Bitcoin Price Rises to $78,000 Today: Peter Brandt Highlights BTC Breakdown Risk

Jakarta, Pintu News – The crypto market has entered a sharp correction phase, causing crypto prices to fall from their recent highs. As predicted, the price of Bitcoin (BTC) dropped to as low as $75,000 in early February, as sell-offs and liquidations increased.

Initially, this decline looked like a normal correction, but it later evolved into a massive sell-off. This reflects weakening prices, waning momentum, and increased volatility across the market.

Investor sentiment has now become more cautious as important technical levels have started to come under pressure, forcing traders to review their short-term expectations. With Bitcoin acting as a bellwether for market direction, its decline has amplified downward pressure across the crypto ecosystem, creating a crucial period ahead.

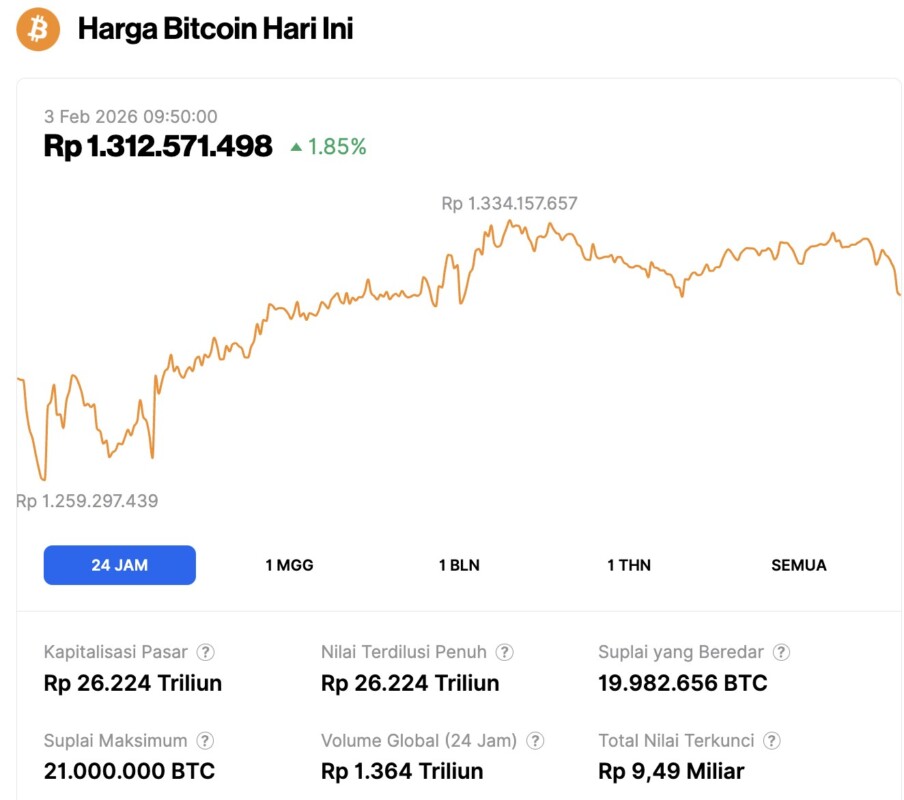

Bitcoin price rises 1.85% in 24 hours

As of February 3, 2026, Bitcoin was trading at $78,163, or approximately IDR 1,312,571,498, marking a 1.85% increase over the past 24 hours. During this timeframe, BTC hit a low of IDR 1,259,297,439 and climbed to a high of IDR 1,334,157,657.

At the time of writing, Bitcoin’s market capitalization is estimated at around IDR 26,224 trillion, while 24-hour trading volume has surged 33%, reaching IDR 1,364 trillion.

Read also: Gold, Silver, or Bitcoin: Which Will Lead by the End of the First Quarter of 2026?

Peter Brandt Highlights Breakdown Risk as Bitcoin Breaks Below Key Structure

According to veteran trader Peter Brandt, Bitcoin’s daily chart is currently showing a decisive structural breakdown, rather than a simple correction. The price has broken below the ascending consolidation channel that was previously a pause area amid the broader downtrend.

This decline was also accompanied by repeated rejection around a declining moving average, reinforcing the dominance of bearish pressure.

Brandt emphasized that the failure of price recovery and the formation of lower highs indicates a distribution phase, not accumulation.

Based on themeasured move pattern, the chart suggests a potential further decline towards the $54,000 zone, with limited temporary support. Unless Bitcoin quickly manages to reclaim the broken structure, the technical trend will remain strongly skewed towards the downside.

Conclusion

Bitcoin is still under strong bearish control after losing the $78,000-$80,000 support zone. Currently, the price is trading below its short- and medium-term moving averages.

Based on the chart shared by Peter Brandt, confirmation of the breakdown of the bullish consolidation structure opens up a potential drop to the $66,500 area as interim support, then towards the primary bearish target around $54,000 based on the measured move pattern.

On theupside, Bitcoin (BTC) price should be able to re-break the $83,500-$85,000 area on a daily closing basis to invalidate this bearish scenario. Until that happens, any bounce to the $80,000-$82,000 range is likely to be corrective only, with the market bias still leaning towards a continued decline.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Bitcoin Price Taps $75,000-Peter Brandt Warns of a Possible Drop to $54,000. Accessed on February 3, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.