Market Analysis Nov 6th, 2023: Will BTC Continue to Outperform in November?

The euphoria of Uptober for crypto investors seems to continue as the price of Bitcoin rose up to 30% during the month of October. However, many questions arise as to whether November will follow October’s positive performance and become an Upvember, or will it take a turn and become a Downvember instead? A comprehensive analysis can be found in the article below.

The Pintu trading team has gathered critical information and analyzed the general economic situation and the crypto market’s movements over the past week. However, it should be noted that all information in this Market Analysis is intended for educational purposes, not as financial advice.

Market Analysis Summary

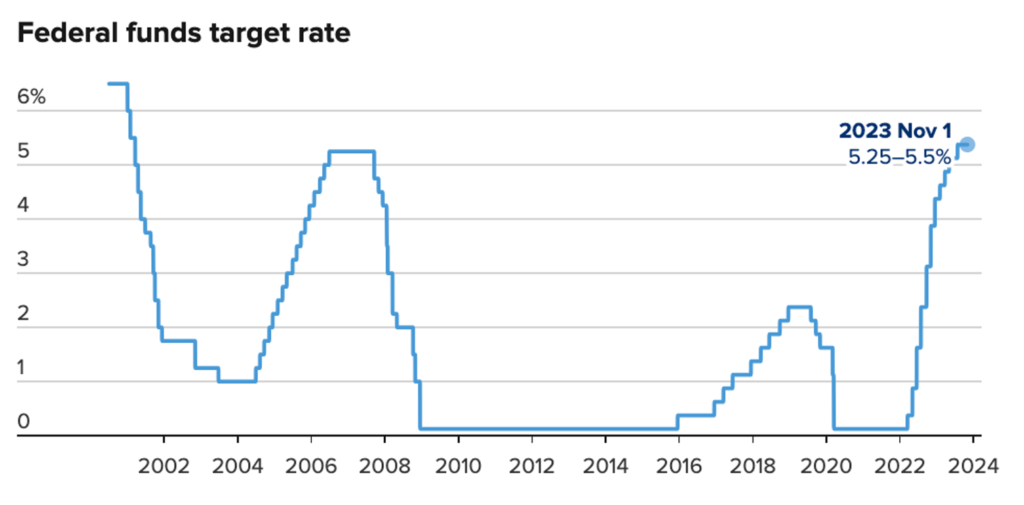

- 🆘 The Federal Reserve maintains interest rates at 5.25%-5.50%.

- 💼 Unemployment claims have slightly increased to 217,000.

- 🦾 The Global S&P Manufacturing PMI holds steady at 50.0, while the ISM Manufacturing PMI remains in contraction.

- ✍🏻 BTC appears overbought after rising 1.2% over the week. Currently, BTC is retracing back to its 150-day Moving Average (MA) to find support.

- 👀 ETH has not been able to break through the 100-week Exponential Moving Average (EMA) resistance line for two consecutive weeks. A significant resistance level for ETH is at the $1,800 price point.

Macroeconomic Analysis

Fed Interest Rate

The Federal Reserve decided to maintain the current interest rates at 5.25%-5.50% on Wednesday. Fed Chair Jerome Powell said that the Fed is still evaluating whether the existing financial conditions are tight enough to control inflation, or if the economy requires further restraint. The Fed is also cautious about the prospect of a significant impact on the economy from rising market-based interest rates and aims to minimize any disruption to the ongoing trend of stable job and wage growth.

Other Economic Indicators

- Core PCE Index: The core personal consumption expenditures price index, a key inflation gauge for the Fed, increased by 0.3% in September and 3.7% year-over-year. This is down from a peak of 5.6% in early 2022, but still remains significantly higher than the Fed’s annual target of 2%.

- Michigan Consumer Sentiment: Consumer sentiment declined in October to 63.8, the lowest level since the start of the pandemic. This suggests that consumers are becoming more cautious about spending as inflation remains high.

- ADP Employment Change: Private sector employment in the United States increased by 113,000 in October, slightly below market expectations. Wages also saw a year-over-year increase of 5.7%.

- JOLTs Job Openings: Job openings in the US rose in September to 9.553 million, indicating a continued tightness in the labor market. This is likely to lead the Fed to maintain higher interest rates for an extended period to manage demand.

- S&P Global Manufacturing PMI: The S&P Global US Manufacturing PMI increased from 49.8 in September to 50.0 in October, indicating a stabilization in operational conditions’ health. However,there were concerns about diminishing backlogs of work and lower expectations for future output.

- Jobless Claims: The number of Americans filing for unemployment benefits increased by 5,000 to 217,000 in the week ending on October 28, according to the Labor Department. The four-week moving average of unemployment claims increased by 2,000 to 210,000. A total of 1.82 million people were receiving unemployment benefits as of the week ending on October 21, which is roughly 35,000 more than the previous week and the highest figure since April.

