Solana Overtakes Ethereum in Perpetual Futures Volume – Is SOL Ready for $190?

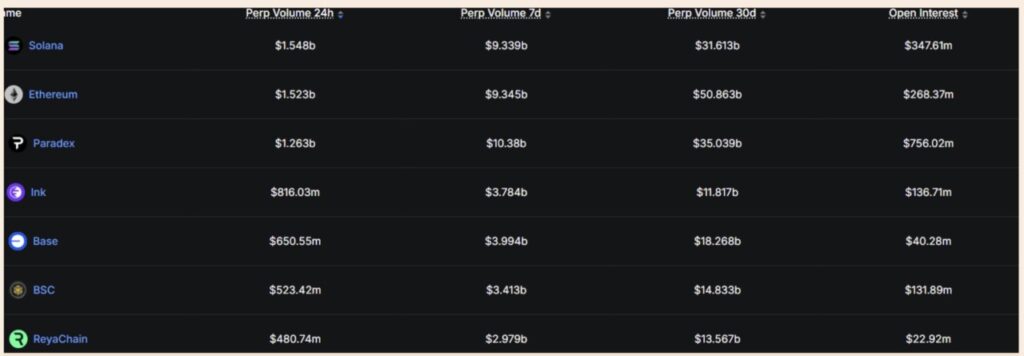

Jakarta, Pintu News – Solana (SOL]) has just made a quiet but significant maneuver. On January 14, 2026, Solana’s perpetual futures trading volume reached $1.548 billion, slightly surpassing Ethereum (ETH) which recorded $1.523 billion at the time.

Although the difference is small in absolute numbers, this achievement is important in the context of the market. It shows that traders are actively choosing Solana for short-term exposure with leverage.

Solana’s Open Interest Reaches $347.6 Million, Surpassing Ethereum’s

According to the AMB Crypto report, the momentum factor played a role. Faster execution, lower transaction costs, and high SOL volatility are driving the flow of funds towards Solana.

Read also: Ethereum Price Weakens to $3,200 Today: ETH Confirms Cup-and-Handle Pattern

However, when looking over a broader timeframe, the overall picture is more complex. Ethereum is still ahead with 30-day perpetual futures volume of $50.86 billion, compared to Solana’s $31.61 billion.

Even so, Solana’s Open Interest (OI) of $347.6 million surpasses Ethereum’s at $268.4 million-suggesting that there is more capital currently placed in SOL derivatives.

This is important because the attention of short-term traders is shifting. Moreover, Solana is starting to prove that it can compete with Ethereum not only in terms of narrative, but also in real leveraged trading activity.

SOL Pressure Below $144 Resistance

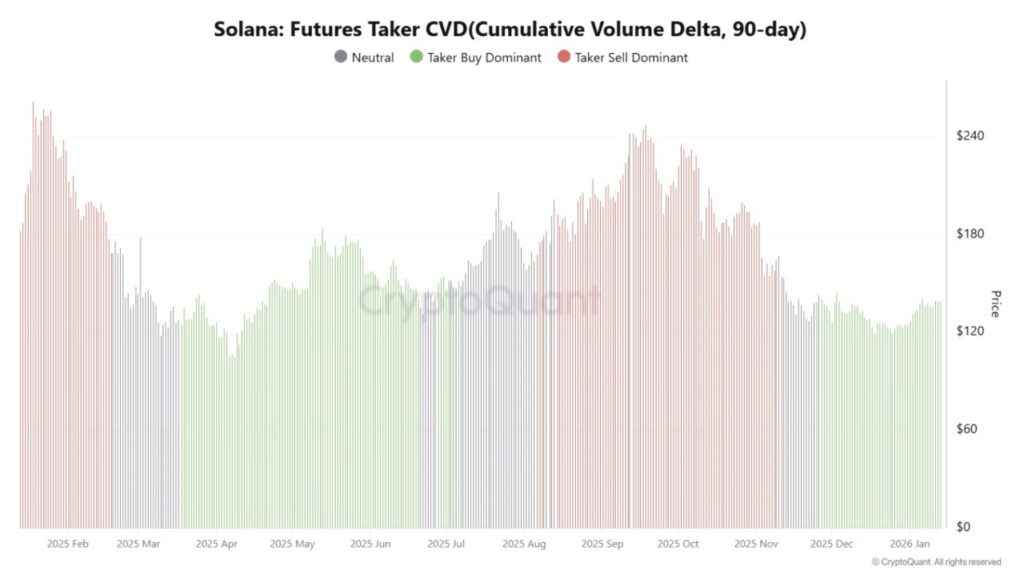

The 90-day Futures Taker CVD indicator has now turned positive and continues to increase to date.Buy orders(Taker Buy) are starting to dominate over sell orders(Taker Sell), indicating that aggressive buyers are starting to enter the market.

This pattern often emerges when the market is able to absorb selling pressure without causing a sharp price spike-creating a condition commonly referred to as a “coiled spring “, where prices have the potential to explode if the pressure is great enough.

Interestingly, the ever-growing green bars indicate the increasing demand for leverage and the growing confidence of market participants. Traders are starting to venture beyond the spread to open long positions.

Usually, this reflects expectations of higher price increases – not just random short-term movements. Nevertheless, the price movement remains restrained. SOL remains blocked at the resistance area around $144, indicating that sellers are still actively defending the zone.

Even so, persistence is the key signal. As long as the dominance of buying by takers persists and Open Interest (OI) does not drop drastically due to liquidation, pressure will continue to build. Above this resistance level, liquidity becomes thinner.

Read also: 1 Pi Network (PI) Price in Indonesia Today

Therefore, optimism is still considered reasonable. If the green CVD continues to hold, the potential for a breakout will open up. If that happens, the momentum formed could push SOL prices to the $190 to $200 range, in line with leverage and price expansion intentions.

OI Growth Exceeds Prices, Hinting That…

On January 14, the OI-Weighted Funding Rate showed repeated green spikes. This signaled that traders were opening new long positions, rather than simply reacting to liquidation.

Meanwhile, Open Interest (OI) has increased to $8 billion-far above the low levels seen throughout 2025. On the other hand, SOL prices have stabilized in the $140-143 range, which is significantly higher than the previous $120-130 zone.

This surge was largely driven by leveraged traders and institutional funds, especially as volatility began to ease.

Continued investment along with stable prices suggests accumulation, without creatingovercrowded market conditions. Importantly, prices have not spiked aggressively.

This controlled condition indicates that long positions were successfully absorbed without triggering excessive buying pressure(short squeeze).

To keep this trend sustainable, two key conditions must be maintained: The Funding Rate needs to remain positive but manageable, and OI needs to remain high without triggering a wave of chain liquidation. If these two conditions are met, then leverage will strengthen the market structure, not weaken it.

Overall, the current market structure reflects healthy positioning. New long positions continue to be built gradually, and the market is showing confidence without entering into a euphoric phase-keeping the opportunity for price increases open.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Solana flips Ethereum in perps volume – Is a $190 move loading? Accessed on January 15, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.