New Record! Ethereum Records $8 Trillion Worth of Stablecoin Transactions

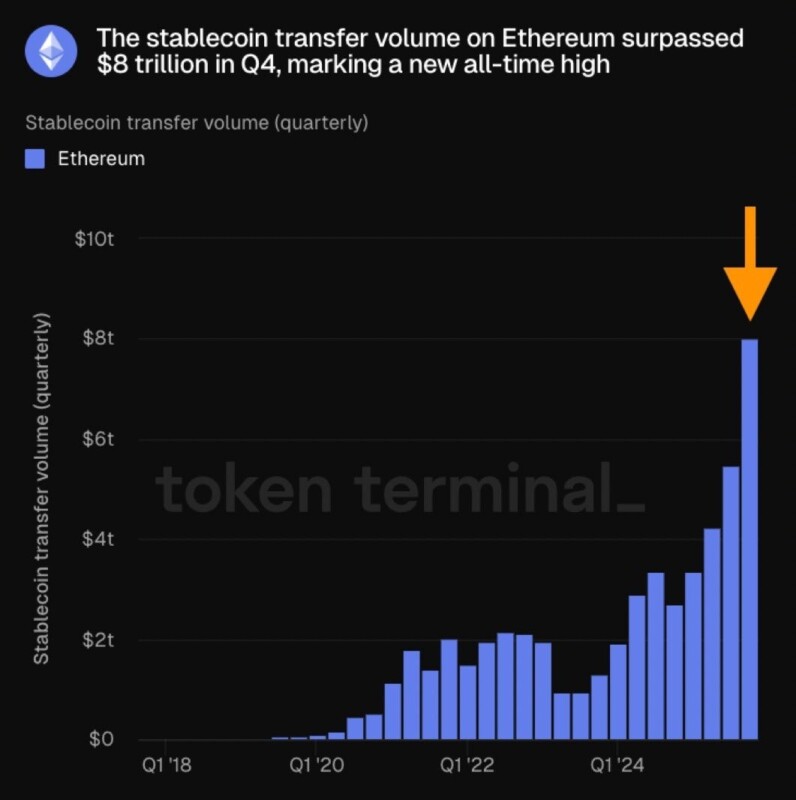

Jakarta, Pintu News – In the fourth quarter of 2025, the transfer volume of stablecoins on the Ethereum (ETH) network reached an unprecedented figure of more than $8 trillion. This figure marks a new record high, according to a report from Token Terminal. This significant increase is almost double the second quarter’s transfer volume of more than $4 trillion.

Increased Volume and Issuance of Stablecoins

The transfer volume of stablecoins on Ethereum (ETH) has reached new highs totaling $8 trillion in the last quarter of 2025. This represents significant growth compared to the previous quarter which recorded only $4 trillion. This growth demonstrates the widespread adoption of global on-chain payments.

