5 US Economic Data Predicted to Determine Bitcoin, Gold, and Silver Volatility

Jakarta, Pintu News – Key economic data from the United States this week has the potential to be a big catalyst for the prices of risky assets such as Bitcoin (BTC), safe haven assets such as gold and silver, as well as the cryptocurrency market in general, amid still fragile macro conditions.

1. The Federal Reserve (FOMC) Interest Rate Decision

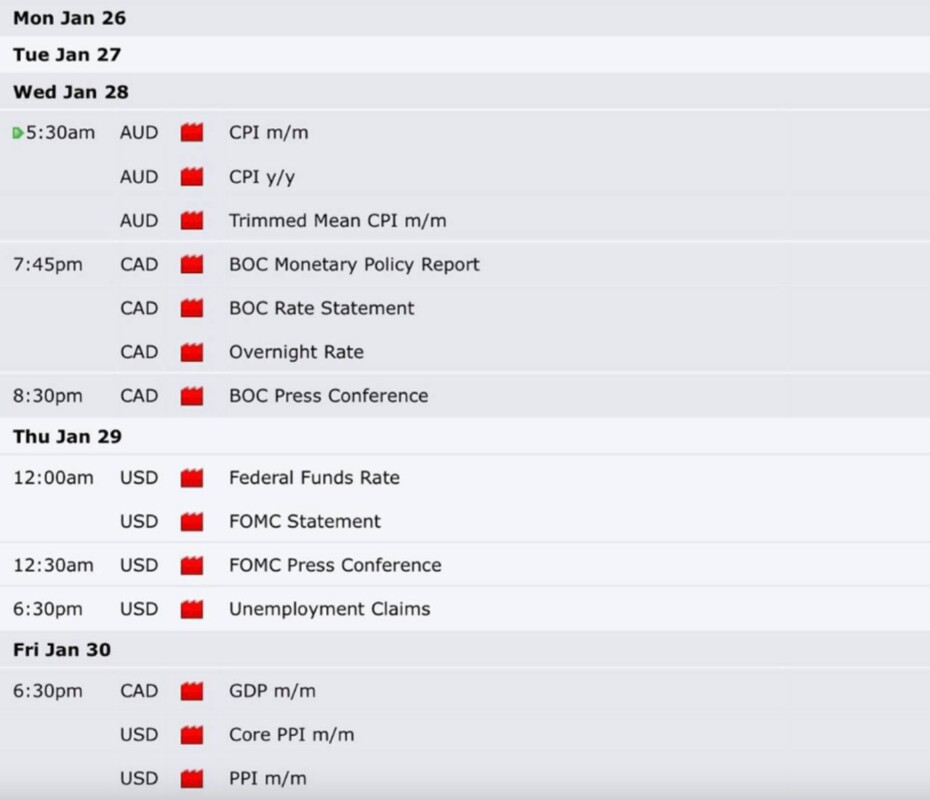

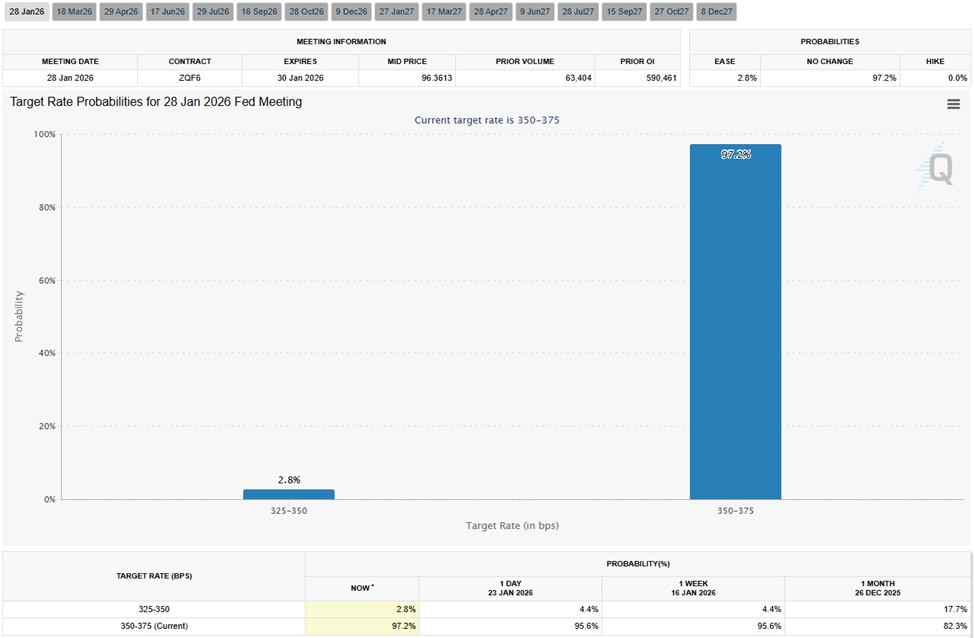

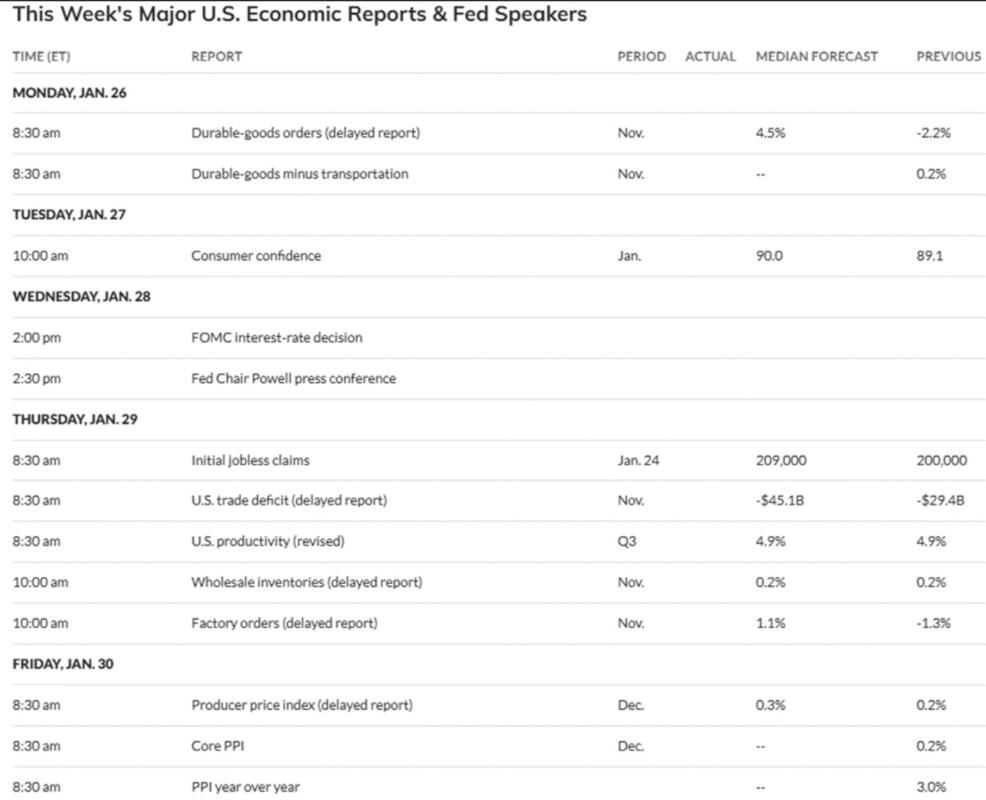

The interest rate decision from the Federal Open Market Committee (FOMC) and Fed Chair Jerome Powell’s press conference are among the most important events expected to affect Bitcoin and precious metals prices this week. According to various economic calendars, the market expects the Fed to keep rates on hold, but the tone of Powell’s statement could trigger a change in investor sentiment.

If the Fed gives dovish signals (potential rate cuts), riskier assets like Bitcoin usually get a boost, while demand for gold and silver as hedges may weaken. Conversely, hawkish signals can increase volatility and strengthen safe havens like gold.

Also Read: 5 Key Facts on Silver vs Gold Supply Gap and Its Impact on Crypto & Commodity Assets

2. Initial Unemployment Claims Data

Initial jobless claims data in the US provides a snapshot of labor market conditions. A higher-than-expected figure could strengthen expectations of future interest rate cuts, which may see investors turn to riskier assets including cryptocurrencies. Conversely, low jobless claims usually indicate a strong labor market, which can suppress volatility and reduce the appeal of safe haven assets such as gold and silver.

