XRP Towards $2: Oversold Signal Gives Hope of Recovery (1/15/26)

Jakarta, Pintu News – The Ripple (XRP) market recently experienced a sharp decline that triggered a wave of panic selling among investors. This exacerbated the bearish sentiment in the market, with many Ripple (XRP) holders trying to limit their losses. However, there are signs of a possible recovery as oversold signals emerge.

Ripple (XRP) Holders Seek to Prevent Further Losses

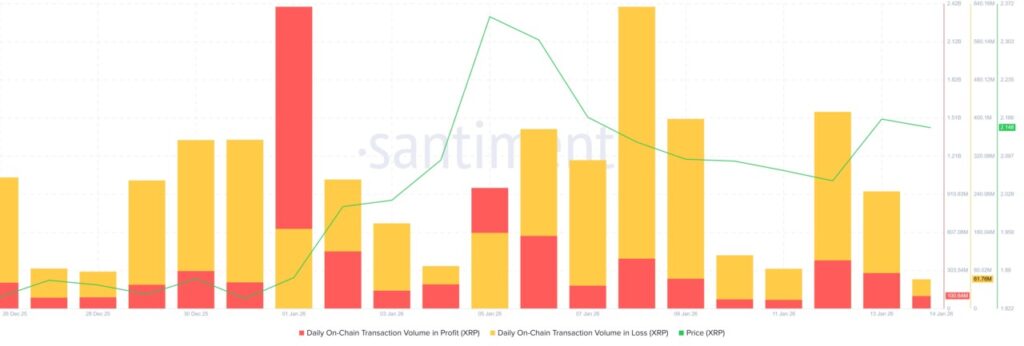

Profit-to-loss volume data on the chain shows that Ripple (XRP) trading activity in the last 20 days has been dominated by losses. Investors tend to sell their assets during brief price rises, hoping to exit their positions close to breakeven.

However, as the downward trend continued, selling pressure increased to avoid a deeper drop. These volatile market conditions forced many Ripple (XRP) holders to make quick decisions. This strategy, while aimed at minimizing losses, often only worsens the situation as it adds to the selling pressure in an already bearish market.

Also Read: Monero (XMR) sets new record, will it continue to surge in January 2026?

Ripple (XRP) Price Recovery Potential

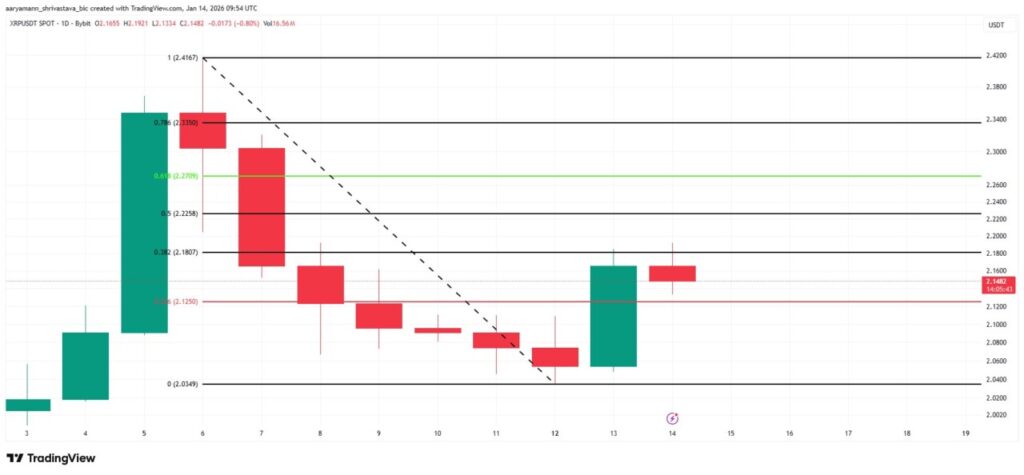

Currently, Ripple (XRP) is trading around $2.14, showing signs of a short-term recovery. Using Fibonacci retracement levels drawn from recent highs to lows, some important reference zones have been identified. The current market structure suggests that buyers are starting to try to take control of the market.

The emerging oversold signal could be an indicator that Ripple (XRP) is ready for a recovery rally. If buyers continue to push the price upwards, it is possible that Ripple (XRP) could recover some of its losses in the near future.

Technical Analysis and Market Sentiment

Technical analysis shows that Ripple (XRP) has reached an oversold condition, which is often followed by a price rebound. Indicators such as the RSI (Relative Strength Index) have dropped to levels that suggest that Ripple (XRP) may be oversold. This is often a turning point for the price to start a recovery.

Market sentiment, while still bearish at the moment, can change quickly with fundamental or technical changes. Investors and market analysts are constantly monitoring these indicators to determine the right time to enter or exit the market.

Conclusion

Although the Ripple (XRP) market is currently facing challenges, technical signals show potential for recovery. Investors who understand the risks and market dynamics may find opportunities in this volatility. As always, it is important to conduct a thorough analysis before making investment decisions in the often unpredictable cryptocurrency market.

Also Read: 7 Crypto Oversupply Signals Could Reset Bitcoin to $10,000 – Here Are the Indicators!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. XRP Holders Can Relax as Price Rises. Accessed on January 15, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.