Gold Token Demand Increases, US Dollar Weakens: What’s the Impact?

Jakarta, Pintu News – Demand for gold tokens has risen sharply as the value of the US dollar weakens. Tether Gold (XAUT) now dominates more than half of the gold-backed stablecoin market, signaling a shift in investor preference to safe-haven assets amid global geopolitical and economic uncertainty.

Tether Gold Stablecoin Dominates the Market

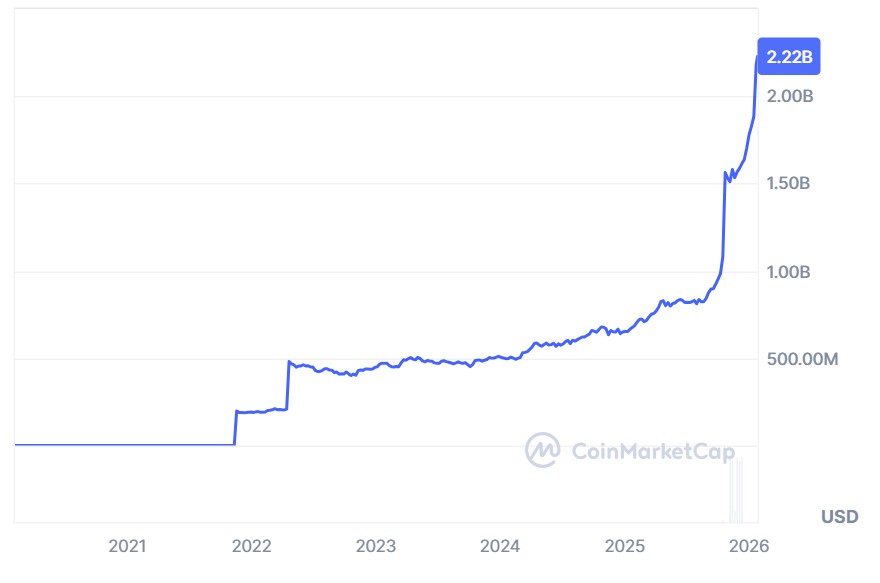

Tether Gold (XAUt) from Tether has become the dominant player in the gold-backed stablecoin market, with a total value exceeding $2.2 billion. Currently, there are 520,089 XAUt tokens in circulation, with each token secured by physical gold held in reserve. Tether’s CEO, Paolo Ardoino, stated that the scale of Tether Gold investments is now equivalent to some sovereign gold holders.

This statement comes on the heels of gold prices on the Comex reaching $5,000 per troy ounce, up about 17% since the beginning of the year. This rise in demand for tokenized gold reflects the trend of increased interest in physical bullion. This suggests that investors are increasingly directing their investments towards assets that are considered safe amid global uncertainty.

Also Read: 5 Key Facts on Silver vs Gold Supply Gap and Its Impact on Crypto & Commodity Assets

US Dollar Decline and Gold Purchases by Central Banks

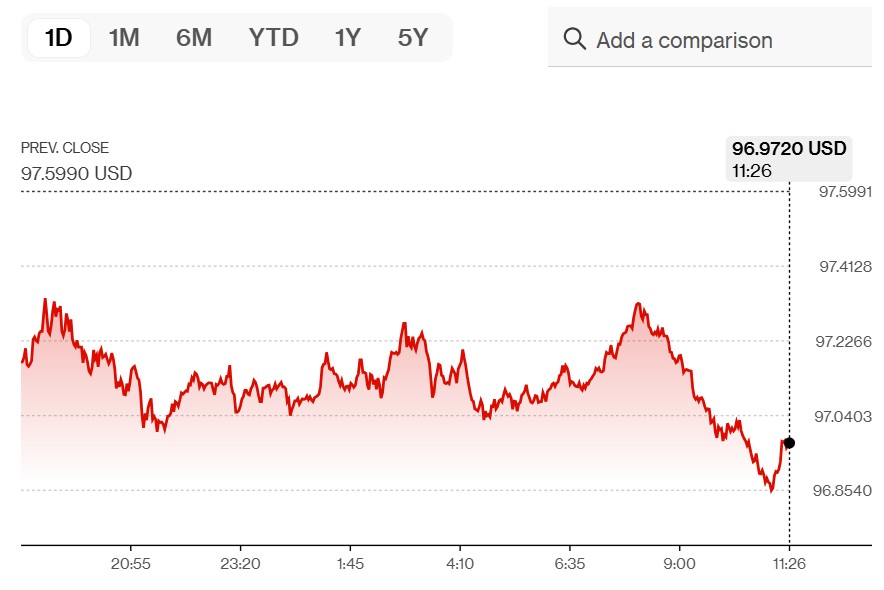

The US Dollar has experienced a significant decline since President Donald Trump took office in early 2025, with the US Dollar Index (DXY) falling 9.4% last year. This was the worst performance since 2017 and has continued into this month, reaching its lowest point since September.

Analyst Otavio Costa of Azuria Capital stated that the dollar has broken the long-term support line for the first time in over a decade, with confirmation likely on a monthly basis.

On the other hand, global central banks have increased their gold purchases, with net purchases reaching 220 tons by the third quarter of 2025. This is part of efforts to reduce reliance on assets denominated in the US dollar and shift to assets considered safer outside the global financial system.

Bitcoin Can’t Replace Gold as a Hedge yet

While Bitcoin (BTC) is often considered as an alternative to hedge against falling currencies, to date, it has not been able to attract a steady stream of long-term investments, especially from older, conservative investors.

Karel Mercx, an investment strategist from Beleggers Belangen, finds that Bitcoin still hasn’t lived up to its promise as a trading tool that can protect against currency downgrades.

As such, gold is still the top choice as a hedge. The significant rise in gold prices and the dominance of gold tokens show that gold is still considered the most effective and reliable safe-haven asset amid the current economic and geopolitical uncertainties.

Conclusion

With increasing global uncertainty and a weakening US dollar, gold, both in physical and tokenized form, continues to demonstrate its strength as a safe-haven asset. Tether Gold’s dominance in the gold-backed stablecoin market signals a notable shift in investment preferences, which are increasingly toward assets that are perceived as safer and more stable.

Read More: Altcoin Price Spikes: A Seasonal Phenomenon Not to be Missed!

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Cointelegraph. Gold-Digital Rally Mirrors Rising Stressed Dollar. Accessed on January 27, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.