Bitcoin Investments Are Growing — Here Are the Crypto Stocks to Watch

Jakarta, Pintu News – Stock markets saw fluctuations on Tuesday as Wall Street digested news of a criminal investigation into Federal Reserve Chairman Jerome Powell.

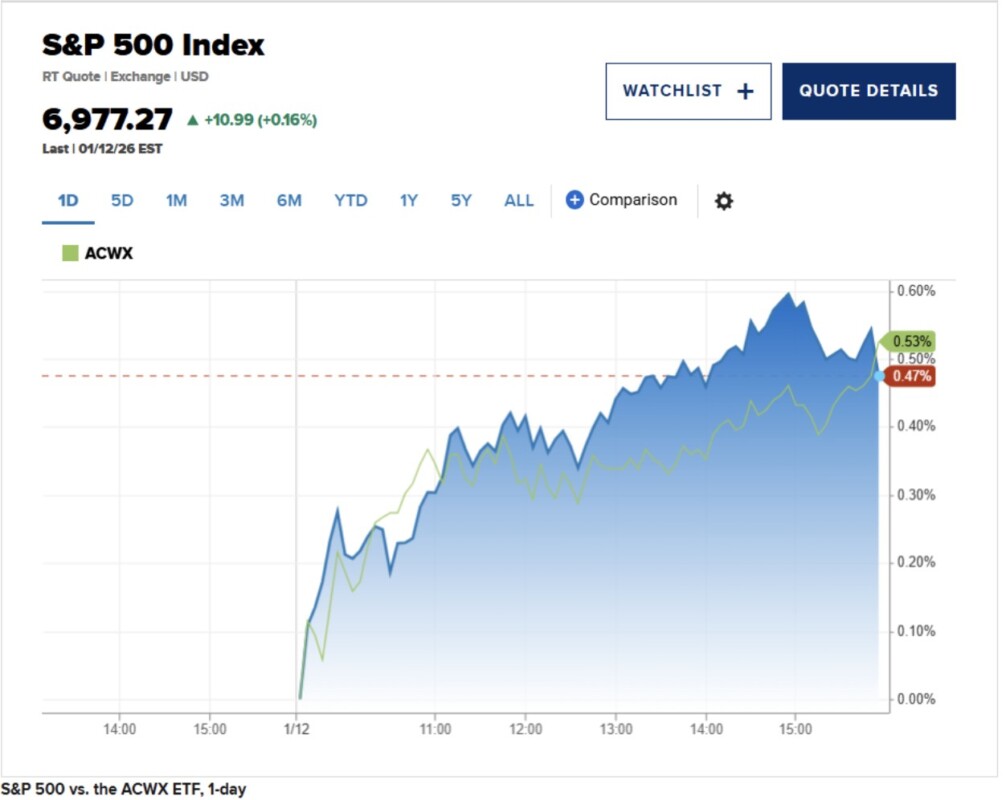

The price of the S&P 500 index moved close to flat due to uncertainty among investors regarding central bank independence. While traditional indices are relatively stable, crypto stocks such as MSTR, Metaplanet, and the S&P 500 price movement are of particular interest.

MSTR adds $1.25 billion in bitcoin, triggering stock rally

Among crypto stocks, Strategy Inc. (MSTR) recorded early gains after announcing a major acquisition of Bitcoin (BTC).

Read also: Top 4 US Stocks that Analyst Ali Martinez Highlighted!

The company bought 13,627 Bitcoins for about $1.25 billion. This is the third consecutive week that MSTR has increased its Bitcoin reserves. This accumulation reflects a growing belief in the future value of digital assets.

MSTR shares rose 1.5% in morning trading, reaching levels of 159.65. Strategy appears to have an aggressive exposure to crypto, which was supported by the market response. Executive Chairman Michael Saylor indicated there would be additional purchases, stating that the firm plans to buy more Bitcoin by the weekend.

Metaplanet Strengthens as Bitcoin Holdings Increase

Metaplanet shares have surged again, rising more than 1.6% to $540. This marks a 46% rally so far in 2026. The company has taken the risky step of buying more than 35,000 Bitcoins and investing around $451 million in the process.

With these large holdings, Metaplanet became one of the companies with the largest Bitcoin reserves in the world. Their crypto-first approach has also continued to benefit shareholders, as share prices recovered and increased investor confidence in alternative assets.

S&P 500 price stabilizes amid Fed turmoil

The general market was shaky, but the price of the S&P 500 index (SPYX) closed slightly higher at 6,977.82, up 0.15%. Stocks managed to recover from early weakness after news broke that US federal prosecutors had subpoenaed Fed Chairman Jerome Powell. The case relates to his testimony in the Senate regarding the renovation of Fed buildings by 2025.

Read also: 36 Altcoins Worth Considering in the First Quarter of 2026, According to Grayscale

The investigation sparked questions about the central bank’s independence, which destabilized the market. However, a late-session rally led by gains in Walmart and some technology stocks managed to stabilize the index.

Gold, Silver, and Bitcoin Prices Surge

Along with crypto stocks, precious metals and cryptocurrencies recorded strong price movements. Bitcoin held above $91,000, while Ethereum (ETH) remained above $3,100.

Gold prices surged to a record high of $4,630 per ounce, and silver shot above $86, due to increased demand for hedge assets amid market uncertainty.

The US dollar depreciated in value, while bond yields fell, further adding to market volatility. Investors’ focus is now turning to the Fed’s next steps, especially regarding inflation, the unemployment rate, and possible regulatory changes.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Crypto Stocks to Watch: MSTR, Metaplanet, and S&P 500 Price. Accessed on January 15, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.