7 Nvidia (NVDA) Stock Value Predictions in 2026: Could it Rise 60%-70% or More?

Jakarta, Pintu News – Shares of Nvidia Corporation (NVDA), one of the global leaders in the semiconductor and AI computing sectors, remain in the spotlight for investors towards the end of 2026 despite the volatility in the technology market.

Various analysts and market projections predict that NVDA stock still has significant room for growth driven by the strength of its AI and data center businesses, but there are also downside risks if competition and global sentiment change. Here are seven key predictions worthy of investors’ attention.

1. Nvidia Capitalization Prediction Grows Big

Some analysts project that Nvidia could reach a market capitalization of between US$7 trillion and US$9 trillion by the end of 2026 if the data center business continues to grow rapidly. This projection is based on the sales growth ratio in the data center segment, which currently contributes significantly to revenue. At the midpoint of this range, the stock is expected to trade around US$330 per share, reflecting a potential upside of more than 70% from current levels.

The potential value shows confidence that Nvidia will still lead AI hardware demand worldwide. However, this projection is optimistic and assumes continued growth and consistent delivery from the company’s management.

Also Read: 5 Crypto that Whale is Eyeing in February 2026, Quietly Accumulating Amid Volatility

2. Wall Street Analyst Consensus Price Target

The average one-year price target for Nvidia stock in 2026 hovers around US$255-US$260 per share, with a high of over US$450 and a low of around US$140 according to the latest analyst consensus. This range reflects the strong speculation in the market regarding the volatility of tech stocks and external factors such as trade wars and AI competition.

A target in the range of US$260-US$300 per share means a potential upside of around 30-70% compared to the price at the start of 2026. Investors should take this target as a sign of growth expectations, although it does not guarantee price realization.

3. Projected Wall Street Target Around US$300

Some institutions such as 24/7 Wall St. project that Nvidia’s share price could reach around US$300.14 by the end of 2026, which reflects a potential upside of around 68.6% from current levels. This target considers Nvidia’s dominance in the AI market and revenue growth.

The price target implies strong expectations from the data center and GPU segments, while showing that Nvidia is considered one of the key growth stocks among institutional analysts.

4. Stock Price Prediction in Technical Range

Nvidia’s share price forecast is also mapped out technically, with analysts’ target range of US$140-US$432 per share through 2026. These levels reflect a bearish to bullish scenario for medium-term investors.

This wide range reflects Nvidia’s sensitivity to global macro conditions, AI industry dynamics, and overall market sentiment. Investors are advised to understand that the lowest target could occur if market pressure intensifies.

5. Projected Increase 35%-40%

Some market analysts expect Nvidia stock to increase by about 35% by the end of 2026 with a target price of about US$260 per share, considering the median of analysts’ target estimates. These forecasts indicate a moderate but still positive view on the prospects for NVDA stock.

With a strong long-term strategy, investors can look at this figure as an indicator that steady growth is still possible even if volatility remains.

