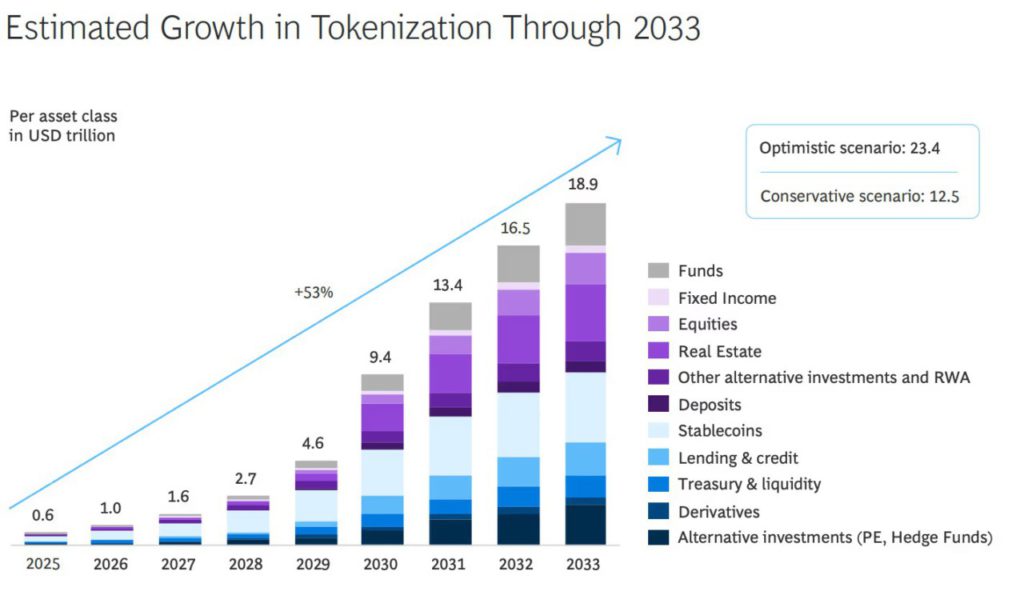

Tokenized Asset Market Predicted to Reach $18.9 Trillion by 2033

Jakarta, Pintu News – The use of blockchain technology to tokenize financial and real assets is predicted to reach a market value of $18.9 trillion by 2033. A joint report released by the Boston Consulting Group (BCG) and Ripple shows that the growth of this technology has almost reached a tipping point, with an average annual growth potential of 53%.

Asset Tokenization: Definition and Growth Potential

Tokenization is the process of recording ownership and transfer of assets using blockchain technology. Assets that can be tokenized include securities, commodities, and real estate. This technology offers higher efficiency, faster and cheaper transaction settlement, and the possibility of 24-hour transactions.

JPMorgan’s Kinexys platform has processed over $1.5 trillion in tokenized transactions, with daily volumes of over $2 billion. Tokenization has shown success in some early use cases, such as tokenized government bonds.

This allows corporate treasurers to move unused cash into tokenized short-term government bonds from digital wallets without intermediaries, managing liquidity in real time and around the clock.

Also Read: XRP Price Prediction: Between Deep Correction and Hopes of Rebound in Crypto Market (8/4/25)

Challenges Faced in the Adoption of Tokenization

Despite the promising prospects, there are several barriers hindering the widespread adoption of tokenization. Fragmented infrastructure, limited interoperability between platforms, uneven regulatory progress, inconsistent storage frameworks, and lack of smart contract standardization are some of the key challenges.

Currently, most tokenized assets are settled in isolation, with cash payments outside the chain limiting efficiency gains. The legal framework for tokenized securities and infrastructure is well developed in several regions such as Switzerland, the European Union, Singapore and the United Arab Emirates.

However, large markets like India and China still have restrictive or unclear regulations, which complicates cross-border operations and forces companies to customize their infrastructure for each market.

Market Transformation Through Tokenization

Tokenization not only opens up access to previously non-transparent and illiquid markets such as personal credit, but also enables fractional ownership with clearer pricing. The carbon market is also an area of potential, where a blockchain-based registry could improve transparency and tracking of emissions credits.

The adoption phase of tokenization includes the use of low-risk instruments such as bonds and funds, expansion to more complex products such as personal loans and real estate, and full market transformation including illiquid assets such as infrastructure and private equity.

Conclusion

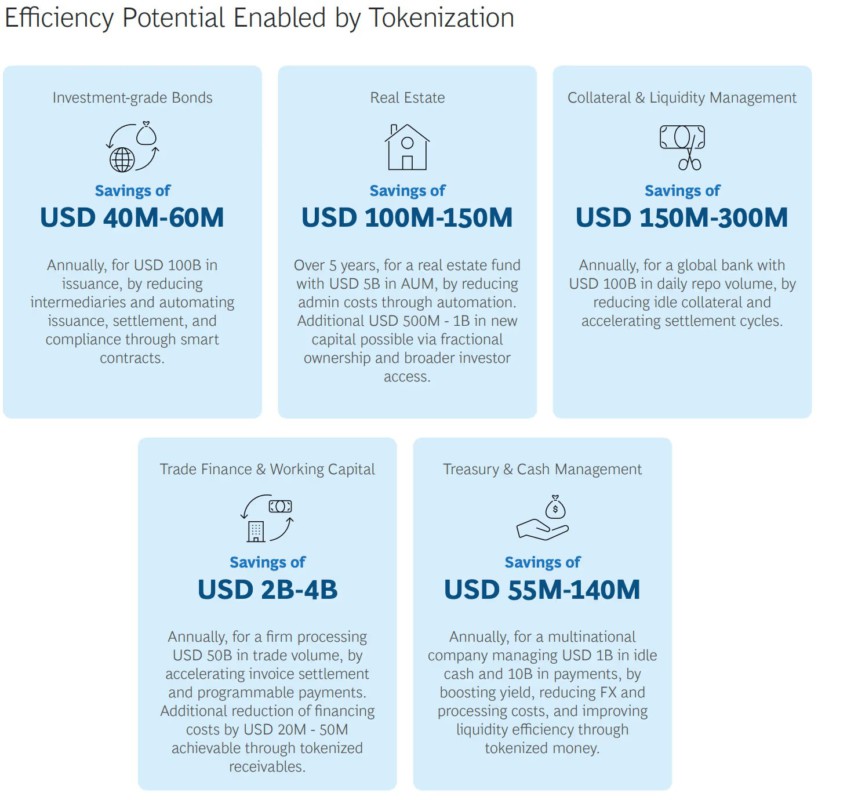

With technological advancements and evolving regulations, asset tokenization offers great opportunities for the transformation of global financial markets. Despite challenges, early adoption by large enterprises and the potential for significant cost savings promise a bright future for asset tokenization.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coindesk. Ripple, BCG Project $18.9T Tokenized Asset Market by 2033, but Obstacles Remain. Accessed on April 8, 2025

- Featured Image: Generated by AI