BTC & ETH Price Analysis

Bitcoin

BTC is overbought, gaining further 1.2% over the week but retraced to the 150 MA line to find its support. The current value of Bitcoin stands at $34,370, indicating a minor decline within the last 24 hours. Nevertheless, it’s important to acknowledge that BTC has demonstrated significant gains over more extended timeframes. Over the past week, it has weakened by 0.9%, and its performance over the last month reflects an impressive surge of 21%. Over the course of the past year, BTC’s value has experienced a remarkable increase of 66.6%.

However, despite these notable gains, there are indications that the cryptocurrency market is showing signs of cooling down. The trading volume on various exchanges has decreased, with Bitcoin registering only $13 billion in the last 24 hours, representing a 17% reduction.

Ethereum

ETH continues to exhibit a relatively weaker performance compared to BTC, with a weekly performance of -0.53%. Notably, it has not surpassed its EMA 100 weeks resistance line for the second consecutive week. There is a significant resistance level at the 1.8K price point, and surpassing this price level would indicate a positive upward momentum for ETH.

On-Chain Analysis

- 📊 Exchange: As the exchange reserve continues to rise, it indicates higher selling pressure. Net deposits on exchanges are low compared to the 7-day average. Lower deposits can be interpreted as lower selling pressure.

- 💻 Miners: Miners’ are selling holdings in a moderate range compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- 🔗 On-Chain: More investors are selling at a profit. In the middle of a bull market, it can indicate a market top. Long term holders’ movement in the last 7days was lower than the average. They have a motive to hold their coins. Investors are in a Anxiety phase where they are currently in a state of moderate unrealized profits.

- 🏦 Derivatives: Long position traders are dominant and are willing to pay to short traders. Selling sentiment is dominant in the derivatives market. More sell orders are filled by takers. As open interest increases, it indicates more liquidity, volatility, and attention are coming into the derivative market. The increasing trend in open interest could support the current ongoing price trend.

- 🔀 Technicals: RSI indicates an overbought condition where 92 % of price movement in the last 2 weeks have been upwards and a trend reversal can occur. Stochastic indicates an oversold condition where the current price is close to its high in the last 2 weeks and a trend reversal can occur.

News About Altcoins

- Solana has seen a surge in price, reaching a 14-month high. The Solana token has risen more than 20% to approximately $45.3, the highest level since August 2022. This price increase is fueled by major announcements at the Breakpoint conference, including the launch of Firedancer by Jump Crypto, which is now live on the testnet, and the release of the first smart wallets on Solana by Fuse Wallet. Despite this significant increase, the price of SOL is still down 83% from its all-time high of just under $260.

News from the Crypto World in the Past Week

- The Unibot chatbot on Telegram was hacked. Unibot has confirmed that it fell victim to a token approval exploit while transitioning to a new router, with the stolen crypto now having been exchanged for ether via Tornado Cash. PeckShield reported that the attacker first transferred the stolen crypto to Uniswap before funneling it through Tornado Cash. Unibot has pledged to reimburse the stolen funds, while the price of its token plummeted nearly 25% to just over $42, down from a peak of nearly $220 in mid-August.

- Sam Bankman-Fried, the 31-year-old founder of FTX, was found guilty by a jury of his peers on seven criminal counts. Sam faces a maximum sentence of 115 years in prison. The charges include fraud and conspiracy against FTX customers and Alameda Research lenders, conspiracy to commit securities and commodities fraud against FTX investors, and conspiracy to commit money laundering. Bankman-Fried, an MIT graduate and the son of two Stanford law professors, has pleaded not guilty to charges stemming from the collapse of FTX and its affiliated hedge fund, Alameda, late last year.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- PancakeSwap +86,10%

- MultiversX (EGLD) +51,94%

- Neo (NEO) +45,17%

- Immutable +39,14%

Cryptocurrencies With the Worst Performance

- Maker (MKR) -5,12%

- Render (RNDR) -5,10%

- Quant -3,43%

- Bitcoin Cash -2,64%

References

- Camila Russo, Solana’s SOL Token Soars to 14-Month High Amid Breakpoint Conference, thedefiant, accessed on 6 November 2023.

- Sam Reynolds, Unibot Exploiter Swaps Stolen Crypto for Ether Via Tornado Cash, Coindesk, accessed on 6 November 2023.

- Mackeznie Sigalos, Sam Bankman-Fried found guilty on all seven criminal fraud counts, Cnbc, accessed on 6 November 2023.

Share

Related Article

See Assets in This Article

BTC Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-