5 Bitcoin Facts Ahead of the Last Test of the IDR720 Million Price: Rebound Signal or Trap?

Jakarta, Pintu News – The price movement of Bitcoin (BTC) is back in the spotlight after entering a crucial phase that is often referred to as the “final downside test”. In the context of the global crypto and cryptocurrency market, this phase often determines whether the price will continue to decline or reverse. This article summarizes the key educational points that are relevant for both novice and experienced investors.

1. What is the Final Downside Test on Bitcoin

The final downside test refers to the phase when Bitcoin price approaches the strongest support level before a potential recovery. Historically, this area often triggers increased buying volume from long-term investors. This leaves the market at a balance point between selling pressure and accumulation.

In the previous few cycles, BTC experienced sharp corrections before eventually rebounding significantly. The pattern shows that a decline is not always a permanent negative signal. For the cryptocurrency market, this phase is often a transition to a new trend.

Also Read: 5 Fun Facts: Bitcoin Often Rebounds in February – Lessons from Historical Data

2. Key Price Levels to Watch Out For

In the latest analysis, the area of USD 42,500 or around IDR 718,698,750 is one of the important psychological levels. This level is seen as the last test zone before a potential price recovery. If it holds, market sentiment is likely to improve gradually.

Conversely, if the level is broken, short-term volatility may increase. However, the continued decline is often limited as selling pressure begins to weaken. This situation is common in mature crypto market cycles.

