Ethereum Plunges 60% from ATH, Signs of a New Bear Market for ETH?

Jakarta, Pintu News – Ethereum (ETH), the native asset of the Ethereum network, is under pressure again after dropping to a year low of around US$1,927 and is now more than 60% below its all-time record of US$4,950.

The drop has been a major test of holders’ confidence, with on-chain data and inflows to exchanges indicating the start of a new bear market phase. Amidst the selling pressure, one large group of holders was recorded adding exposure, although it is unclear whether this accumulation is strong enough to lift ETH back above US$2,000.

Distribution and Accumulation Patterns: Who’s Selling, Who’s Buying?

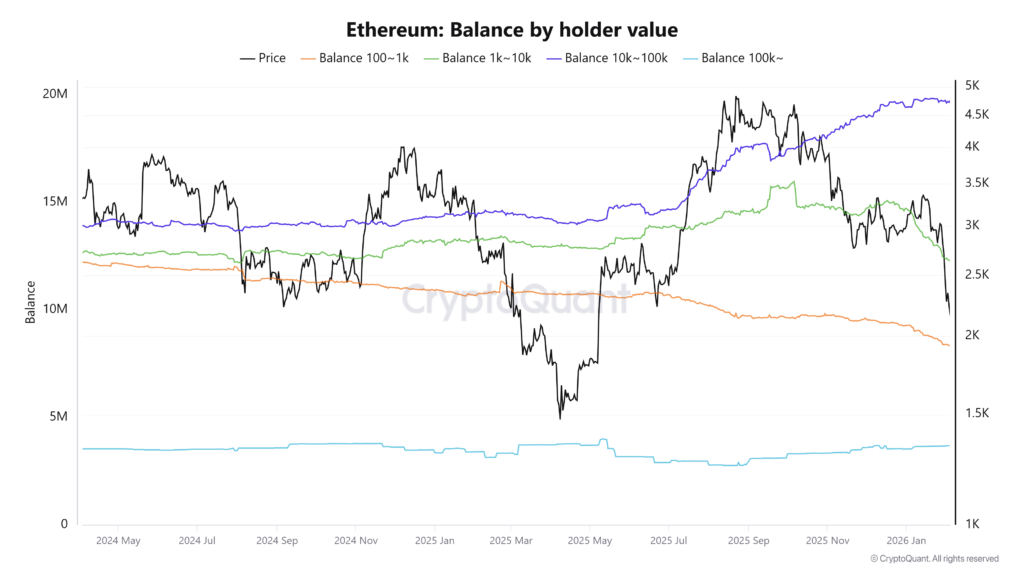

In the last five months, Ethereum distribution data by holding size shows a clear shift in behavior between wallet groups. Wallets containing 100-1,000 ETH dropped from around 9.79 million ETH (August 2025) to 8.32 million ETH, while the 1,000-10,000 ETH group shrank from 14.51 million to 12.26 million ETH. These changes indicate small-medium holders are likely to distribute their assets as the price returns to the May 2025 range.

In contrast, large wallet groups appear to be capitalizing on price weakness for accumulation. Wallets of 10,000-100,000 ETH rose from 17.18 million to 19.77 million ETH, and wallets of 100,000+ ETH increased from 2.75 million to 3.68 million ETH, suggesting selling pressure from mid-holders was absorbed by whales and large entities. Nevertheless, the dominance of accumulation at the upper level does not yet guarantee a trend reversal without the support of broader market sentiment.

Read also: Bitcoin’s chances of breaking $90,000 are slim, options market already “throwing up its hands”?

ETH Traded Below Realized Price All Groups

On-chain, Ethereum is now trading below the realized price for all holder groups, which is the average price at which the coin last changed hands. The realized price for 100,000+ ETH wallets stands at around US$2,120, while the 100-1,000 ETH group is near US$2,690. ETH briefly closed below the aggregate realized price of around US$2,630 over the weekend, a level often associated with financial stress-based selling pressure.

This “below average cost of capital” condition across all groups means that the majority of holders are in a loss position on a mark-to-market basis. Historically, such a phase is often associated with local capitulation, but it also opens up additional downside risk if sentiment does not improve. Without a clear positive catalyst, retail investors are likely to be hesitant to add to positions, although whales are starting to build accumulation.

Also read: Bitcoin Breaks $64,000, Selling Pressure Gets Extreme: Where is BTC’s Bottom?

