3 Altcoins that Crypto Whales Bought in Early February 2026 After Market Correction

Jakarta, Pintu News – While Bitcoin (BTC) price continues to move closer to the bottom of the $80,000 range and general market risk sentiment appears fragile, on-chain data is showing a different, albeit subtle, signal.

Retail investors are still dominated by fear. However, whales seem to see this as an opportunity for asset accumulation. Based on findings from the CCN website, these crypto whales have started shifting their portfolios to a small number of altcoins. Here are the top three altcoins that they are targeting.

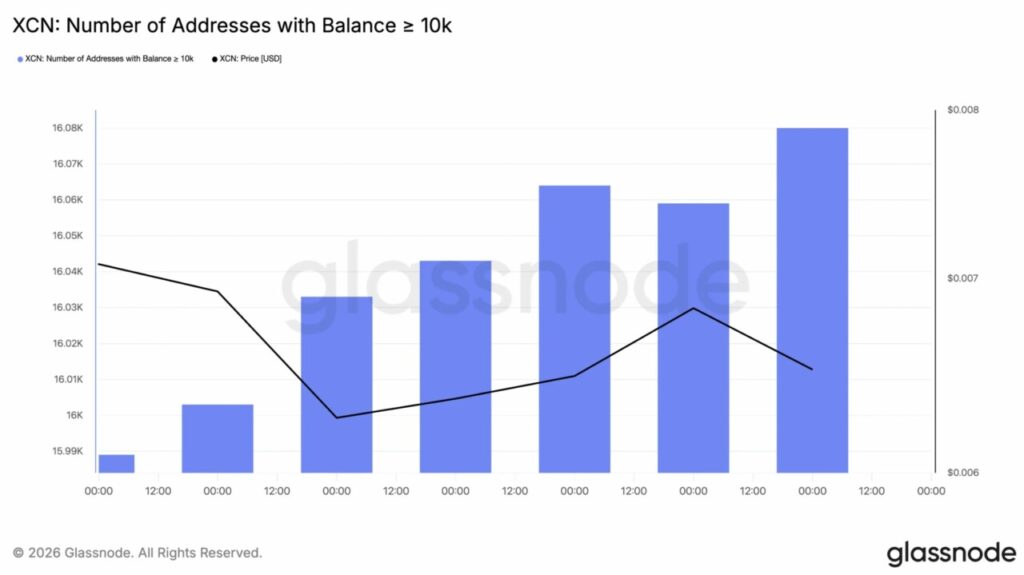

Onyxcoin (XCN)

Onyxcoin (XCN) is a perfect example of the “supply first, price later” pattern. After a price spike in early January, whales added around 290 million XCN between mid to late January. The net accumulation value during this correction period amounted to about $2.6 million.

Read also: February 2026 Ethereum Price Prediction: ETH Could Explode or Crash?

On-chain data shows a clear change in the behavior of large holders of XCN. The number of wallet addresses holding at least 10,000 XCN has steadily increased throughout the observed period.

Interestingly, the price of XCN actually decreased when the number of whale addresses increased – a noteworthy trend difference.

Historically, patterns like this are often indicative of silent accumulation, where large investors build positions when prices are weak, rather than when the market is strong. Over time, the price of XCN has tried to slowly recover. However, this recovery has yet to show a strong follow-through.

Even so, the number of wallets belonging to large holders continued to grow and eventually reached a local high. Looking ahead, this pattern is often a medium-term catalyst. For now, XCN is still moving within a limited range.

However, the underlying on-chain trend indicates that the downside potential could be limited. If this accumulation continues and the price of XCN rallies again, the foundations for a bigger breakout may already be in place.

Convex Finance (CVX)

On-chain data indicates a change in behavior of Convex Finance (CVX) holders. Large wallets are starting to move in aggressively. The graph shows a consistent increase in the number of addresses holding between 10 million and 100 million CVX tokens.

Since late October, this group of large holdings has continued to grow without much interruption. More importantly, the pace of accumulation accelerated in late January, with a significant surge pushing holdings to new highs.

