Could Bitcoin (BTC) Price Surge to $100K in Early 2026?

Jakarta, Pintu News – At the start of 2026, Bitcoin (BTC) is showing strong signs of recovery with significant institutional fund flows. Despite experiencing rejection at the December highs between $94,000 and $96,000, market expectations of a Bitcoin (BTC) price increase to the $100,000 level are growing. This analysis will delve deeper into the potential price movement of Bitcoin (BTC) based on historical data and current market conditions.

Analysis from Experts

Matt Mena, a Crypto Research Strategist at 21Shares, gives an optimistic view of Bitcoin’s (BTC) performance in 2026. Based on the last 15 years of historical data, Bitcoin (BTC) has never recorded two consecutive years of decline. This indicates that 2026 has the potential to be a very positive year for Bitcoin (BTC) after a less than encouraging performance in 2025.

Farzam Ehsani, CEO of VALR crypto exchange, also predicted that Bitcoin (BTC) could reach up to $130,000 in the first quarter of 2026. According to him, the current consolidation could be a springboard for further price increases, especially if the gold and silver rallies begin to subside.

Also Read: 5 Conditions for the Crypto Market to Hit an All-Time High in 2026, Here’s What Needs to Happen!

Catalysts and Potential Barriers

Some of the factors that could push Bitcoin (BTC) price to reach $100,000 are regulatory support through the passage of crypto bills and stable equity market conditions. Matt Hougan, CIO of Bitwise, emphasized the importance of these factors in supporting Bitcoin’s (BTC) bullish trend.

However, there are also potential obstacles that could disrupt this positive outlook, such as the crash that occurred on October 10. Such an event could reduce investor confidence and slow down the pace of price recovery.

Market Expectations for the First Quarter of 2026

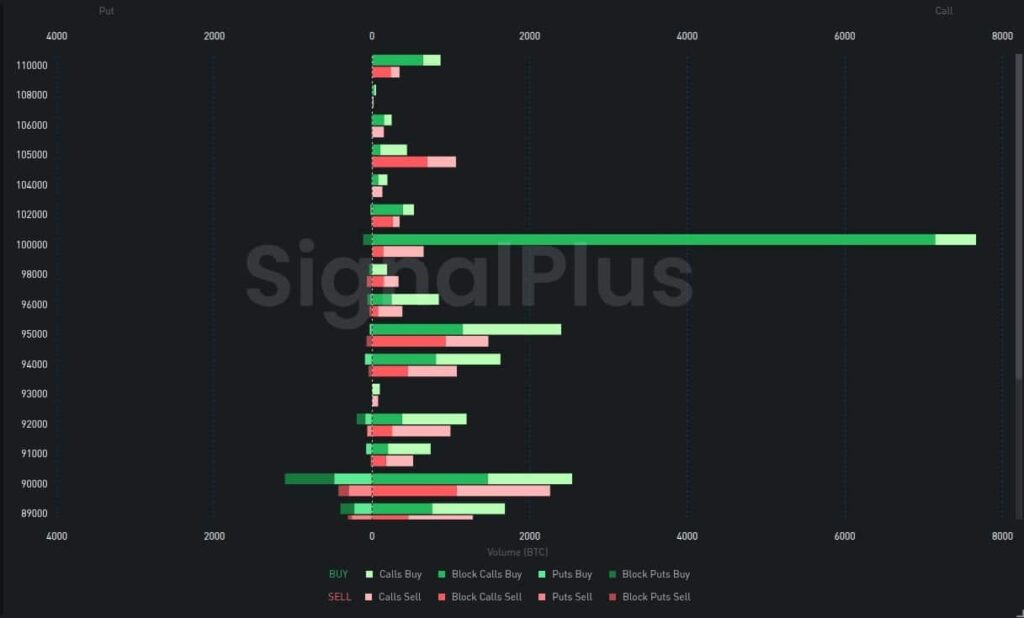

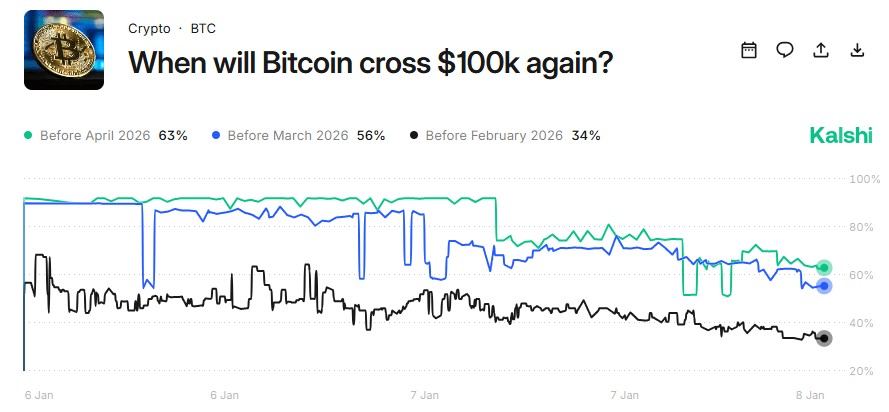

While there are high expectations for the $100,000 milestone in January, market analysis suggests that there is a greater chance of it occurring in March or April. This is supported by data from Ostrovskis’ Options which shows an increase in demand for call options in the $98,000 to $100,000 price range.

The market seems to be waiting for some further developments before triggering a major surge. Given this, investors and market watchers should remain alert to the changing dynamics and be ready to make decisions based on the latest developments.

Conclusion

With various expert analyses and predictions, as well as evolving market conditions, Bitcoin (BTC) has strong potential to reach or even surpass $100,000 as early as 2026. However, as always with crypto investments, risks remain and it is important for every investor to conduct in-depth research before making an investment decision.

Also Read: The Pattern Repeats? Ripple (XRP) is Ready to Surge Like 2017!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects

this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Can Bitcoin’s price rally swiftly to $100k in January 2026. Accessed on January 9, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.