5 Highlights of 2026 Metals Outlook: Gold US$6,000 & Nickel US$17,000, Which Stocks Benefit?

Jakarta, Pintu News – Selling pressure on precious metals and industrial metals since the beginning of the year is considered to open up further upside opportunities for mining issuers. Gold prices corrected around 10% from its peak, while industrial metals such as nickel fell 5-9% from its highest level. However, fundamentally, the outlook for 2026 is considered to remain constructive with a preference for gold over nickel.

1. Sell-Off Considered as Momentum for Accumulation

The recent correction in metal prices was triggered by macro sentiments, including Fed policy dynamics and technical factors due to high leveraged positions of speculators. The increase in margin requirements on commodity exchanges such as CME and SHFE also deepened the short-term pressure.

However, this weakening is considered more technical than fundamental changes. Assuming an average 2026 gold price of US$5,200 per ounce or around IDR87.21 million (exchange rate of IDR16,771/USD) and a year-end target of US$6,000 per ounce or around IDR100.63 million, the room for increase is still open.

Also Read: 5 Shocking Facts About Jeffrey Epstein’s Influence in Silicon Valley

2. Gold Stays ahead amid US Fiscal Risks

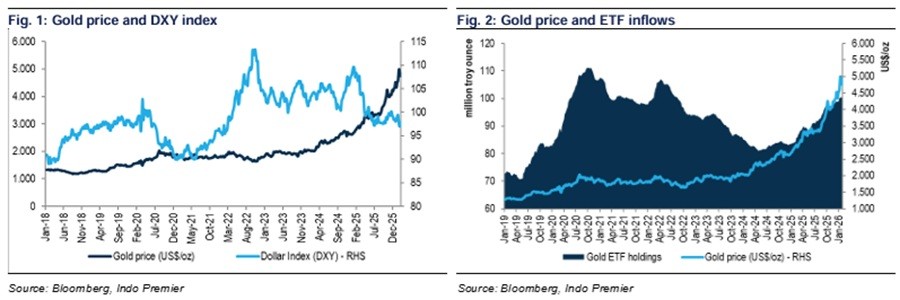

Structurally, gold is seen as still supported by global central bank buying and ETF inflows. Concerns over US fiscal discipline and potential US dollar weakness are additional catalysts for the precious metal.

Short-term volatility due to interest rate sentiment does not change the medium- to long-term thesis. Gold remains positioned as a hedge against currency depreciation risk and monetary policy uncertainty.

3. Nickel: RKAB Risk More Manageable than Expected

In the nickel sector, the government remains committed to cutting the RKAB quota from around 370 million wmt to 250-260 million wmt. Although it looks significant, last year’s production realization was around 300 million wmt, while the projected 2026 demand is estimated at 330-340 million wmt.

With potential additional ore imports from the Philippines of 30-40 million wmt as well as quota adjustment opportunities in the second half of 2026, the supply balance is expected to remain slightly surplus at around 100 thousand tons or around 3% of total supply. LME nickel prices are projected at US$17,000 per ton or around Rp285.11 million, up from US$15,000 per ton or around Rp251.56 million in 2025.

4. Preferred Stocks: Gold Favored

In the gold space, PT Aneka Tambang Tbk (ANTM) and PT Sumber Global Energy Tbk (EMAS code) are the top choices. Both are considered to have direct exposure to the upward trend in gold prices with relatively limited regulatory risk.

For nickel, PT Vale Indonesia Tbk (INCO) and PT Merdeka Battery Materials Tbk (MBMA) are selective options. INCO is considered more defensive because it has obtained RKAB approval, while MBMA has prospects from the expansion of downstream projects.

5. Key Factors for Investors to Watch

Some important 2026 developments to watch out for include the direction of US fiscal and monetary policy, including the potential for interest rate cuts which will be positive for gold. In addition, the certainty of RKAB quotas for other nickel issuers and the potential export tax on nickel products are also crucial variables.

The main risk comes from the possibility of a more hawkish stance from the Fed and lower-than-expected RKAB quota realization. On the other hand, the risk of new project execution in mining issuers may also affect stock performance.

Overall, the metals sector is maintained in an overweight position with a preference for gold over nickel. The combination of macro support and previous price correction is considered to open up further upside opportunities for mining issuers in 2026.

Also Read: 5 Interesting Facts Behind 2.5 BTC Transfer to Genesis Bitcoin Wallet

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

Gold-Based Crypto: When Physical Assets Meet Crypto Technology

As blockchain technology develops, gold can now be owned not only in physical form such as jewelry or bars, but also in digital form through gold-based crypto assets.

One of the most popular is Tether Gold (XAUt), a physical gold-backed ERC-20-based stablecoin, where 1 token represents 1 troy ounce of pure gold. The gold is stored in vaults in Switzerland and each token is directly linked to certified gold bullion. The system uses automated algorithms to efficiently manage the allocation of gold and Ethereum addresses.

XAUt tokens are available and traded on various crypto exchanges. XAUt is also an attractive alternative for those looking to hedge against inflation or global economic uncertainty, while remaining within the digital asset ecosystem.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Ryan Winipta & Reggie Parengkuan. Metals – 2026 Outlook: Recent Sell-Off Provides Further Upside on Gold/Nickel Miners. Accessed February 11, 2026.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.