This trend is a strong signal of continued accumulation by whales. They do not sell when prices rally, but gradually increase their exposure.

Historically, patterns like this have been significant. When addresses with large balances continue to accumulate, it usually reflects long-term conviction – not momentary speculation.

Such investors generally have a long-term view and a deeper understanding of the market. On the other hand, supply dynamics are becoming increasingly tight. As whales absorb more tokens, fewer coins are available on the open market.

This reduction in liquid supply could be a pressure point if demand starts to pick up. The timing of this accumulation is also interesting. This activity occurs when prices are flat, not after a spike. This suggests that the whales are positioning themselves before potential more volatile price movements, not after.

However, accumulation alone is not enough to trigger a price increase. There needs to be confirmation from wider market participation. Without a further increase in demand, CVX prices may remain sideways despite strong on-chain signals.

Read also: 3 Meme Coins Worth Monitoring Based on Recent Performance, Potential to Soar or Plummet?

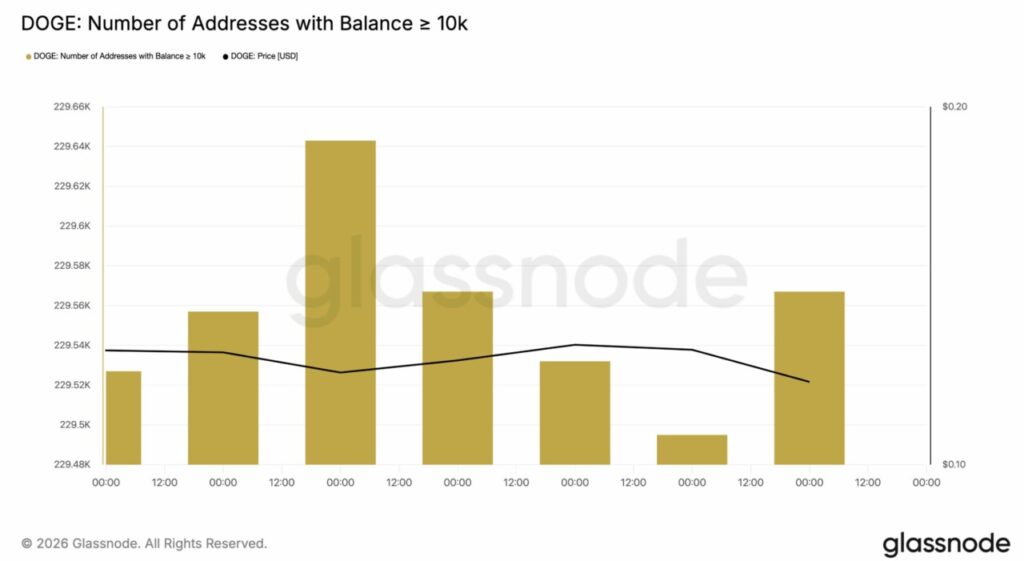

Dogecoin (DOGE)

Data from Glassnode shows that large holders of Dogecoin (DOGE) still remain in the market. These whales may not be as prominent, but they are quietly maintaining their position. The chart monitors the number of DOGE addresses that hold at least 10,000 coins. Although there are minor fluctuations, there is no sharp decline in whale participation.

At the same time, DOGE prices tend to move slightly downwards. This difference in direction is important to note. Large holders are not seen selling aggressively as the price weakens. Instead, they seem to be choosing to hold on while prices consolidate.

Historically, this pattern is more indicative of patience than panic. When the number of whales remains stable during price drops, it often reflects long-term positions.

Typically, these large holders wait for stronger external catalysts before taking major action. Going forward, DOGE’s movement will likely depend on the overall market momentum.

If market sentiment improves, steady whale participation could be an additional impetus for price recovery. On the contrary, if the whales stop accumulating, the Dogecoin price may remain flat while they wait for the right time.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CCN. Revealed! Crypto Whales Are Buying These Altcoins After the Crypto Market Dip – February 2026 Picks. Accessed on February 6, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.