Balance Sheet: Definition, Main Components, and How to Analyze!

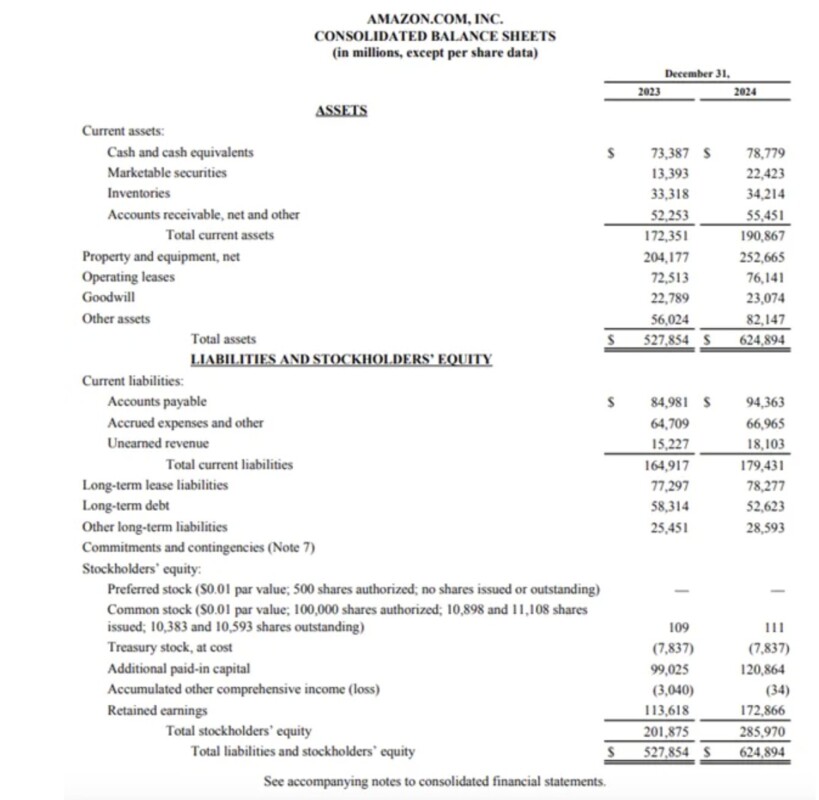

Jakarta, Pintu News – If you’re interested in understanding the financial health of a company, a balance sheet is one report you should be familiar with. Through the balance sheet, you can see a clear picture of what the company owns (assets), what it owes (liabilities), and how much value actually belongs to the shareholders (equity) at one point in time.

What is Balance Sheet

A statement of financial position or balance sheet is a snapshot of what a company owns (assets), what it owes (liabilities), and the value left to the owners of the company (shareholders’ equity).

Read also: Deposit Interest: Explanation, Calculation, and Benefits

This statement is also known as the statement of financial position and is prepared based on the accounting equation:

Assets = Liabilities + Equity

The balance sheet should always be balanced, meaning that total assets should equal total liabilities plus equity. As one of the three main financial statements, the balance sheet is used to assess a company’s financial strength, liquidity (ability to meet short-term obligations), and capital structure.

In appearance, the balance sheet is usually divided into two parts:

- Left-hand side: contains the company’s assets.

- Right-hand side: contains liabilities and shareholders’ equity.

Both assets and liabilities are further categorized into current and non-current (long-term). More liquid accounts, such as cash, inventory, and accounts payable, are placed in the current section. While less liquid or long-term accounts, such asproperty, plant, and equipment (PP&E) and long-term debt, are put in the non-current section.

Balance Sheet Function for Investors

Reporting from Investopedia, for investors, the balance sheet is one of the main tools to assess the financial health of a company before placing capital. From the balance sheet, investors can see how strong the company’s asset position is, how much debt it carries, and how much value actually belongs to shareholders.

This information is then processed into various financial ratios, such as liquidity ratios to measure the company’s ability to pay short-term obligations, leverage ratios to see how much dependence on debt, to return on equity (ROE) and return on assets (ROA) to assess how efficiently the company manages assets and shareholder capital.

Main Components of Balance Sheet

Assets

The accounts in the assets section are usually organized from the easiest to the most difficult to convert into cash (highest to lowest liquidity). Assets are divided into two: current assets (can be cash within ≤ 1 year) and non-current/long-term assets (held > 1 year).

General order of accounts in current assets:

- Cash and cash equivalents: the most liquid assets, such as cash, account balances, Treasury bills, and short-term deposits.

- Marketable securities: equity or debt instruments that are easily traded because themarket is liquid.

- Accounts receivable(AR): bills accrued by customers to the company. Usually accompanied by an allowance for doubtful accounts because not all customers will pay.

- Inventory: goods that are ready for sale, usually valued at cost or market price, whichever is lower.

- Prepaid expenses: payments already made for future benefits, such as insurance, advertising contracts, or rent.

Liabilities

Liabilities are all the company’s financial obligations to outside parties: from bills to suppliers, interest on bonds, to obligations to pay salaries, rent, and utilities.

- Short-term liabilities (current liabilities): due within ≤ 1 year, usually sorted by maturity date.

- Long-term liabilities (non-current liabilities): maturity of more than 1 year.

Examples of short-term liabilities:

- Current portion of long-term debt: the portion of long-term debt that must be paid within the next 12 months. For example, of a 10-year loan, this year’s installment is included in current liabilities, while the remaining 9 years are included in long-term liabilities.

- Accruedinterest(interest payable): interest that has beenaccrued but not yet paid, including interest due to late payment (e.g. late payment of property taxes).

- Accrued wages/salaries (wagespayable): salaries, wages and benefits that employees are already entitled to but have not yet been paid (usually for the last pay period).

