5 Important Shiba Inu (SHIB) Facts and the “Is SHIB Dead?” Question in the Crypto Market

Jakarta, Pintu News – The narrative of whether Shiba Inu (SHIB) is “dead” is once again being discussed among crypto market participants as the price of SHIB has been stuck very low compared to its peak a few years ago. While some of the sentiment comes as an emotional reaction to the price drop, on-chain data shows a more complex picture of the asset’s activity and resilience. Here are five key facts that both investors and beginners need to understand.

1. On-Chain Activity Shows SHIB Is Not Completely Dead

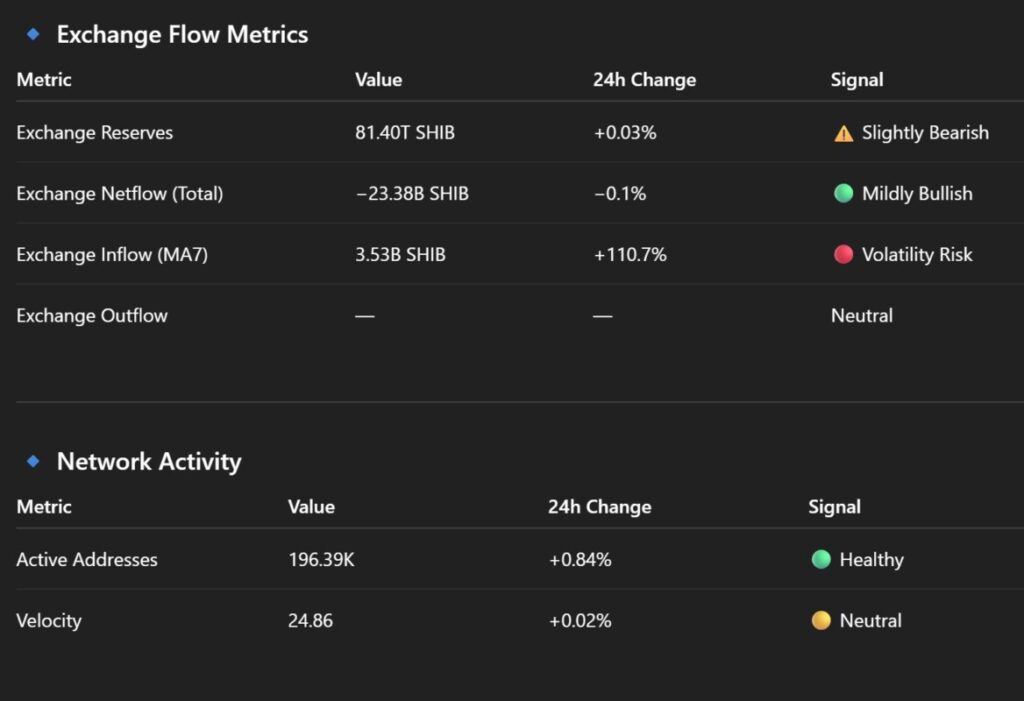

Recent data from on-chain shows that Shiba Inu is still technically active despite weak price movements. Indicators such as exchange netflow show moderate accumulation, suggesting that some investors are still transferring SHIB from exchanges, which is generally interpreted as a signal of long-term holding.

The activity indicates that SHIB has not been completely abandoned by its community. However, moderate on-chain activity does not mean that price movements will be immediately positive. It rather shows that the network is still dynamic and holders are still engaged.

Also Read: 7 Shocking Bitcoin & Crypto Facts in Epstein Files: Crypto’s Early Traces Revealed!

2. Price Pressure Still Strong in Meme Coin Market

SHIB’s price is still at very low levels, and has been under considerable price pressure in recent times. Medium to long-term price trends suggest that SHIB is already well off its all-time highs, which finds it struggling against the dominance of the broader bear market. This reflects that the “off” narrative often comes in response to such price pressure, rather than the network’s fundamental data failing completely.

This kind of narrative has also emerged before when SHIB futures open interest fell significantly, triggering the question of whether derivatives market activity has declined sharply.

3. Burn Mechanism and Supply Reduction Potentially Supporting

The ongoing SHIB burn effort has been slowly but consistently reducing the supply of coins in circulation. Data from the blockchain shows that trillions of SHIBs have been permanently destroyed, lowering the number of tokens available in the market. This deflationary mechanism could be a long-term price support factor if demand picks up again.

In addition, SHIB’s daily active address even showed a slight increase despite the decline in large transaction volume, suggesting that retail interest may still persist.

4. Long-Term Holder and Whale Still Involved

Other on-chain data shows that some large whale groups still hold large amounts of SHIB, and many long-term holders choose to hold rather than sell when the price drops. This reflects that not all investors are abandoning the project, so the “dead coin” narrative needs to be viewed more carefully than just a short-term price reaction.

However, other indicators such as open interest and derivatives trading suggest that active speculation against SHIBs is indeed waning, which is part of a broader market phenomenon against high-risk assets.

5. SHIB Still Has Community and Project Activities

Shiba Inu has a strong community and a number of ongoing initiatives in its ecosystem-although the focus is more on maintaining relevance than sparking a major rally in a short period of time. Some project developers and community supporters are actively trying to build new narratives or integrate new technologies to support SHIB long term.

Overall, although the SHIB price is still weak and the meme coin market is quieter than previous peaks, on-chain data and community activity suggest that Shiba Inu is not “dead”. Investors need to integrate technical data, on-chain and broader market trends when assessing SHIB’s future prospects.

Also Read: 4 Shocking Facts about Bitcoin Breaking Rp1.42 Billion: Similar to BTC April 2025 Technical Signal!

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Watcher Guru. Is Shiba Inu Coin Dead?What SHIB On-Chain Data Reveals. Accessed February 4, 2026.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.