5 Key Takeaways from Tokenized Gold & Blockchains Commodities Reach USD6 Billion in Value by 2026

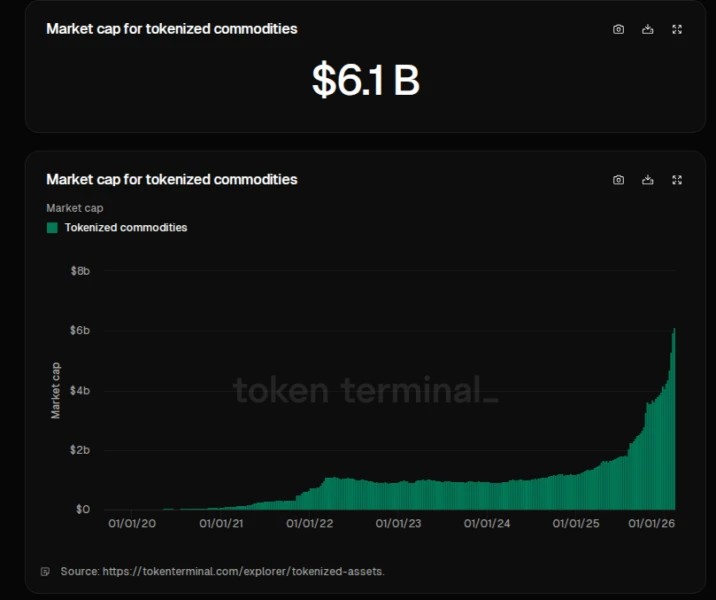

Jakarta, Pintu News – The market for tokenized commodities – real-world assets represented on the blockchain – is showing strong growth to penetrate a total value of more than USD6 billion (approximately Rp101.0 trillion) by 2026. This surge is mainly driven by tokenized gold, which serves as a bridge between traditional investments like gold and blockchain technology. This phenomenon presents both new opportunities and challenges for investors looking to combine crypto and real asset investments in their strategies.

1. Tokenized Commodities Value Up 53 Percent in 6 Weeks

The tokenized commodities market has grown by around 53 percent in just under six weeks, pushing the sector’s capitalization past USD6 billion. This rapid growth has been driven largely by demand for tokens that represent securely stored physical gold and can be traded on the blockchain. Investors embrace this model because it provides exposure to commodity assets without the need to hold physical gold.

Tokenized commodities are not just about gold; however, gold’s dominance remains strong due to its safe-haven character in volatile market conditions. The use of blockchain enables round-the-clock, transparent and fractional trading, which is difficult to achieve with traditional instruments.

Also Read: Tokenized Commodities Surpass $6 Billion: What Does It Mean for Crypto Markets?

2. Gold Tokens Becomes a Growth Leader

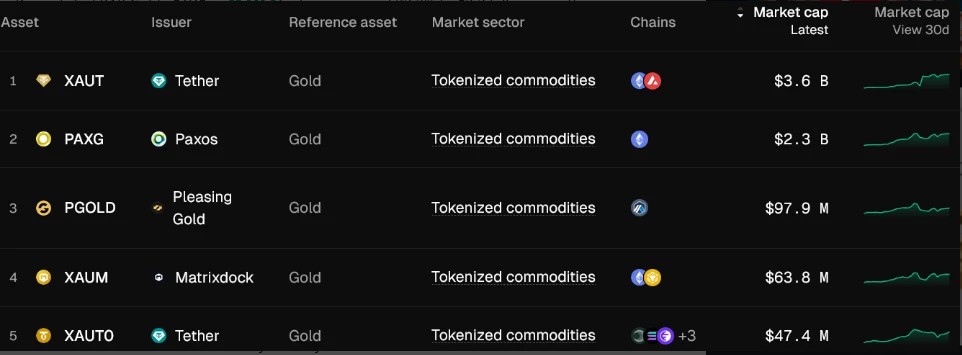

Tokenized gold such as Tether Gold (XAUT) and Paxos Gold (PAXG) account for most of the market value of tokenized commodities. These tokens provide a way for investors to hold ownership claims to physical gold through digital assets that can be traded on various crypto exchanges.

Investors like these tokens because they can buy small fractions of gold, making access to the precious metal more affordable. Transactions via blockchain eliminate the storage and logistics requirements typically associated with physical gold ownership.

3. Tokenized Commodities Accelerate Real-World Asset Adoption

The growth of tokenized commodities reflects a broader trend in the integration of real-world assets with blockchain technology, where real-world assets (RWAs) are becoming an important asset class in the crypto ecosystem. Tokenized commodities leverage blockchain infrastructure to provide liquidity, transparency, and global access not always available through traditional markets.

Tokenized assets also allow retail investors to access instruments that were previously hard to reach or expensive to own, such as small amounts of gold bullion. This model encourages portfolio diversification across asset classes through a single digital platform.

4. Tokenized Gold Growth Beats Stocks & Other Funds

The growth of the gold token market has outpaced several other RWA classes, including tokenized stocks and tokenized funds in the most recent period of increase. The market value of tokenized commodities is now greater than most existing tokenized stocks, indicating that investors increasingly value the combination of gold’s stability with blockchain flexibility.

This shows that traditional assets like gold are still highly relevant in digital investment strategies. This integration encourages greater innovative adoption in the cryptocurrency ecosystem as a whole.

5. Challenges and Risks of Tokenizing Real-World Assets

While this growth is promising, some analysts caution that there are risks to consider, particularly regarding regulation, ownership rights, and international auditing of physical backing. The lack of clear rules in some jurisdictions could lead to legal uncertainty, particularly regarding the 1:1 claim between the token and the physical gold it represents.

In addition, investors need to understand that tokenized gold remains subject to the volatility of the gold price itself as well as blockchain technology risks such as smart contracts and on-chain security. A thorough understanding of the technical and legal aspects is important when considering exposure to tokenized assets.

Also Read: 7 Reasons Silver Demand Remains Strong in 2026: Market Deficit & Investment Rising

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

Gold-Based Crypto: When Physical Assets Meet Crypto Technology

As blockchain technology develops, gold can now be owned not only in physical form such as jewelry or bars, but also in digital form through gold-based crypto assets.

One of the most popular is Tether Gold (XAUt), a physical gold-backed ERC-20-based stablecoin, where 1 token represents 1 troy ounce of pure gold. The gold is stored in vaults in Switzerland and each token is directly linked to certified gold bullion. The system uses automated algorithms to efficiently manage the allocation of gold and Ethereum addresses.

XAUt tokens are available and traded on various crypto exchanges. XAUt is also an attractive alternative for those looking to hedge against inflation or global economic uncertainty, while remaining within the digital asset ecosystem.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC/TradingView. Blockchain Meets Gold: Tokenized Commodities Hit $6 Billion. Accessed February 13, 2026.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.