Tokenized Commodities Surpass $6 Billion: What Does It Mean for Crypto Markets?

Jakarta, Pintu News – The market value of tokenized commodities-real-world assets (RWAs) represented on the blockchain such as tokenized gold-has surpassed more than $6 billion as of early 2026. This surge demonstrates the accelerating adoption of traditional tokenization like gold in crypto markets and is an important signal of how blockchain technology is opening up access to investment instruments that were previously less liquid and out of reach for retail investors.

Commodity tokenization uses blockchain technology to “break down” physical assets like gold into digital tokens that investors can trade fractionally. It has significantly increased in popularity as it offers a more affordable and transparent investment path, as well as expanding the range of asset classes beyond traditional cryptocurrencies such as Bitcoin (BTC) or Ethereum (ETH).

1. Tokenized Gold Leads Growth

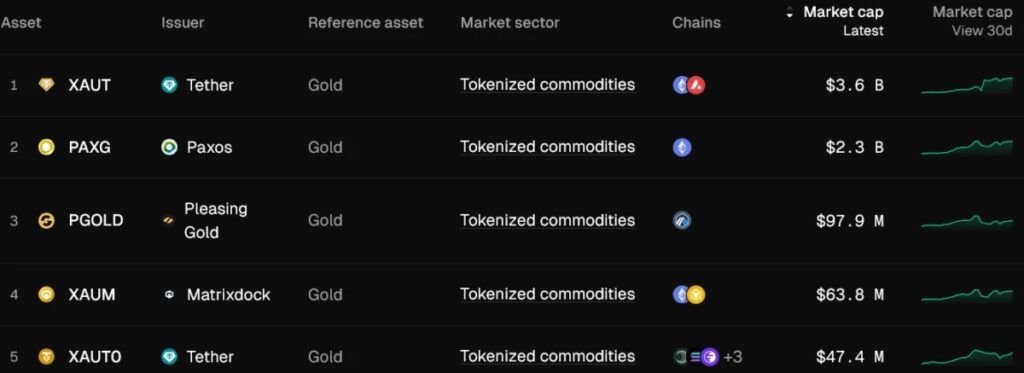

The majority of the current tokenized commodities market value is still dominated by gold that has been represented in digital tokens. Major products such as Tether Gold (XAUt) and Pax Gold (PAXG) account for more than 95% of the total tokenized commodities value of over $6 billion.

Tether Gold alone has recorded over 50% market cap growth in just the past few weeks, while Pax Gold has also increased significantly. Both show that demand for tokenized gold remains strong amid investors’ interest in safe assets and diversification outside of traditional markets.

Also Read: 5 Shocking Facts About Jeffrey Epstein’s Influence in Silicon Valley

2. Commodity Tokenization is Growing Fast

Compared to the beginning of the year, the market size of tokenized commodities saw a sharp jump of close to 53%. This shows that global markets are increasingly accepting new ways of investing in commodities through blockchain, especially when traditional instruments face liquidity challenges and access barriers for small investors.

This growth coincided with the rise in real gold prices, which also fueled demand for products that represent gold ownership in digital form. The tokenized commodities market even grew faster than tokenized stocks or tokenized funds over the same period.

3. What are Tokenized Commodities?

Tokenized commodities are digital versions of physical assets that are stored somewhere (or represented through contracts) and traded on the blockchain. This model allows investors to own small parts (fractions) of large assets like gold or oil without having to buy a full unit.

Since tokenization utilizes blockchain technology, transactions tend to be faster, lower fees, and more transparent than traditional investments. Investors can also list these tokens on various decentralized platforms or centralized exchanges that support RWA.

4. Benefits for Retail Investors

Tokenized commodities open up investment opportunities that were previously limited to large institutions. Retail investors can now own a portion of gold or other commodities with less capital and without the hassle of holding the physical asset itself.

In addition, diversification between tokenized commodities and crypto assets such as Bitcoin (BTC) or other altcoins can help reduce portfolio risk. This combination provides access to assets that are not necessarily correlated with traditional stock or bond markets.

5. Challenges and Risks

While tokenization provides convenience, there are some risks such as the technical risks of blockchain, the need for robust infrastructure, and reliance on third parties holding physical assets. Investors need to understand the physical storage mechanisms and ownership audits that underpin such tokens.

Regulation is also an important issue; tokenized commodities markets are still developing in many jurisdictions, so legal certainty may vary. Clearer policies may encourage further institutional participation.

6. Tokenization and the Future of Asset Markets

Commodity tokenization is part of a broader trend that includes tokenized stocks, real estate, and fixed-income instruments. The total value of tokenized real-world assets (RWA) is growing rapidly, with commodities being one of the key segments.

As blockchain technology matures and adoption becomes more widespread, tokenized commodities could become an important part of the global investment landscape, making commodity markets more inclusive and efficient for investors around the world.

7. Conclusion

The market value of tokenized commodities surpassing $6 billion demonstrates the rapid growth of the sector and the increasing interest of global investors in instruments that combine the characteristics of physical assets and digital technology. This surge marks a new phase in commodities investment that is more accessible, transparent, and closely linked to the growing crypto ecosystem.

Also Read: 5 Interesting Facts Behind 2.5 BTC Transfer to Genesis Bitcoin Wallet

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

Gold-Based Crypto: When Physical Assets Meet Crypto Technology

As blockchain technology develops, gold can now be owned not only in physical form such as jewelry or bars, but also in digital form through gold-based crypto assets.

One of the most popular is Tether Gold (XAUt), a physical gold-backed ERC-20-based stablecoin, where 1 token represents 1 troy ounce of pure gold. The gold is stored in vaults in Switzerland and each token is directly linked to certified gold bullion. The system uses automated algorithms to efficiently manage the allocation of gold and Ethereum addresses.

XAUt tokens are available and traded on various crypto exchanges. XAUt is also an attractive alternative for those looking to hedge against inflation or global economic uncertainty, while remaining within the digital asset ecosystem.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Cointelegraph via TradingView. Tokenized commodities market crosses $6B as gold hits historic rally. Accessed February 12, 2026.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.