Gen Z Abandons Altcoins as Prediction Markets Emerge as the Most Resilient Crypto Product

Jakarta, Pintu News – Generation Z is not completely abandoning crypto and cryptocurrencies, but rather changing the way they speculate. After the post-2024 token cycle left millions of altcoins without liquidity, confidence in the long-term token narrative is fading.

Economic pressures and limited income have accelerated this change in behavior. Under these conditions, prediction markets emerged as a simpler and more scalable alternative to speculation.

Gen Z’s Economic Pressures and Shifting Speculation Strategies

Economic conditions are the main factor behind Gen Z’s shifting preferences. The average income of Gen Z is at US$39,416 or around Rp662.1 million per year, far below the living wage requirement of US$48,614 or Rp816.6 million.

To achieve a comfortable standard of living, the estimated income is as high as US$106,000 or around Rp1.78 billion per year. This gap makes long-term investment strategies feel increasingly unrealistic.

In the context of crypto, investment models based on multi-year roadmaps and promises of future utility are being abandoned. Gen Z tends to prefer speculation instruments with quick and easy-to-understand returns. Prediction markets offer a more transparent, probability-based mechanism. This makes risk feel more scalable than conventional speculative tokens.

Read also: MegaETH Launches February 9, 2026, Ethereum Challenger Super Fast Blockchain

Altcoin Collapse and Liquidity Migration to Prediction Markets

Between the end of 2024 and the end of 2025, the market capitalization of altcoins shrank by about US$150 billion or the equivalent of US$2,519 trillion. Millions of tokens lost liquidity due to auto-liquidation, unilateral withdrawals, and allegations of insider profiteering. These events reinforced the perception that many crypto projects are vulnerable to unsound practices. Retail investor confidence has also undergone significant erosion.

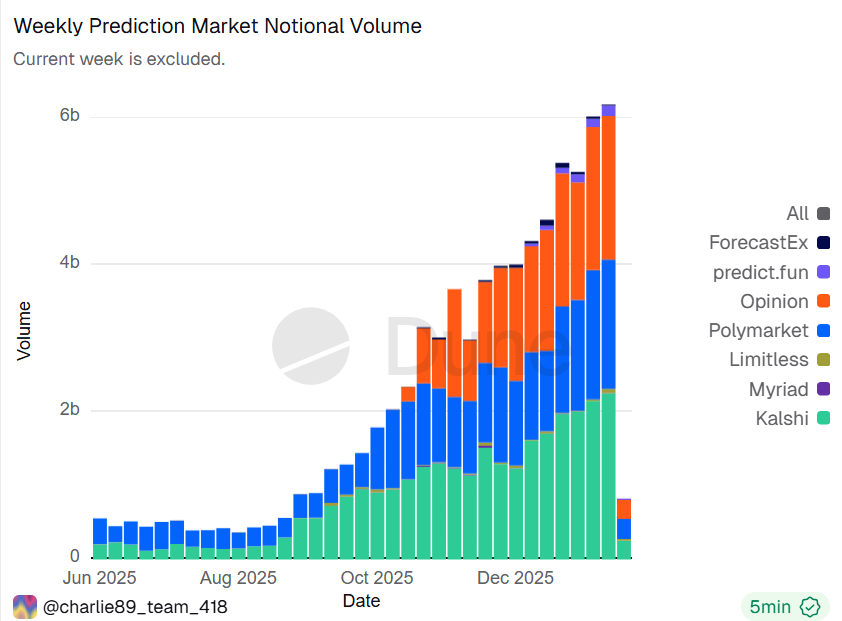

Instead of exiting the blockchain ecosystem, liquidity is moving to prediction markets. Platforms such as Polymarket and Kalshi recorded significant volume spikes. Weekly notional volume increased from around $500 million in mid-2025 to nearly $6 billion in January 2026. This data suggests a rotation of speculation, not a decline in interest in crypto.

Also read: Gold adds BTC’s market cap equivalent in a day, crypto markets lag behind?

Prediction Market as the Most Adaptive Crypto Product

The main appeal of prediction markets lies in the simplicity of their structure. Speculation is simplified to binary outcomes such as yes or no, to happen or not to happen. There are no whitepapers, token unlock schedules, or liquidity risks that disappear suddenly. For a generation increasingly skeptical of project promises, this model offers clarity.

In addition, the prediction market fully utilizes cryptocurrency infrastructure. Custody, settlement, and payment processes run on-chain with the support of stablecoins. Bitcoin (BTC) price-based contracts are among the most active markets, confirming that crypto remains at the core of the ecosystem. With these characteristics, prediction markets are seen as the most sustainable consumer use case in the post-boom altcoin era.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Why Prediction Markets May Be Crypto’s Most Durable Consumer Product. Accessed January 30, 2026.

- Featured Image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.