As Ethereum Defends the $1,957 Mark, Whales Launch a Massive 113.6 Million ETH Buying Spree

Jakarta, Pintu News – Ethereum (ETH) has finally broken the negative trend of ETF outflows for four consecutive weeks. In the week ending February 18, inflows were recorded, signaling the return of institutional demand.

At the same time, Whale wallets started accumulating again. However, long-term holders continued to sell whenever the Ethereum price experienced abounce. This direct conflict between institutional accumulation and long-holder selling pressure will be decisive: whether Ethereum’s price recovery will continue or stall.

Then, how will Ethereum price move today?

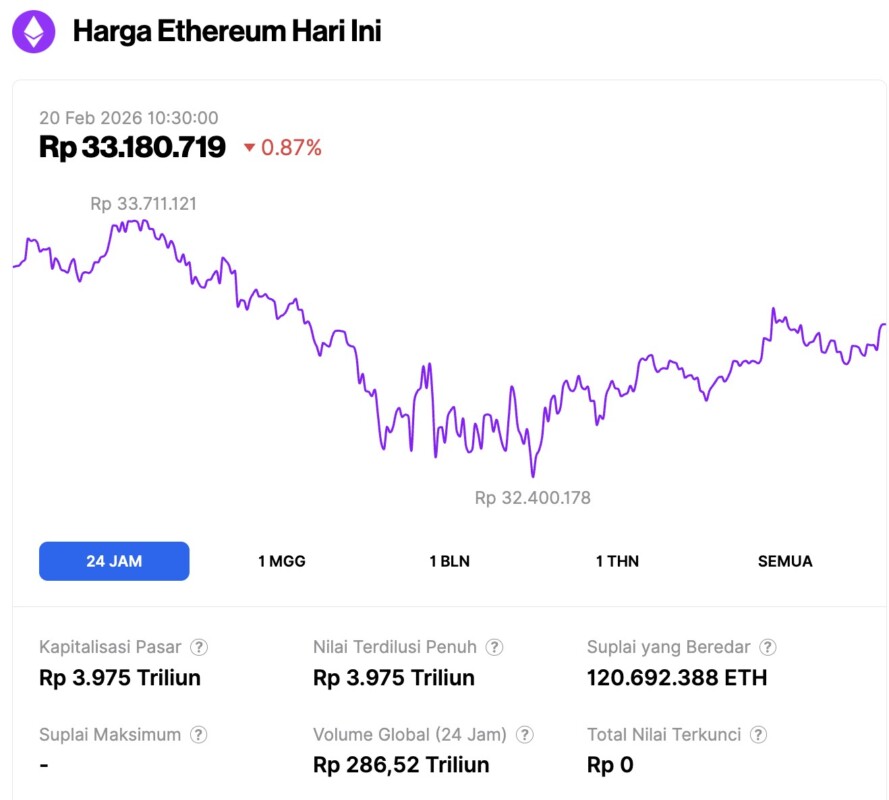

Ethereum Price within 24 Hours

On February 20, 2026, Ethereum was trading at approximately $1,957 (roughly IDR 33,180,719), reflecting a modest 0.87% gain over the past 24 hours. Throughout the day’s trading session, ETH fluctuated between a low of IDR 32,400,178 and a high of IDR 33,711,121.

As of this writing, Ethereum’s total market capitalization sits at approximately IDR 3,975 trillion. Meanwhile, market activity has cooled slightly, with the daily trading volume dropping by 11% to IDR 286.52 trillion.

Read also: Bitcoin Price Updates: Rising to $67,000 Today, Analysts Watch BTC 200 MA Support

ETF downtrend ends, “whales” start buying Ethereum

After experiencing institutional selling pressure for four consecutive weeks, the negative trend on Ethereum is finally showing signs of stopping. Based on data for the week ending January 23 to February 13, the spot Ethereum ETF continued to recordnet outflows. This phenomenon had reflected the low confidence of institutional investors which resulted in a general decline in the price of Ethereum.

Good news emerged in the week ending February 18. The selling trend was officially broken with anet inflow of $6.80 million. While this figure does not compare to the large volume of selling in previous weeks, the shift signals that institutional selling pressure has at least subsided.

In market cycles, the return of positive flows after a long period of outflows often signals the beginning of a price stabilization phase.

At the same time, accumulation activity by whales (large investors) has now returned. Data shows that wallets with jumbo balances have increased their holdings from 113.50 million ETH on February 15 to 113.63 million ETH currently. This increase of 130,000 ETH, when converted to the current market price, equates to an accumulation worth approximately $253 million in just a few days.

The phenomenon of whale accumulation amid weak market conditions is an important indicator, as large investors often take positions early before a broader market recovery begins. However, this growing optimism is likely to face resistance from other investor groups.

