also: Bitcoin Price Remains Stable Amid US and Venezuela Geopolitical Tensions

Although the price is near the resistance area, a breakout doesn’t seem likely anytime soon. Investors who are making profits again are likely to resume selling, which could push prices lower.

In this scenario, WLFI could potentially drop back towards the lower trendline, with the $0.154 level as the next important support area.

To encourage a sustained breakout, WLFI needs to cement $0.172 as a solid support level. This requires a reduction in selling pressure as well as a return of buying interest from investors.

If the bullish momentum continues and the distribution pressure remains limited, WLFI has a chance to break the resistance and advance towards $0.182, which would invalidate the current bearish-neutral view.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. World Liberty Financial Token Rally Amid Trump Venezuela Conflict. Accessed on January 5, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.