3 Altcoins Crypto Whales Are Accumulating — A Signal for Early February 2026?

Jakarta, Pintu News – January has been a tumultuous month for the crypto market. After experiencing a rise at the beginning of the month, the market experienced a sharp decline towards the end of the month. Several major tokens lost the progress they had made in a matter of days.

Amidst this uncertainty, crypto whales started positioning themselves around three assets that showed early signals of price reversal in February.

On-chain data shows an increase in accumulation as selling pressure begins to ease, as well as the appearance of bullish divergence patterns forming or nearing confirmation. This indicates that large wallet holders would rather prepare for a selective price recovery, rather than chasing short-term momentum.

Shiba Inu (SHIB)

Shiba Inu (SHIB) has been one of the more surprising names in crypto whale activity heading into February. While most altcoins weakened throughout January, SHIB actually recorded a gain of around 3.3% in the last 30 days, making it one of the few major tokens that could potentially close the month with a positive performance.

Read also: 3 Meme Coins Worth Monitoring Based on Recent Performance, Potential to Soar or Plummet?

This relative strength is now starting to be supported by the actions of large investors.

Since January 27, the whales have increased their holdings from 666.05 trillion to 666.74 trillion SHIB-an increase of 690 billion SHIB. This indicates consistent accumulation amidst weak market conditions. Interestingly, these accumulation moments correlate with the emergence of important technical signals.

Between November 4 and January 25, SHIB formed a bullish divergence pattern: the price printed new lows, but the Relative Strength Index (RSI) indicator recorded higher lows. The RSI itself measures the strength of momentum – and when the price falls but the RSI rises, it indicates that selling pressure is starting to weaken.

This divergence formed within a technical pattern known as a falling wedge, which is a bullish pattern where prices narrow before a possible breakout. After the signal appeared on January 25, SHIB printed two green candles, and whales started accumulating from January 27.

Although SHIB prices have corrected since January 28, whale ownership has remained stable. This suggests that large investors have not exited and are likely waiting for further technical confirmation.

Currently, a similar divergence pattern is forming again. To confirm a reversal, SHIB’s next price candle should close above $0.0000071. If this happens, momentum could strengthen towards the important breakout zone around $0.0000091, with potential for further upside towards $0.000012.

However, if the $0.0000071 level fails to be broken, then the bullish opportunity could weaken and the risk of a price drop increases again.

For the time being, accumulation by whales and improving momentum signals suggest that SHIB is being positioned as a potential recovery candidate in February.

Pendle (PENDLE)

Pendle (PENDLE) is another token that crypto whales seem to have started positioning for in February, despite the token’s price being under pressure. Based on on-chain data, large holders have increased their holdings from 181.54 million to 184.81 million PENDLE since January 27-an increase of 3.27 million tokens.

At current prices, this accumulation is worth about $6.3 million, which shows a high level of confidence amidst the sluggish market conditions.

Interestingly, this accumulation occurred when PENDLE’s performance on the surface appeared weak. The token was down about 6% as of January 30, and 5.2% in the past month, reflecting weak market interest in DeFi assets and yield-based products.

However, the behavior of the whales shows that large investors prefer to prepare for a potential medium-term trend reversal, rather than chasing short-term price movements.

In the 12-hour chart (Jan 30), the PENDLE started showing early signs of bullish divergence: between November 14 and January 30, the price printed new lows, while the RSI formed higher lows – an indication that selling pressure is starting to weaken.

For this setup to remain valid, the current candle on the 12-hour chart must hold above $1.78. If this level is successfully defended, the potential for a reversal remains open.

This pattern is also in line with the whale accumulation that increased after January 27, following the previous divergence signal between November 14 and January 25.

Read also: Crypto Market Under Pressure: When Can Crypto Prices Recover from the Bearish Trend?

If the momentum strengthens, the first resistance is around $2.08-about 14% above the current price. If this level is broken, the next upside potential is around $2.38 to $2.87. However, if the price fails to hold at $1.78, then the bullish potential will weaken and downside risks will increase again.

For now, PENDLE is showing a classic whale-led reversal pattern: accumulation as the price drops, accompanied by a signal of momentum starting to improve.

Cardano (ADA)

Cardano (ADA) suddenly caught the attention of crypto whales ahead of February, fueled by massive accumulation from two major groups of holders.

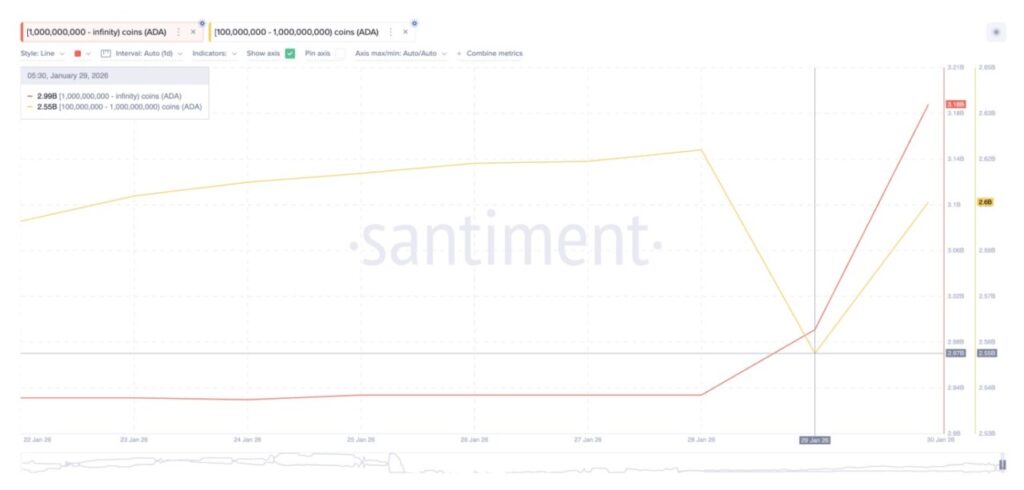

The data shows that wallets holding 1 billion ADA or more started adding to their holdings since January 28. Their total holdings rose from around 2.93 billion to 3.18 billion ADA. Shortly after that, the group of owners with 100 million to 1 billion ADA joined in on January 29, increasing holdings from 2.55 billion to 2.60 billion ADA.

Altogether, these two groups of whales have accumulated nearly 300 million ADA in just 48 hours-indicating a coordinated move in their investment strategy.

This buyout stands out because Cardano is under market pressure. The ADA price is down almost 6% in the past 24 hours, and about 7.2% in the past month, reflecting general market weakness. At first glance, these are not conditions that look bullish. However, the technical chart gives a clue as to why the whales are getting interested.

Between December 31 and January 30, the ADA price formed a lower low, while the RSI printed a higher low, creating a bullish divergence pattern. To confirm this signal, the next price candle should hold above $0.31, and the RSI should not drop below the December 31 level.

Currently, ADA is trading at around $0.32, which still maintains that technical structure. The RSI should also remain above its uptrend line.

If this signal is confirmed, the first recovery target is around $0.36, which is an important resistance level previously broken on January 22. Reaching this level could potentially provide an upside of around 12% from the current price.

However, if the price drops below $0.31, then the reversal pattern will be considered a failure and the whale accumulation scenario becomes invalid.

As such, Cardano shows technical potential for a trend reversal – which is now being looked at by large investors despite the general market weakness.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. What Crypto Whales Are Buying For Potential Gains In February 2026. Accessed on February 6, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.