PEPE price jumps 26% after viral tweet: New Meme Coin Leader in 2026?

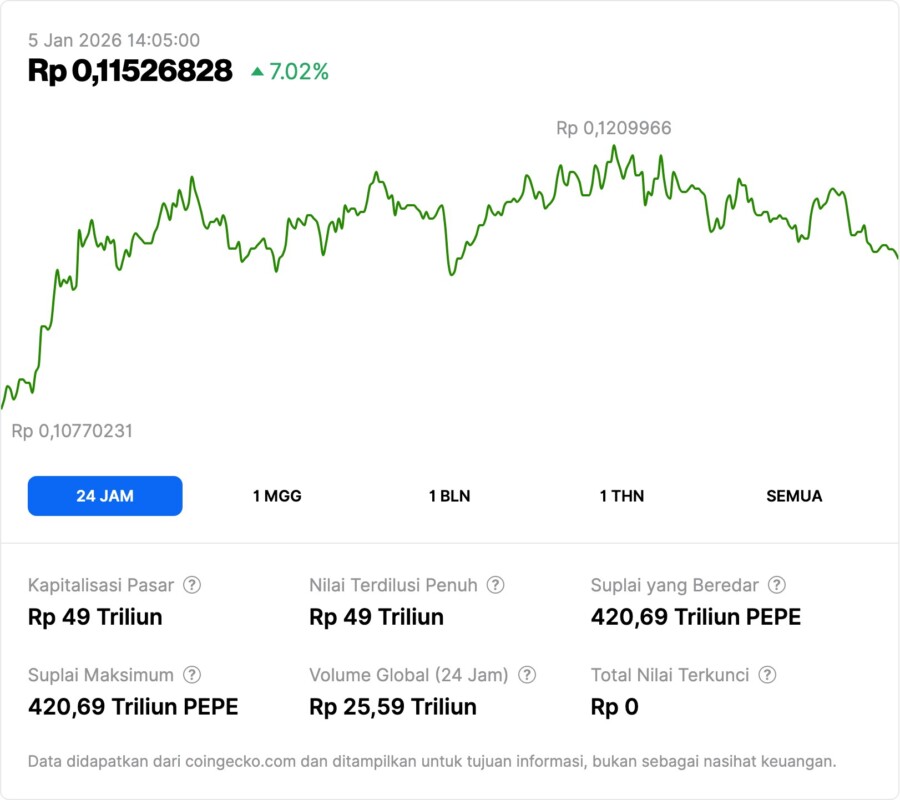

Jakarta, Pintu News – The Pepe Coin (PEPE) meme coin recently recorded a significant price increase of 26% on January 2, triggered by a tweet that went viral. This phenomenon is reminiscent of the market dynamics of meme coins that are heavily influenced by social momentum. With just one widespread post, PEPE managed to trigger massive liquidation, increase trading volume, and again provoke speculation about its long-term prospects.

Viral Tweet Sparks Liquidation-Driven Rally

This rally coincided with a post from PEPE’s official account stating “We ride at dawn,” which quickly spread across various social platforms. This surge in attention had an immediate impact on market activity, triggering a short liquidation of approximately $2.65 million and pushing daily trading volume to $805 million.

As much as 83% of the liquidations on that date came from short positions, so the price movements tended to be mechanical. Traders speculating on a price drop were forced to buy back PEPE, which increased price pressure in a short period of time.

Also Read: 2026, a Hopeful Year for Solana: Predictions and Challenges

Momentum Without Fundamentals

Although the price action looks strong, the underlying structure is still fragile. Pepe Coin (PEPE) offers no fundamental utility, revenue mechanism, or protocol-driven demand. This price behavior continues to rely almost entirely on sentiment, virality, and speculative positioning.

This makes the rally very sensitive to changes in social attention. Momentum can build quickly, but it can also die down just as quickly when engagement declines or when capital is pivoted to the next narrative.

Whale Concentration Adds Risk

Another structural factor shaping PEPE’s outlook is the concentration of supply. A whale-dominated distribution increases volatility and increases the risk of a sudden reversal if large holders decide to take profits.

In this environment, retail investor-driven hype often only temporarily supports prices and struggles to sustain long-term trends. Without broader utility or ecosystem growth, PEPE remains vulnerable to sharp swings driven by positioning rather than adoption.

Conclusion

The 26% spike in PEPE price shows how quickly meme coins can move when social momentum aligns with solid positions. Short liquidation and viral engagement can lead to huge gains, but this does not solve the absence of fundamental demand.

Whether PEPE can emerge as the leading meme coin of 2026 depends on its ability to maintain attention and technical momentum in a market that continues to spin narratives.

Also Read: Ripple’s (XRP) Big Breakthrough in 2026, Are You Ready?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto Daily. Pepe Jumps 26% After Viral Tweet, Can It Lead Meme Coins in 2026. Accessed on January 5, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.