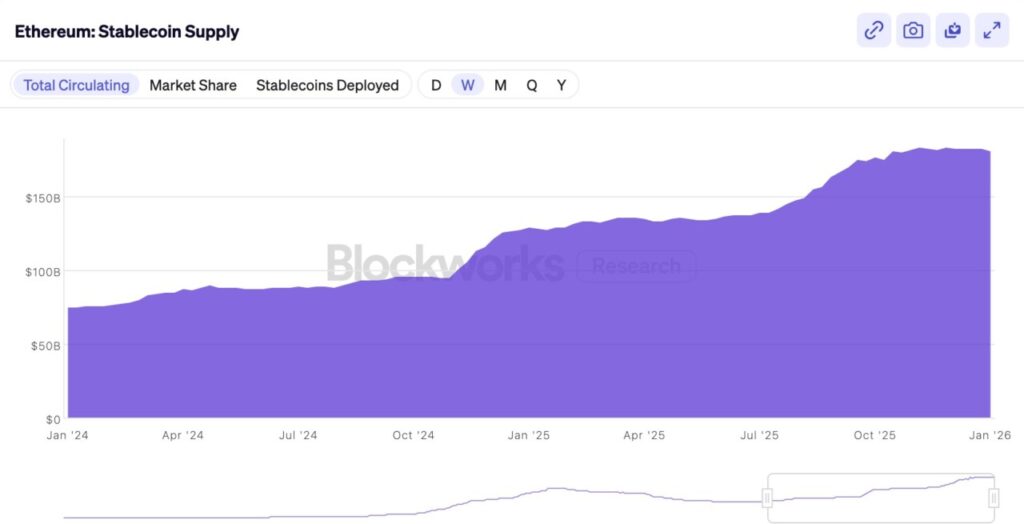

In addition, stablecoin issuance on Ethereum (ETH) also increased by about 43% through 2025, from $127 billion to $181 billion. This increase shows the growing trust of users in stablecoins as a stable and reliable transaction tool.

Also Read: Ethereum (ETH) Approaching Critical Moment, Is January 2026 Time to Surge?

Daily Transaction Record and Active Address

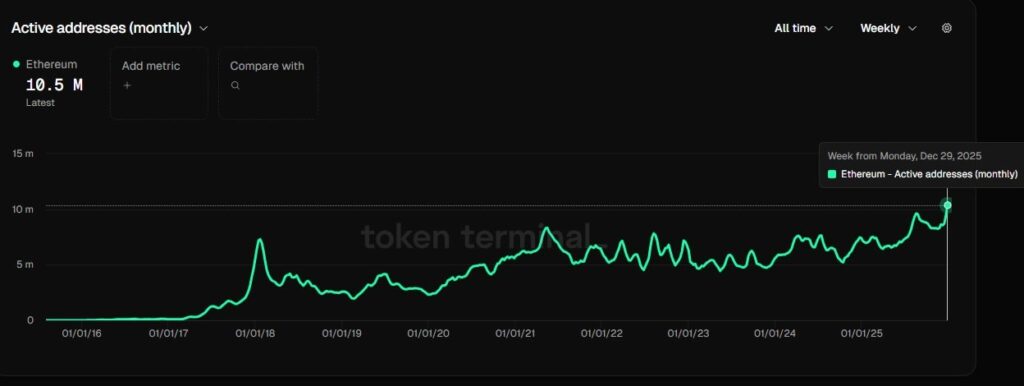

Alongside the increase in transfer volume, Ethereum (ETH) also set a record for the number of daily transactions. At the end of December, the Ethereum (ETH) network recorded 2.23 million transactions in a single day. This represents a 48% increase compared to the same period in the previous year.

In addition, the number of monthly active addresses on Ethereum (ETH) also reached a new peak with a total of 10.4 million addresses in December. This increase shows that more and more users are utilizing Ethereum (ETH) for their various digital transaction needs.

Ethereum’s Dominance in Real Asset Tokenization

Ethereum (ETH) remains the primary settlement layer for stablecoins and real asset tokenization (RWA), holding around 65% market share of the total on-chain RWA value of around $19 billion. This market dominance even increases to over 70% when layer-2 networks and EVMs are included in the equation.

In the context of stablecoin issuance, Ethereum (ETH) has a market share of 57%, with the Tron network in second place with 27%. Tether (USDT) remains the market leader in issuance with $187 billion, which is 60% of the entire stablecoin market, and more than half of that is on Ethereum (ETH).

Bright Future for Ethereum

With new records set in transfer volumes and transaction amounts, as well as a significant increase in stablecoin issuance, the future of Ethereum (ETH) looks very bright. The network is not only the top choice for stablecoin transactions, but also the leading platform for tokenization of real assets. The growing trust and adoption from users suggests that Ethereum (ETH) will continue to play an important role in the global digital finance ecosystem.

Also Read: Bitcoin (BTC) Price Surges, Will it Continue to Rise in January 2026?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Cointelegraph. Stablecoin Transfer Volume on Ethereum Tops $8T in Q4 ATH. Accessed on January 6, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.