Bitcoin Holds Steady at $92,000 — Will the Bulls Break Through the Bearish Wall?

Jakarta, Pintu News – Bitcoin (BTC) price has been volatile around $93,000 after dropping below $92,000 in intraday trading, making it difficult for buyers (bulls) to dominate the market.

Currently, price movements are showing mixed signals and are increasingly defensive in nature. On the other hand, activity in the derivatives market has also begun to subside, indicating that traders are de-risking ahead of major macroeconomic events, rather than rushing out of the market.

With the focus on the upcoming CPI and GDP data, the next BTC price movement could be crucial.

Bitcoin Price Up 0.15% in 24 Hours

On January 20, 2026, Bitcoin was trading at $92,305, or approximately IDR 1,573,460,537—marking a modest 0.15% gain over the past 24 hours. During this period, BTC dipped to a low of IDR 1,570,869,787 and climbed to a high of IDR 1,590,564,128.

At the time of writing, Bitcoin’s market capitalization is around IDR 31,283 trillion, while its 24-hour trading volume has declined by 4% to IDR 564.03 trillion.

Read also: Top Crypto to Watch this Weekend: BTC, ETH, and SOL as Open Interest Skyrockets

What Does This Chart Show?

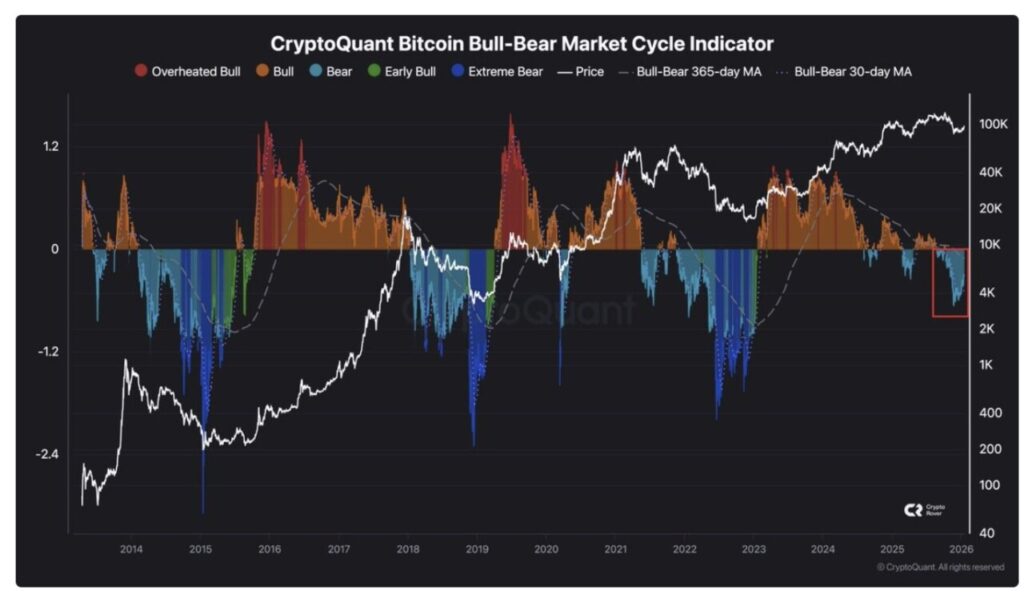

CryptoQuant’s Bitcoin Bull-Bear Market Cycle Indicator essentially serves as a momentum “weather map” for Bitcoin’s long-term cycle. When this indicator shows a warmer color (bull/very bullish market), it usually reflects rising risk appetite and trend strength.

Conversely, when the indicator fades into the blue(bear) zone, it indicates the market is starting to cool down and upward momentum is weakening.

Currently, the indicator has entered into blue bear territory, which historically often appears during temporary decline phases, consolidation, or the beginning of a downtrend. However, the important point is that this tool is not a switch that instantly changes the market direction from bull to bear all of a sudden.

Rather, it should be read as a warning that market conditions are starting to weaken, not proof that the entire cycle is over.

The chart also highlights the previous period where the indicator briefly entered the bearish zone without immediately triggering a long-term bear market. The current situation resembles more of a “mid-cycle reset”, where momentum is weakening, but there are no definite signs of the next direction.

As such, traders need to monitor support levels closely, because if support is broken, it could be the start of a bear market.

Read also: American Burger Chain Steak ‘n Shake Invests $10 Million in Bitcoin as Part of Bold New Strategy

Bitcoin’s Next Move – Will Support at $90,000 Hold?

Bitcoin’s next price movement depends on the strength of the support zone at $90,000. If BTC is able to hold above that level on a daily close and macroeconomic data doesn’t trigger a major shift towardsrisk-off, then CryptoQuant’s bear zone signal is likely just a mid-trend cyclical cool-down, not an overall trend reversal.

In that scenario, Bitcoin has the opportunity to bounce back to the $95,000 area, then continue to the psychological level of $100,000, and could even reach $106,000 to $110,000 if momentum is fully restored.

However, if BTC closes the trade below $90,000 convincingly, then the bias will turn bearish and open up opportunities for a drop to the $88,000, $85,000, or even $80,000 area.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Bitcoin Price Regains Momentum, Can Bulls Push BTC Above Bearish Pressure? Accessed on January 20, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.