Inflows to Exchanges and Taker Ratio Pressure ETH Price

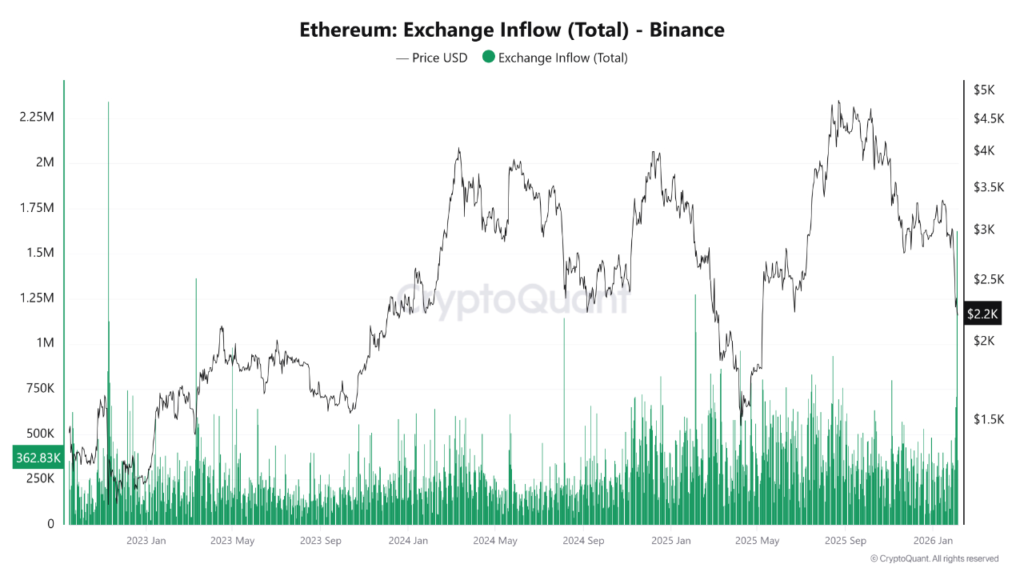

In terms of market microstructure, Ethereum’s selling pressure is clearly reflected on the Binance exchange. ETH inflows to Binance surged to around 1.63 million ETH in a single day, the highest level since 2022. A surge in inflows amidst a downtrend in price is usually read as a sell preparation or defensive rebalancing, not just a technical move. This keeps downside risks high as the ready supply on exchanges increases.

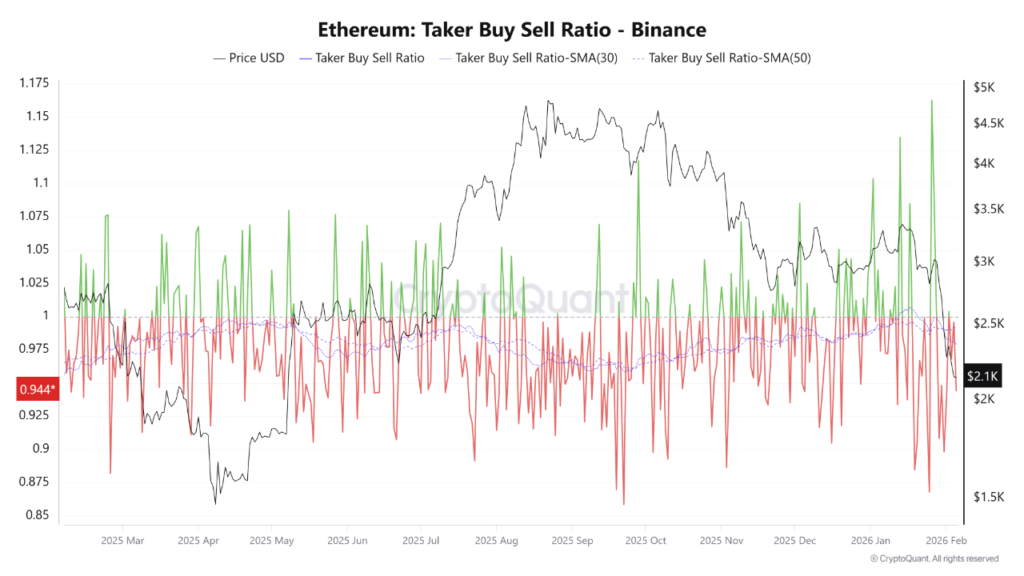

Execution data also gives similar signals. The buy/sell taker ratio on Binance hovers around 0.94, below the neutral level of 1, with the 30- and 50-day averages also consistently below 1. This means that aggressive sell orders dominate over aggressive buy orders in the short term. Some analysts see this combination of high inflow and weak taker ratio as an early indication of a “true bear season” for ETH, with difficult price conditions likely to continue for longer.

Conclusion

Ethereum’s (ETH) drop below US$2,000 was accompanied by three main signals: distribution by intermediate holders, accumulation by whales, and strong selling pressure on exchanges. ETH is now trading below the realized price of all holder groups, signaling a phase of widespread stress among investors. As long as the inflows to exchanges and the dominance of sell orders have not subsided, the risk of a further decline remains high, although accumulation by large holders could potentially be the foundation for a long-term recovery.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Ether slips below $2K as ETH holder confidence faces major stress test. Accessed February 6, 2026.

- Featured Image: Generated by Ai

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.