3. Producer Price Index (PPI) and Wholesale Inflation

The Producer Price Index (PPI) and core PPI figures are important indicators in monitoring inflationary pressures at the wholesale level. If the PPI data shows stronger inflation, market expectations for price growth may increase, driving demand for gold and silver as a hedge against inflation.

The impact on Bitcoin and crypto itself is usually more complex: high inflation can fuel speculative investment interest, but on the other hand it can trigger fears of high interest rates depressing the price of risky assets.

4. Big Tech Revenue Report

Earnings reports from major tech companies such as Microsoft, Apple, Tesla, and Meta are also included in this economic data calendar. Strong earnings results can boost investors’ risk appetite, thus having a positive impact on Bitcoin and other risky assets. Conversely, earnings below expectations can trigger risk off sentiment, which tends to strengthen demand for gold and silver as safe havens.

5. US Government Shutdown Risk

The deadline for a potential government shutdown later this week is also a factor that could rattle the markets. Political uncertainty such as the threat of a shutdown often increases demand for gold and silver as investors seek hedges. Meanwhile, this kind of negative sentiment often suppresses risky assets like Bitcoin in the short term as investors are more cautious with risk exposure.

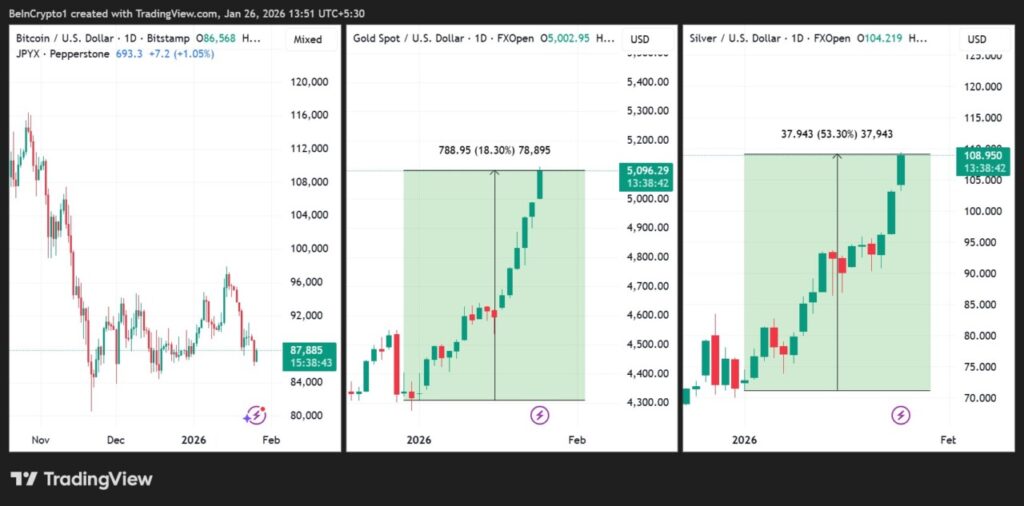

Implications for Bitcoin, Gold, and Silver

The relationship between US economic data and the prices of assets like Bitcoin and gold is often not linear. Bitcoin, which is often positioned as a risky asset, can move parallel to equities in risk on conditions, but act more defensively when market sentiment reverses. Meanwhile, gold and silver tend to attract investor interest when inflation expectations are high, interest rates are falling, or macro risks are rising.

Conclusion

Five key US economic events this week-including the Fed’s interest rate decision, employment data, PPI figures, tech earnings reports, and shutdown risk-are expected to trigger Bitcoin, gold, and silver price volatility in the short term. Regular monitoring of the economic calendar is an important tool for investors to anticipate changes in market sentiment and adjust portfolio strategies accordingly.

Read More: Altcoin Price Spikes: A Seasonal Phenomenon Not to be Missed!

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Beincrypto. 4 US Economic Events to Influence Bitcoin, Gold, and Silver Prices This Week. Accessed January 28, 2026.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.