Positive Signals Emerge, But Long-Term Investors Keep Selling

Ethereum’s 8-hour chart (2/19) is currently showing an important momentum signal that has historically often been the first sign of a price increase.

From February 2 to 18, Ethereum’s price hit a newlower low, which means it plummeted past its previous support limit. However, during the same period, the Relative Strength Index (RSI) indicator – which measures buying and selling strength – recorded ahigher low.

This pattern of opposite movement between the price and the RSI is known as bullish divergence (uptrend indication).

Read also: Zora Expands into Solana: Features Trend Speculation Amid SOL Optimism to Break $500!

This signal proved accurate twice earlier this month:

- The First Pattern: Occurred between February 2 to 11, which managed to trigger an 11% surge in Ethereum price.

- Second Pattern: Appeared between February 2 to 15, which prompted an additional price recovery of 6%.

Interestingly, these two moments of ETH price bounce occurred while ETF funds were stilloutflowing. This indicates that buyers (bulls) are already trying to take control of the market even under pressure.

Currently, the situation is more favorable as ETFinflows have returned and whales have started buying up assets. This increases the chances of a further price bounce.

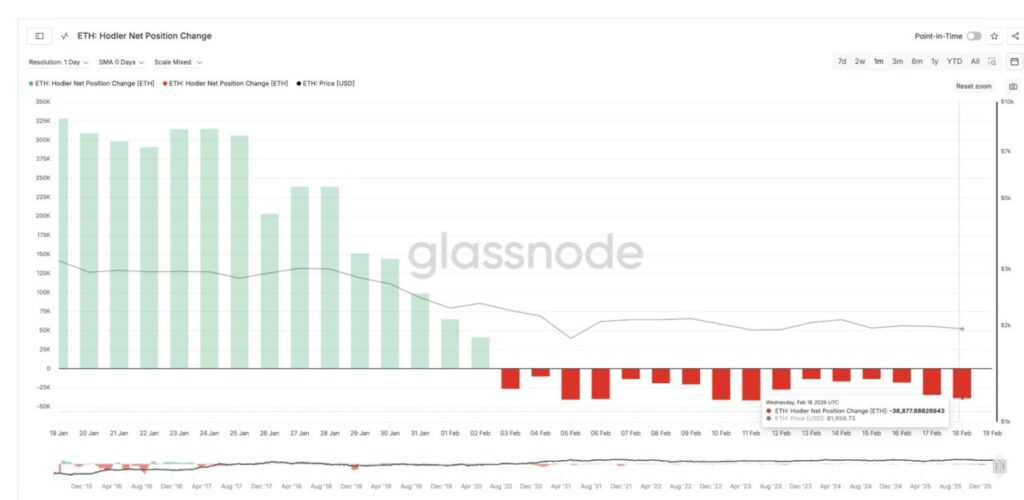

Unfortunately,long-term holders are showing the opposite movement. This can be seen from the Hodler Net Position Change indicator, which tracks whether they are hoarding or offloading assets. A negative value on this indicator confirms that they are redistributing (selling) their assets.

To give you an idea, on February 17, long-term investors were recorded selling 34,841 ETH in the last 30 days. In just one day (February 18), this figure jumped sharply to 38,877 ETH. This surge in selling pressure occurred just as a positive signal(bullish divergence) was forming.

This fact shows that long-term investors are taking advantage of the momentum of strengthening prices to cash out(exit positions). Similar behavior was also the culprit for the failure of the price rally in early February, where the price recovery did not last long as it was held back by massive selling from this group.

Triangular Pattern Reveals Critical Levels

Currently, Ethereum is moving inside a symmetrical triangle pattern on the 8-hour chart. This pattern forms when the price movement is sandwiched between support and resistance lines that are narrowing.

This pattern reflects the balance of power between buyers and sellers. In the case of Ethereum, the buyer camp is driven by whales and institutional ETF fund inflows. Conversely, the sellers’ camp is dominated by long-term asset holders who are cashing out their positions. This tug-of-war is why Ethereum’s price movement is still stuck in a consolidation phase.

As for the upside potential, the first resistance level is around $2,030-the level that previously thwarted the recovery attempt. If the price manages to break this point, the strengthening momentum will be validated while confirming the breakout from the triangle pattern. The next big hurdle is at $2,100. If this level is successfully crossed, the uptrend recovery will get stronger and pave the way for higher prices.

Even so, downside risks remain looming. The closest point to defend(reclaim level) is at $1,960. If it fails to hold in that area, Ethereum risks slipping to $1,890. A deeper drop could even drag the price down to $1,740 if the selling pressure intensifies.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading and crypto gold investment experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum ETFs Break 4-Week Outflow Streak – Can ETH Price Finally Recover? Accessed on February 20, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.