Ethereum Holds Around $3,100 — Whale Scoops Up $33 Million in ETH Amid Price Dip!

Jakarta, Pintu News – Amid Trump’s statements on tariffs and the latest threats against European markets, the crypto market experienced a sharp fall on January 19, 2026. The crypto market capitalization fell from $3.23 trillion to $3.13 trillion, registering a drop of $100 billion.

In this broader market crash, Ethereum (ETH) was hit quite hard and lost some of its recent gains. The price of Ethereum dropped to a low of $3,177 before recovering slightly.

Then, how will Ethereum price move today?

Ethereum Price Drops 0.38% in 24 Hours

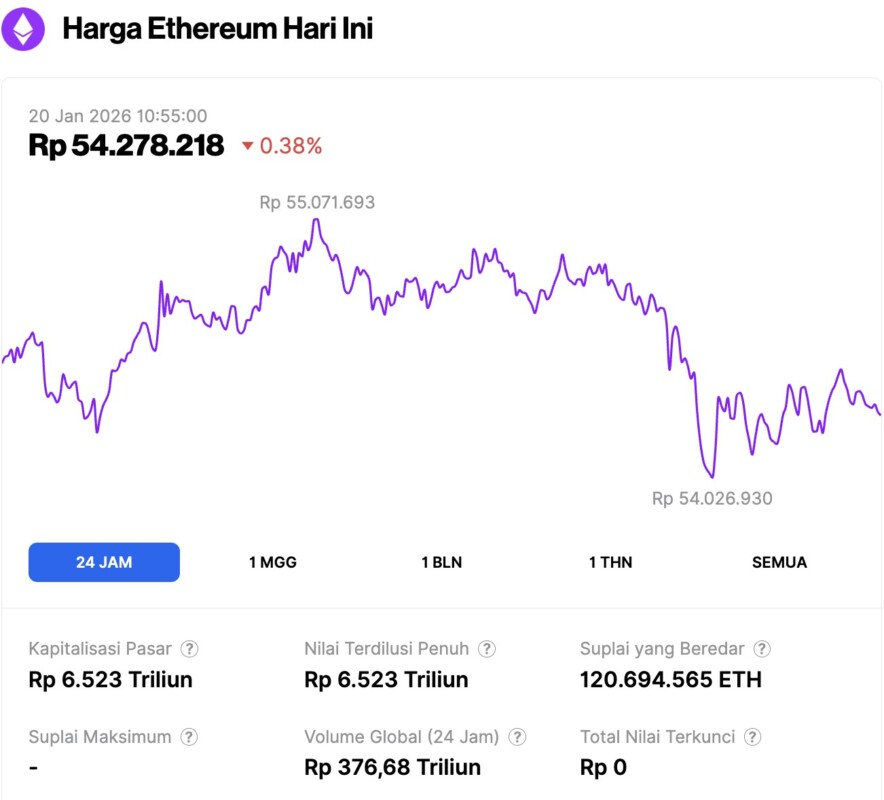

As of January 20, 2026, Ethereum was trading at approximately $3,185, or around IDR 54,278,218, marking a slight decline of 0.38% over the past 24 hours. Within that timeframe, ETH dipped to a low of IDR 54,026,930 and peaked at IDR 55,071,693.

At the time of writing, Ethereum’s market capitalization is hovering around IDR 6,523 trillion, while its daily trading volume has fallen by 8% to IDR 376.68 trillion in the past 24 hours.

Read also: Bitcoin Holds Steady at $92,000 — Will the Bulls Break Through the Bearish Wall?

Market Crash Triggers $109 Million Liquidation

After ETH dropped through the $3,200 level, Futures positions-especially long positions-experienced massive liquidation. The liquidation heatmap shows that ETH was over-leveraged in the price range of $3,350 to $3,450.

However, the price fell from a high of $3,368 to $3,117, triggering a large liquidation zone below the $3,200 level. As soon as the price touched the zone, long positions started to be liquidated, which then triggered a chain effect of massive liquidation and selling in the market.

According to data from CoinGlass, total liquidations surged to a monthly high of $109 million. Of this, long positions accounted for $101 million of the total forced liquidations.

Usually, when a long position of this size is liquidated, the selling pressure intensifies-which is often a sign of further price declines.

Ethereum Whales Buy as Price Falls

Interestingly, after the market took a dip, an Ethereum whale seized the moment to accumulate ETH at a discount. Based on data from Onchain Lens, the whale bought 10,057 ETH worth $33.68 million from Binance.

After the purchase, the whale supplied ETH to Aave V3 and borrowed $45 million in USDT to buy 13,461 stETH. In another wallet, the whale withdrew and used $129 million USDT to purchase 38,780 stETH.

This move shows confidence on the part of the whales, indicating that market participants prefer to get yield amidst a weakening market structure.

With ETH locked on the DeFi platform, liquid supply is effectively reduced, which can destabilize prices during market downturns.

In addition, activity on crypto exchanges also reflected the “buy the dip” sentiment. Based on data from CryptoQuant, there was a spike in outflows of 517,471 ETH between January 18 and 19.

Read also: Vitalik Buterin admits Ethereum has “regressed” Over the Last 10 Years, What is the Solution?

As a result, ETH netflow on exchanges continues to show a bullish structure, staying in the negative zone for eight consecutive days. Usually, a negative netflow signifies high outflows, which is a clear signal of massive accumulation in the spot market.

With whale accumulation and market conditions like this, there is hope that ETH could soon recover from its ongoing correction.

Is ETH in Danger, or Just a Temporary Correction?

Ethereum’s recent price decline has been triggered more by macroeconomic uncertainty than structural weaknesses in the asset itself. In fact, demand for ETH remains high, both from large investors (whales) and retail investors, as explained earlier.

Nonetheless, heavy selling pressure remains evident. Ethereum’s Ergodic SMI indicator showed a bearish signal through a downward crossover, and dropped to the 0.18 level.

In addition, ETH has also dropped below two long-term moving averages, the 100 EMA and the 200 EMA, signaling strong downward pressure on prices.

If external factors such as economic uncertainty continue to affect investor sentiment, ETH is at risk of dropping to the $3,166 level, and could even break the important support at $3,000.

On the contrary, if demand remains strong and is able to withstand these external pressures, ETH has a chance to recover, erase the current losses and break the $3,300 level again.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Ethereum: Can $33 mln in whale buys help clear ETH’s recent losses?. Accessed on January 20, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.