Dogecoin Price Slips 2% Today — What’s Next for DOGE?

Jakarta, Pintu News – Dogecoin (DOGE) is facing immense pressure as the meme coin slips further into its test of endurance. After experiencing a 12% drop in the last seven days, DOGE has now broken the crucial support level of $0.15 and briefly touched an intraday low of around $0.12.

This movement extends the negative trend that has been in place since the beginning of 2026, coupled with declining interest from retail investors. For now, there are no signs that the Dogecoin price will see a significant increase.

So, how is the Dogecoin price moving today?

Dogecoin price drops 2.23% in 24 hours

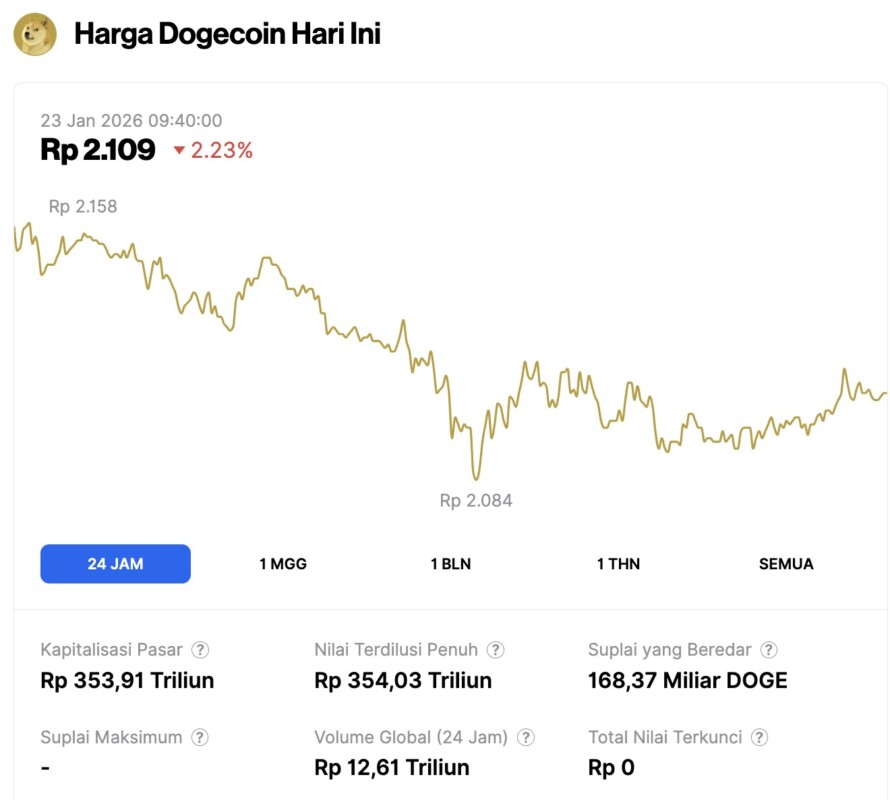

On January 23, 2026, Dogecoin saw a 2.23% dip over the past 24 hours, with the price settling at $0.1249, or approximately IDR 2,109. During that period, DOGE traded within a range of IDR 2,158 to IDR 2,084.

At the time of writing, Dogecoin’s market capitalization is estimated at around IDR 353.91 trillion, with a 24-hour trading volume of roughly IDR 12.61 trillion.

Read also: Meme Coin Predictions: Dogecoin, Shiba Inu, and Pepe are in Bitcoin’s Shadow!

Dogecoin Breakdown at $0.15 Changes Price Structure

This drop is very important. The DOGE price has now lost several layers of historical support, confirming a trend shift to a broader bearish direction. Technically, on the 4-hour chart, the DOGE price is still moving in a descending channel pattern.

Every attempted rally towards the $0.15 resistance throughout January has been met with strong selling pressure, reinforcing the formation of lower highs and continued downward pressure. As long as this channel has not been broken to the upside, the rally is most likely just corrective in nature, not a sign of a trend change.

Currently, the Dogecoin price is trading around $0.12, holding just above the key demand zone after the breakdown earlier this month. As seen, the meme coin was rejected from the $0.15 supply area and then dropped further, confirming short-term control by the sellers, rather than just a temporary correction.

The latest selling was stuck at the $0.12 support zone, where buyers started to show strong defense. This area has now been tested several times, which makes it even more important as a short-term price floor.

In addition, the Bull Bear Power (BBP) indicator is still negative but starting to flatten, while trading volume declined after the initial breakdown-suggesting that the panic selling phase may have passed.

Asset holder sentiment is also negative, reflectingcapitulation rather than confidence. Historically, this kind of extreme sentiment usually appears at the end of a downtrend, rather than at the beginning of a new trend.

While this does not confirm a trend reversal, it does indicate that the downward momentum is starting to getcrowded. As long as the price of DOGE holds above $0.12, the market is likely to flatten out or attempt a recovery rally towards $0.14.

The first technical sign of recovery would be if DOGE manages to break back above the descending channel. However, if the $0.12 level is broken again, the risk of a further decline towards $0.10 will reopen.