- Customer prepayments: funds that have been received from customers, but the goods/services have not yet been provided. The company is obliged to:

a) provide the goods/services, or

b) refund the customer. - Accrued dividends (dividendspayable): dividends that have been declared/decided, but not yet paid to shareholders.

- Earned and unearned premiums: similar to advances, the company has received payment in advance but has not fully performed its obligations and will have to return the unearned portion if the agreement is canceled.

- Accounts payable: usually the most common current liability, an obligation to pay bills from suppliers that are generally due about 30 days after goods/services are received.

Examples of long-term liabilities:

- Long-term debt: principal and interest on bonds or loans with maturities of more than one year.

- Pensionfund liability: a company’s obligation to deposit funds into an employee pension plan.

- Deferred taxliability: taxes that have accumulated but will only be paid in future years. This difference can arise due to differences in financial reporting rules and tax rules (e.g. different depreciation methods).

Some types of liabilities can be classified as off-balance sheet, meaning they are not shown directly on the balance sheet, although they are still a commitment or risk to the company.

Read also: What is a Black Card? How to get it and its benefits!

Shareholders’ Equity

Shareholders’ equity is the portion of a company’s value to which the owners or shareholders are entitled. Equity is also often called net assets, because it is the difference between total assets and total liabilities (net assets after deducting debt to outside parties).

An important component of equity:

- Retained earnings: net income that is not distributed as dividends and remains with the company for reinvestment or debt repayment.

- Treasury stock: company shares that have been bought back by the company. These shares can be resold in the future to raise additional funds or used as a tool in the face of a potential hostile takeover.

- Preferred stock: if issued, usually recorded separately from common stock. Preferred stock has apar value that is set administratively rather than based on market prices.

- Common stock: similar to preferred stock, the value of this account is calculated by multiplying the par value by the number of shares issued.

- Additional paid-in capital/capital surplus: the difference between the funds paid in by shareholders and the totalpar value of the shares issued. So it reflects the shareholders’ investment above the par value.

Note that shareholders’ equity is not the same as market capitalization.

- Market cap is calculated from the current share price times the number of outstanding shares.

- Meanwhile, paid-up capital and equity on the balance sheet reflect the amount of funds that shareholders have invested in the company, regardless of what the stock market price is now.

Important Ratios in Balance Sheet Analysis

In analyzing the balance sheet, investors usually focus on a few key ratios that help assess a company’s liquidity, debt levels, and financial stability. Some of these key ratios include:

- Current Ratio

Measures the company’s ability to pay short-term liabilities using current assets.Polylang placeholder do not modify

- Quick Ratio (Quick Ratio / Acid-Test)

Similar to current ratio, but excludes inventory from current assets as it is considered less liquid.Polylang placeholder do not modify

- Working Capital / Working Capital Ratio

Describes the difference between current assets and current liabilities, as well as how loose the company’s daily financial “breath”is.Polylang placeholders do not modify

- Debt-to-Equity Ratio

Shows how much the company is financed by debt compared to shareholders’ capital.Polylang placeholder do not modify

- Debt-to-Assets Ratio

Measures the portion of a company’s assets that are funded by debt.Polylang placeholders do not modify

By combining the above ratios, investors don’t just look at the raw asset and debt numbers, but can get a more complete picture of the company’s ability to meet its short-term obligations, capital structure, and long-term resilience.

How to Analyze Balance Sheet Effectively

In the balance sheet analysis, the focus is on assessing how efficiently a business operates. To do this, several items in theincome statement will be compared with the accounts on thebalance sheet.

The various metrics in the balance sheet are generally grouped into several categories, including:

- Liquidity

- Leverage (level of debt usage)

- Operational efficiency

Some key liquidity ratios that are often used:

- Quick ratio

- Current ratio

- Net working capital

Examples of key leverage ratios:

- Debt to equity ratio

- Debt to capital ratio

- Debt to EBITDA

- Interest coverage ratio

- Fixed charge coverage ratio

Meanwhile, the commonly used operating efficiency ratio:

- Inventory turnover

- Accounts receivable days

- Accounts payable days

- Total asset turnover

- Net asset turnover

By utilizing the various ratios above, we can assess how efficiently the company generates revenue and how quickly inventory turns into sales.

These ratios can also be compared:

- Historical (over time within the same company), and

- Horizontal (compared to industry or competitor averages).

The comparison helps assess the company’s ability to pay its obligations (solvency) and the level of leverage used.

An in-depth analysis should also include consideration of liabilities or commitments that do not appear directly in the financial statements, but still affect the company’s level of risk.

Conclusion

In a nutshell, a balance sheet is a map of a company’s financial condition at one point in time: what it owns (assets), what it owes (liabilities), and how much actually belongs to the owners or shareholders (equity). From this one report, investors, lenders, and business owners can assess a company’s financial strength, liquidity, capital structure, and level of risk.

By understanding the main components of a balance sheet and using key ratios-such as liquidity, leverage, and efficiency ratios-you not only see the numbers, but also read the story behind the numbers: whether the company is being managed healthily, has too much debt, or has great room to grow.

Ultimately, a good understanding of balance sheets will help you make wiser and more measured financial and investment decisions.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Adam Hayes. Understanding Liquidity Ratios: Types and Their Importance. Accessed on February 10, 2026

- CFI. Analyzing Financial Statements: Key Metrics and Methods. Accessed on February 10, 2026

- Investopedia. Balance Sheet: Explanation, Components, and Examples. Accessed on February 10, 2026

- Tim Vipond. Balance Sheet: Definition, Template, and Examples. Accessed on February 10, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.