3. Investor Behavior and On-Chain Data

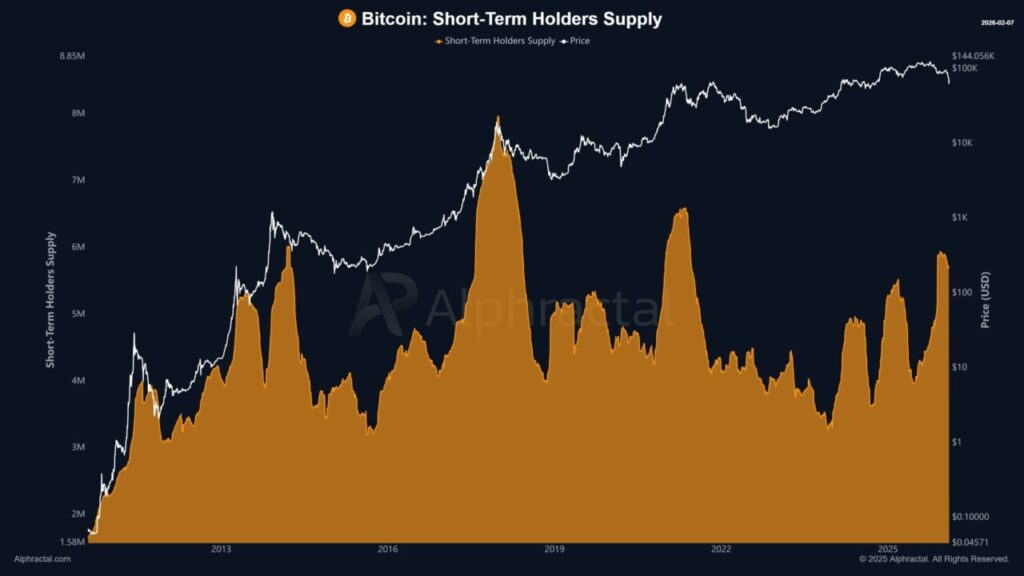

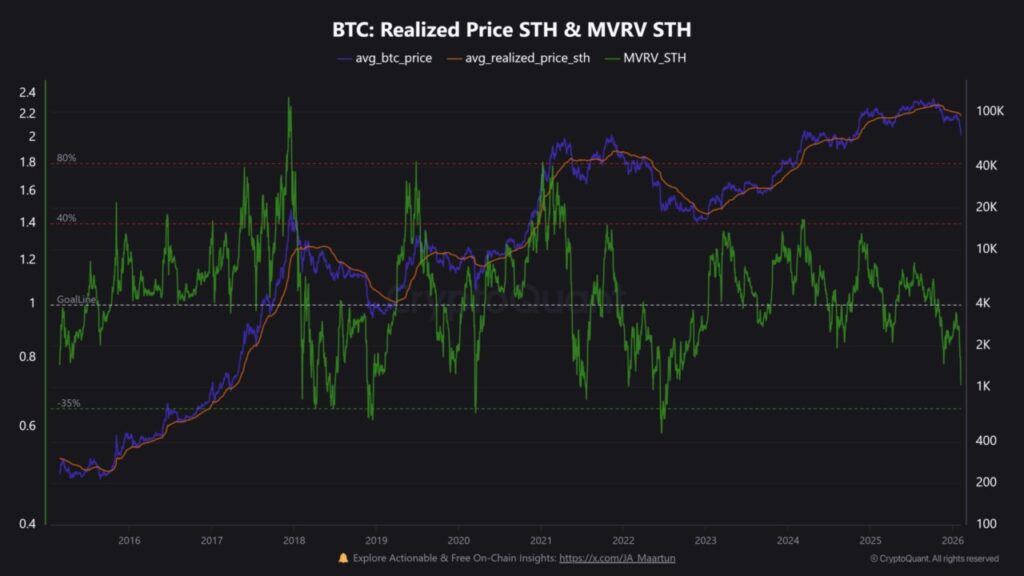

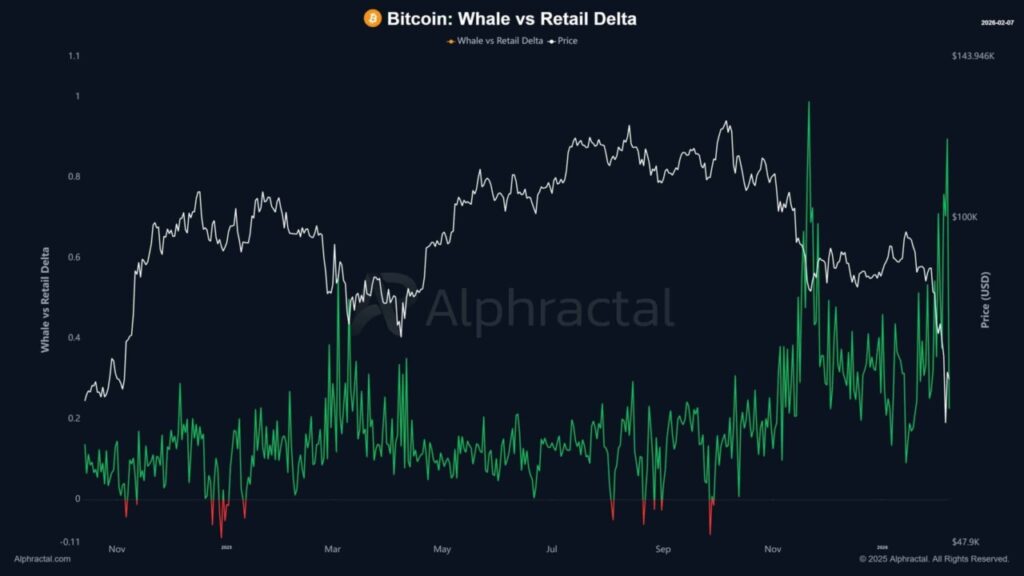

On-chain data shows that most long-term holders are not aggressively selling. This indicates that confidence in Bitcoin’s fundamentals is still relatively strong. Slow accumulation is often seen in phases of price weakness.

In addition, BTC outflows from exchanges tend to be steady. This pattern is often interpreted as investors’ intention to hold assets in the medium to long term. In the context of cryptocurrencies, such behavior often precedes the recovery phase.

4. Short-term Risks that Remain Lurking

Although the opportunity for a rebound is open, the risk of further correction remains. Global macroeconomic sentiment and monetary policy still have a big influence on crypto assets. This uncertainty can trigger price fluctuations in a short time.

Novice investors need to understand that volatility is a key characteristic of Bitcoin. Risk management is a key factor in dealing with extreme movements. A gradual approach is often considered safer than impulsive decisions.

5. Strategic Opportunities for Investors

The final phase of a downside test is often seen as a moment of investment strategy evaluation. Some investors see it as a gradual accumulation opportunity with measured risk. This approach is common in the cyclical nature of the cryptocurrency market.

However, decisions should still be tailored to your individual risk profile. There is no guarantee that every downturn will be followed by a quick recovery. Education and understanding of the crypto market is the main foundation for making decisions.

Also Read: 5 AI Perspectives: Will XRP Fall Below $1 in February 2026?

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMBCrypto. All About Bitcoin and Its Final Downside Test Before Price Recovery. Accessed February 9, 2026.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.