6. Downward Challenges Cannot Be Ignored

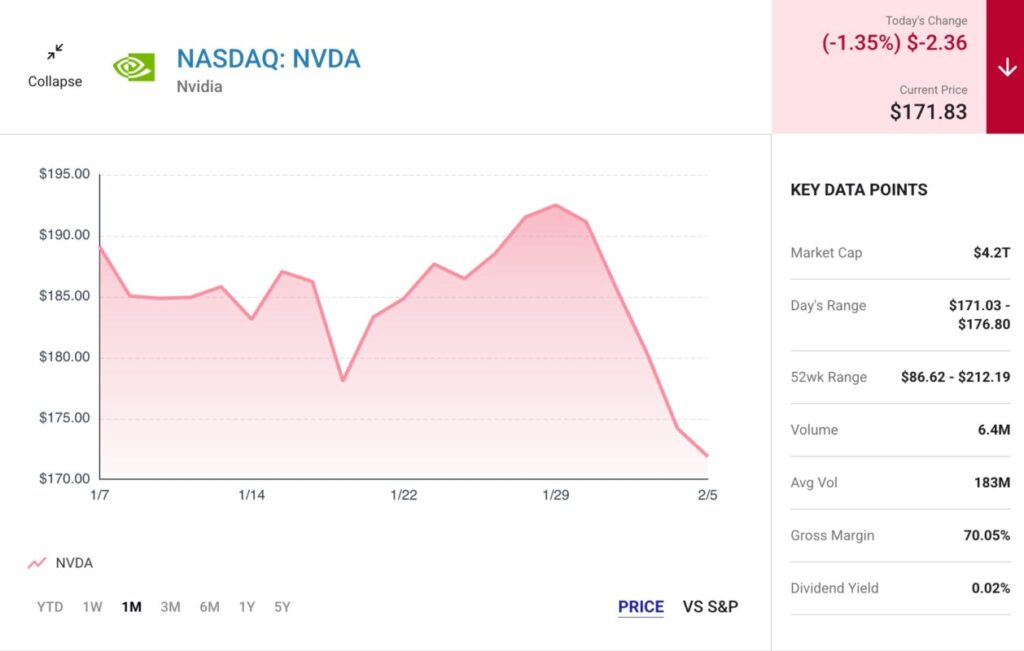

Bearish scenarios are also taken into consideration, such as the possibility of prices falling to the US$100-US$170 area if the technology market and global economic pressures worsen. Analysis based on historical trends shows that Nvidia shares have crashed in previous years, so downside risks remain.

A number of factors such as chip competition from other companies and uncertainty over export tariffs will also affect the stock’s prospects. Investors need to pay attention to these risks in portfolio planning.

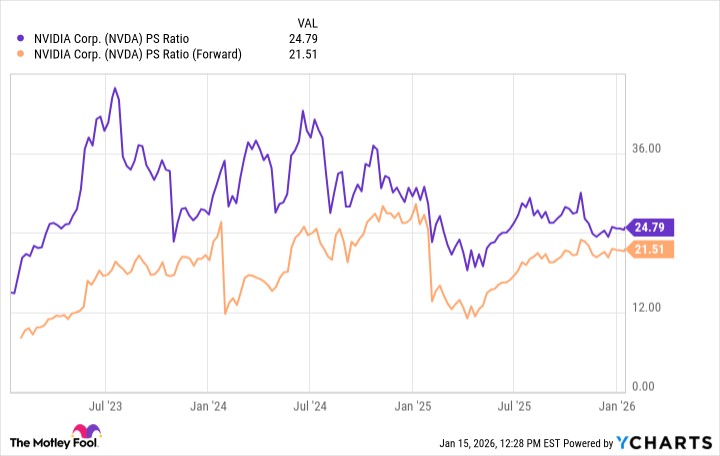

7. Fundamental AI Factors and Nvidia’s Dominance

Justification for optimism in Nvidia stock comes from the company’s dominance in the GPU segment and growing demand for AI. The data center and high computing business segments are projected to remain the drivers of revenue growth in 2026.

Nvidia’s strong position in the global AI market is seen as the main reason its shares are considered worth buying in the long term, although the growth cycle may experience fluctuations.

CHECK THE PRICE OF US XSTOCKS HERE!Now you can sell/buy US stock tokens such as Nvidia (NVDAX), Amazon (AMZNX), Meta (METAX) in the form of crypto tokens with just a few thousand rupiah on xStocks Door.

By leveraging blockchain technology, you can now enjoy a faster settlement process for tokenized US stocks, more affordable start-up capital, and a more global investment experience.

Also Read: 3 Crypto Underrated in February 2026 that Investors are Starting to Look at, Not Just Hype!

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- The Motley Fool. Prediction: Nvidia Stock Will Be Worth This Much By Year-End …Accessed February 6, 2026.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.