ETFs and Whales could be the savior? Data Shows Otherwise

At the same time, institutional participation in Dogecoin is still nowhere to be seen. Despite the launch of DOGE ETFs in late 2025 by issuers such as Grayscale and 21Shares, early 2026 saw almost nonet inflows.

Without steady institutional demand, the Dogecoin price becomes vulnerable to liquidation actions from retail investors when the market is under pressure.

Signals from on-chain data further reinforce concerns. Whale activity indicates capital rotation, not accumulation.

Read also: Ethereum Slips to $2,900 as Market Eyes Potential 50% Upside

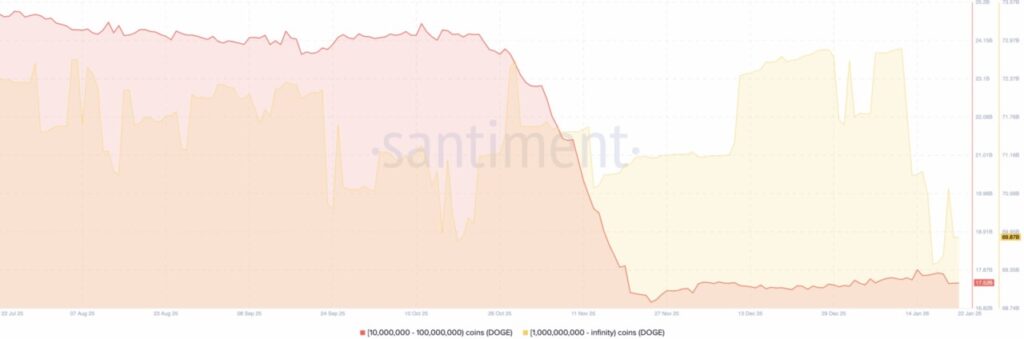

Large holders appear to be shifting funds away from sentiment-driven assets like DOGE. For example, data from Santiment shows a change in whale behavior which explains Dogecoin’s recent weak performance.

The supply held by medium whales-that is, wallets holding between 10 million and 100 million DOGE-has been declining consistently since late October.

This decline accelerated even more in November and shows no sign of reversal yet. This indicates a sustained distribution, not just short-term profit-taking.

Meanwhile, the largest whales-wallets with more than 1 billion DOGE-showed more erratic behavior. After an accumulation phase in December, their holdings stagnated and then declined again until mid-January.

This suggests that even long-term or strategic holders are starting to reduce their exposure, removing one of the layers of price support from the downside.

In terms of price, this helps explain why Dogecoin has struggled to sustain itsrebound. As long as supply continues to leave the hands of large holders, any rally is likely to face selling pressure from above unless this trend begins to stabilize.

For prices to truly recover, the chart at least needs to show a pause in the whale outflow. However, as of now, this is still nowhere in sight.

Why 2026 is Different for Dogecoin

The memecoin landscape has changed. Speculative cycles in 2021 and 2024 gave viral coins an advantage. But by 2026, the market became much tighter and less forgiving.

Regulatory uncertainty has also played a role. Ongoing delays regarding the CLARITY bill have led investors to prefer assets that have a clearer legal foundation, such as Bitcoin (BTC), Ethereum (ETH), and XRP (XRP).

Meme coins, which rely more on sentiment than fundamental structure, are now disproportionately affected. In addition, macroeconomic pressures are exacerbating the situation. The escalating trade conflict between Trump and the EU over Greenland tariffs has triggered broad “risk-off” market conditions.

When Bitcoin price struggles to maintain key levels, traders tend to reduce their exposure to speculative assets first-and DOGE is at the top of the list.

Unless buyers can quickly reclaim the $0.15 level and turn it into support, the pressure remains on the bulls. For now, faith in Dogecoin is being tested in a market that no longer rewards based solely on meme popularity.

Read also: GameFi Starts to Rise in 2026: These 3 Crypto Lead the Rally Trend!

DOGE Price Outlook

Dogecoin price is still under pressure on the daily chart, trading around $0.12. Just like on the 4-hour chart (1/21), the meme coin is still trapped in adescending channel that was formed since October and has yet to be broken.

The long-term trend remains bearish, with the pattern of lower highs continuing and the price struggling to break important Fibonacci resistance levels. The $0.14 zone-which aligns with the 0.236 retracement level and the previous breakdown structure-repeatedly served as a strong upper limit and resisted any rally attempts.

On the downside, DOGE is again testing the $0.12 demand zone, an area that has held several times in recent weeks. Also, the Awesome Oscillator (AO) indicator is still in negative territory but is beginning to flatten, indicating that the bearish momentum is weakening rather than increasing.

For now, the Dogecoin price seems to be in a stabilization phase, not a definite trend reversal. If selling pressure increases, DOGE could drop below $0.10.

However, if it is able to hold above $0.12, there is still a chance for a corrective bounce towards $0.14.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CCN. Dogecoin (DOGE) Price Breaks Key Support After 12% Drop as Memecoin Risks Extended Correction. Accessed on January 23, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.