Ethereum Price Falls to $3,199 as Network Activity Sees a Surge

Jakarta, Pintu News – The crypto market seems to be under bearish pressure, with ETH prices falling below $3,300. However, the Ethereum (ETH) price is showing fresh signs of tightening supply, as staking-related activity increases.

On-chain data monitoring flows on the Beacon Chain and validator activity suggests renewed interest in locking up ETH for network security, despite the price consolidating near a crucial support zone.

The data shows that Ethereum’s Proof-of-Stake ecosystem entered 2026 with an increasing number of deposits, a growing queue of validator entries, and a sharp spike in the number of new addresses.

This combination reinforces the narrative of a “dwindling supply of liquid circulating ETH.” Despite these bullish factors, the price of ETH continues to move below this threshold. This begs the question: when will the token’s price break out of its consolidation phase and experience a breakout?

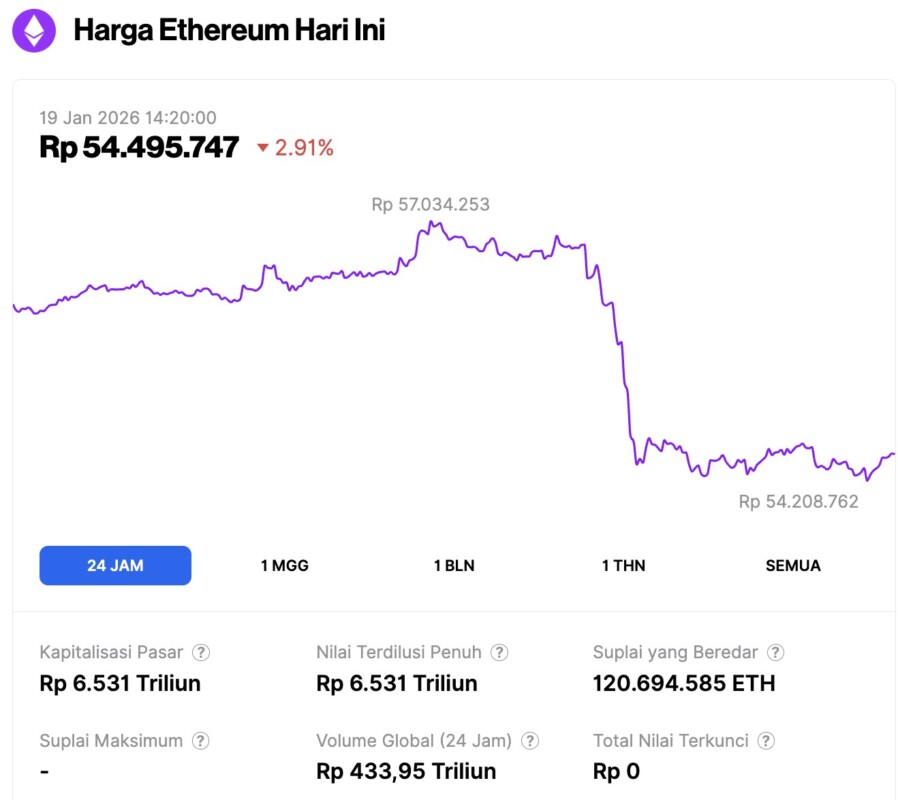

Ethereum Price Drops 2.91% in 24 Hours

On January 19, 2026, Ethereum was trading at approximately $3,199, equivalent to IDR 54,495,747 — marking a 2.91% decline over the past 24 hours. During this time, ETH reached a low of IDR 54,208,762 and a high of IDR 57,034,253.

At the time of writing, Ethereum’s market capitalization is around IDR 6,531 trillion, while its daily trading volume has surged by 119% in the last 24 hours, reaching IDR 433.95 trillion.

Read also: Will BTC, ETH, & XRP Reach New Peaks with the Passage of the CLARITY Act?

Ethereum Staking Jumps Sharply

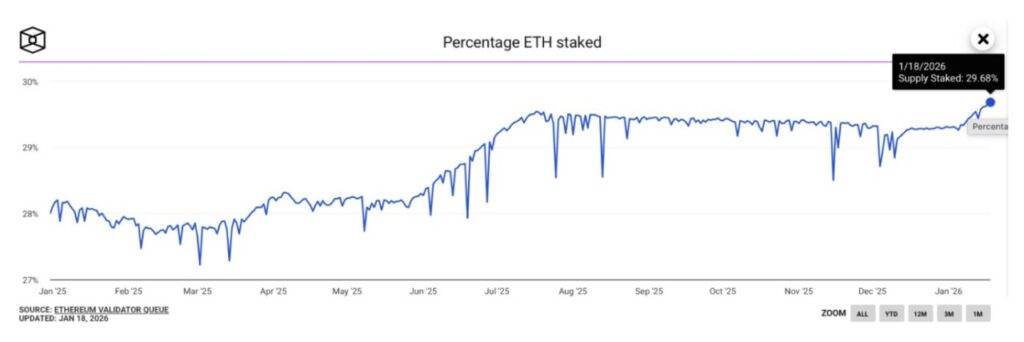

Ethereum has shown a steady upward trend since its inception. Moreover, the ETH staking activity that started before the Merger process has now reached its peak. Most of the current circulating ETH supply has been locked in staking-a very strong bullish signal for the crypto market.

