These 3 Altcoins are Said to Have the Potential to Print a New All-Time High in February 2026

Jakarta, Pintu News – The first half of 2026 opened with crypto markets still in turmoil, but some altcoins are starting to show signs of reversal. Capital flows are looking more selective, tending to flow to projects that have clear roadmaps, improving on-chain metrics, or strong narratives like privacy and decentralized infrastructure.

Amidst these conditions, there are three assets that are considered to have the opportunity to challenge the all-time high price record in February 2026. The following analysis summarizes the driving factors, key levels, and risks to watch.

Midnight (NIGHT)

Midnight (NIGHT) took off at launch in December 2025, but the euphoria quickly faded due to early investor profit-taking. The selling pressure held back price movements throughout January and made sentiment more cautious. Entering February, conditions began to look more constructive as the market picked up on signs of weakening outflows. This change is important as transitional phases are often the start of a more stable recovery.

In terms of fundamentals, the Midnight (NIGHT) roadmap highlights the Kūkolu phase in Q1 2026 which targets a stable mainnet, trusted validators, and privacy-focused applications. At the same time, the Chaikin Money Flow is moving up indicating that distribution pressure is easing and opportunities for new fund inflows are increasing.

If buying interest strengthens, NIGHT could potentially bounce off the $0.053 area and open a path towards a record $0.120, equating to a potential upside of around 126%. However, if the momentum fails to hold, the risk of a drop to $0.039 remains open and could invalidate the recovery scenario.

Also read: 3 Crypto that Could Explode or Collapse This Week

Hyperliquid (HYPE)

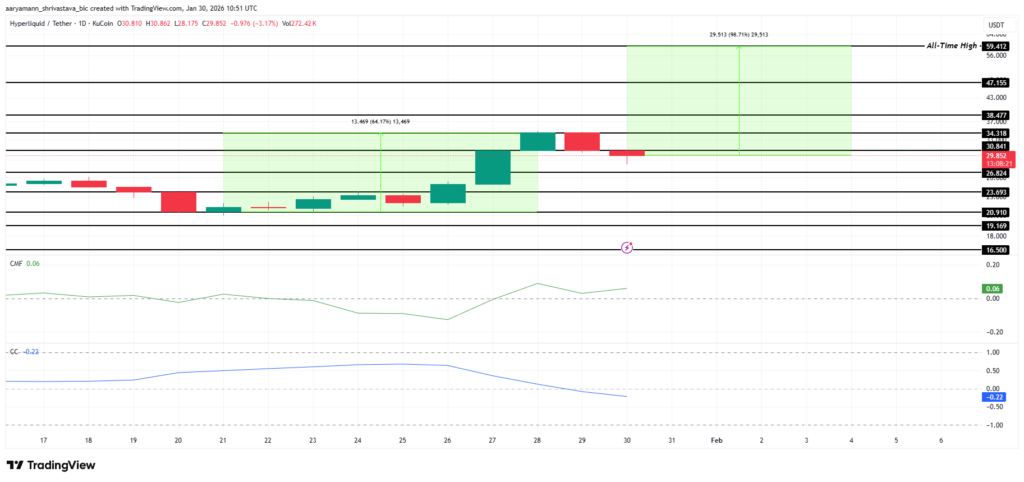

Hyperliquid (HYPE) is trading at around $29 and needs about 98% upside to get back to the $59 peak. Although it is still a long way off, recent data shows a change in market behavior that tends to be more accumulative. Chaikin Money Flow breaking the zero line indicates that inflows are starting to dominate over outflows. Such a shift is often seen as the initial phase of a recovery as buyers begin to absorb the supply that previously depressed prices.

Another factor reinforcing the bullish narrative is HYPE’s correlation to Bitcoin (BTC) which hovers around -0.22, making its movements relatively more independent. Demand has also seen a sharp increase through a surge in HIP-3 open interest which reached $793,000,000 on January 26-27, 2026, up from $260,000,000 a month earlier. This increase reflects the growing interest in decentralized commodity trading and alternative market structures.

If the push continues, HYPE has a chance to break the $38 resistance and move to $47, then confirm the path to $59 if the level turns into support. On the risk side, failure to sustain inflows could trigger renewed selling pressure. In a negative scenario, the price could drop to $23 or even $20, which would weaken the recovery thesis.

Therefore, key resistance and support areas determine whether the rally is sustainable or just a temporary bounce. This dynamic also confirms that HYPE can move differently from Bitcoin (BTC), so its volatility can be sharper.

Read also: Hot on TV, Ripple (XRP) Price Suddenly Appears $126 on CNBC?

Monero (XMR)

Monero (XMR) is hovering around $437 after losing ground below the $450 support, with a decline of around 30% in the last 11 days. Quick corrections like this often trigger concerns, but can also create conditions for selling fatigue. The Money Flow Index shows the selling pressure is nearing saturation point, so the downward momentum could potentially weaken. Although the indicator has not yet entered the oversold area, the signals point to a diminishing dominance of sellers.

If demand strengthens again, XMR has a chance to start a recovery and reclaim the area above $500 by February 2026. The re-emerging privacy narrative could be a catalyst, especially when the market is looking for assets with clear utility and identity.

In a sustained recovery scenario, the gradual targets are at $600 and $679, opening the door to $800 which equates to about 83% upside potential. However, if the privacy narrative is not followed by strong fund flows, XMR risks flattening below $500 while maintaining support above $417.

Conclusion

Midnight (NIGHT), Hyperliquid (HYPE), and Monero (XMR) are all displaying an interesting combination of catalysts and fund flow signals ahead of February 2026. NIGHT rests on the progress of the privacy roadmap, HYPE is driven by open interest data as well as a negative correlation to Bitcoin (BTC), while XMR relies on the potential resurgence of the privacy narrative after a sharp correction.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Altcoins That Could Hit New All-Time Highs in February 2026. Accessed on February 2, 2026

- Featured Image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.