Dogecoin Slips Slightly Today — Could DOGE Face Further Downside?

Jakarta, Pintu News – The price of Dogecoin (DOGE) continues to decline, with its price movement remaining within a clearly formed descending channel. This pattern is characterized by progressively lower peaks and bottoms, indicating that selling pressure is still dominant and any attempted reversal by buyers continues to be held back at the channel resistance area.

Instead of experiencing a strong recovery, Dogecoin’s corrective movements have been regular and controlled, which usually indicates a continuation of the downtrend rather than a reversal. So, how will Dogecoin price move today?

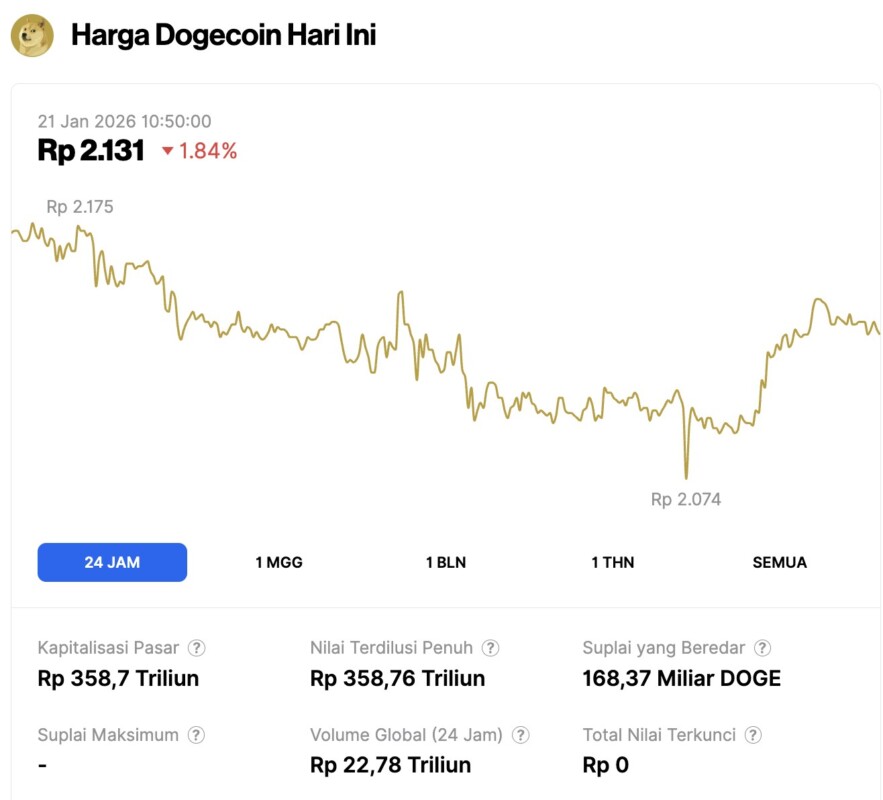

Dogecoin price drops 1.84% in 24 hours

On January 21, 2026, Dogecoin saw a 1.84% dip over a 24-hour period, trading at $0.1254, which is equivalent to IDR 2,131. Throughout the day, its price fluctuated between IDR 2,175 and IDR 2,074.

At the time of writing, Dogecoin’s market capitalization is approximately IDR 358.7 trillion, with a 24-hour trading volume of around IDR 22.78 trillion.

Read also: Dogecoin (DOGE) Price Predicted to Strengthen Up to 20% Ahead of SCOTUS Ruling!

Key Technical Points of Dogecoin Price

- DOGE is trading within a descending channel, confirming the bearish trend structure.

- Losing control points indicates weakening market acceptance and seller dominance.

- Key support is around $0.11 (VAL confluence), but downside risks still remain.

Descending channels are common during corrective phases and downtrends, and are often a reliable framework for monitoring trend direction. In the case of DOGE, both resistance and support channels are clearly formed, creating a technical map for price movements.

This structure is important because it reflects a steady and controlled selling pressure. In an uptrend reversal, the price usually breaks through the channel resistance with strong momentum and a decisive close. However, the DOGE is still moving along the boundaries of this channel, signaling that the bearish trend is still ongoing.

Each rally attempt always failed to break through the structure, reinforcing the pattern of progressively lower peaks. Until prices are able to close above the descending channel resistance and stay at that level with market acceptance, sellers remain in control of the overall direction of movement.

$0.11 Support as Next Higher Time Frame Demand Zone

The next major area of support is around $0.11, which is in line with the low area value (VAL) and is a demand zone on the high time frame. Historically, this area is often the point where buyers attempt to defend the price and trigger a reactive bounce.

DOGE has shown a response from this area, but the bounce is fairly weak. Weak reactions in support areas usually indicate that buyers are starting to absorb selling pressure, but are not yet strong enough to reverse momentum or reclaim important resistance levels.

If the price continues to fail to break back above the point of control (POC) and remains trapped within the descending channel, then the $0.11 level will be a crucial decision point. Strong defenses may result in a temporary bounce, but if weakness persists, the market is likely to re-test the lower boundary of the channel.

Channel Bottom Support May be Tested

The weakness of the current price bounce increases the likelihood that DOGE will again test the support at the bottom of the descending channel. This is a common behavior in a sustained bearish trend: the price bounces off the support area, fails to break resistance, and then goes back down to resume the downward trend.

If the DOGE returns to the lower boundary of the channel, traders should observe whether the price shows signals of a stronger bullish reaction, such as an impulsive recovery or increased volume. If these signals do not appear, the downtrend is likely to continue gradually.

Read also: Shiba Inu Price Prediction: SHIB Threatened to Fall Again? Technical Signals Reveal Bear Dominance

This is why the $0.11 area is so crucial. It is not just a support level, but a zone that determines whether DOGE will stabilize within its current range or break deeper towards the continuation of the bearish trend.

Market Structure Still Favoring Continuation of Downtrend

From a market structure point of view, Dogecoin is still in a bearish state. The core structure remains as follows:

- Lower price peaks (rally on hold)

- Lower price basis (trend continues)

- Loss of POC (value shifted to lower price)

- The downward channel is still respected (control remains with the seller)

As long as this structure hasn’t changed, a downward continuation scenario remains the greater possibility. Any upward movement that doesn’t manage to break the channel or reclaim key levels should be considered a corrective bounce, not a legitimate trend reversal.

A true trend reversal requires DOGE to reclaim the POC, break through channel resistance, and form a higher price base to support a new uptrend.

Forecast of Future Price Movements

Currently, Dogecoin is still trading in a descending channel, with the bearish market structure still intact. The loss of control points (POCs) confirms that the market is starting to accept lower prices.

Although the $0.11 level remains an important support zone on high time frames, the weak response from that support suggests that sellers still control the momentum, and the lower boundary of the channel is likely to be tested again.

If DOGE breaks below $0.11 and fails to reclaim it immediately, then a continuation of the downtrend becomes more likely as the market seeks liquidity at lower levels.

However, if support holds and buyers show stronger momentum, DOGE may keep moving within the range of this channel, although the general trend is still bearish until resistance is broken.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Crypto News. Dogecoin Price Solidifies Descending Channel. Accessed on January 21, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.