The amount of ETH staked has now reached a record of about 36 million ETH, or about 30% of the total circulating supply. Meanwhile, the balance of Ethereum deposit contracts is reported to have reached about 77.85 million ETH, which accounts for about 46.6% of the total supply according to some trackers.

In other words, while the staking numbers reached an all-time high, this condition is more accurately described as a high concentration of ETH locked in Proof-of-Stake (PoS) deposit contracts.

The 30% percentage of outstanding supply in-stake reflects strong long-term conviction, low short-term selling pressure, and favorable conditions for price increases. Ultimately, however, it is the price action and demand triggers that determine whether this bullish structure will result in a significant breakout.

On the other hand, the number of validators looking to stake continues to rise, with the queue waiting to start staking jumping to 2.5 million-the highest number in history.

In contrast, the exit queue (validators who want to withdraw their stakes) has almost reached zero, signaling that selling pressure from the validator side is very low.

Spike in New Ethereum Addresses in January: Network Activity Increases

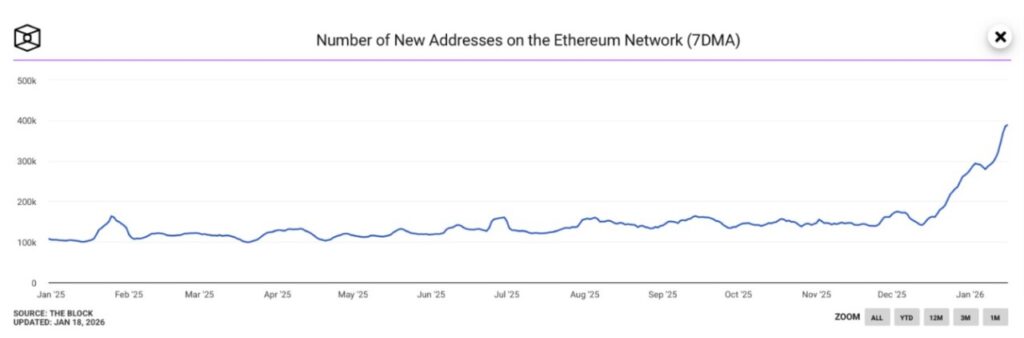

After a long period of flat trends, Ethereum network activity is now rising sharply. The 7-day moving average of the number of new Ethereum addresses jumped dramatically into January 2026, reaching the highest level in its historical chart.

Currently, the number of daily ETH addresses is in the range of 110,000 to 160,000, reflecting steady adoption even in times of market consolidation. In late December to early January, this metric had a sharp spike, touching 400,000 new addresses per day.

Read also: Sei Network Prepares to Launch Giga Upgrade, What’s New?

This sharp rise could be considered an early signal of a bull market, as historically, active address spikes are often the precursor to significant price breakouts.

When will ETH price break the $3500 barrier?

After the latest drop, Ethereum price is currently trading in a strong zone between resistance and support levels. Both bulls and bears seem to be very active, which has caused the price movement to be stuck in the range of $3,150 to $3,300.

Based on the current chart dynamics, the consolidation phase is expected to continue, as the price trend has not yet reached the top of the decisive movement pattern.

ETH price is currently in a zone of fairly strong demand and support. The RSI indicator is also showing a rise within a parallel channel and is testing the lower boundary of the channel. Therefore, this level is expected to experience areversal, which could prevent the price from falling deeper below the $3,050 area.

However, with the RSI getting closer to the overbought zone, there is a potential bearish signal starting to emerge for ETH.

For the bullish momentum to persist, the price should be able to continue consolidating strength between the $3,280 to $3,220 range. On the other hand, volatility in the market has started to decrease, which has led to a more compressed price movement. This over-compression could be the trigger for a bigger breakout in the near future.

If this scenario occurs, Ethereum price could potentially break the $3,500 barrier before the end of the month.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. ETH Price Dips 3.15% Toward $3200: Why Ethereum Could Be Setting Up for a Strong Rebound. Accessed on January 19, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.