Bitcoin Struggles at $83,500 – Can BTC Rebound to $85K Amid Heavy Selling? (March 17)

Jakarta, Pintu News – According to Coingape (3/17/25), the price of Bitcoin (BTC) briefly passed the $85,000 mark on Sunday, March 16, marking an 11% recovery from last week’s low of $76,000.

Bullish traders have significantly increased leveraged positions on BTC ahead of the US Federal Reserve’s interest rate decision scheduled on March 19.

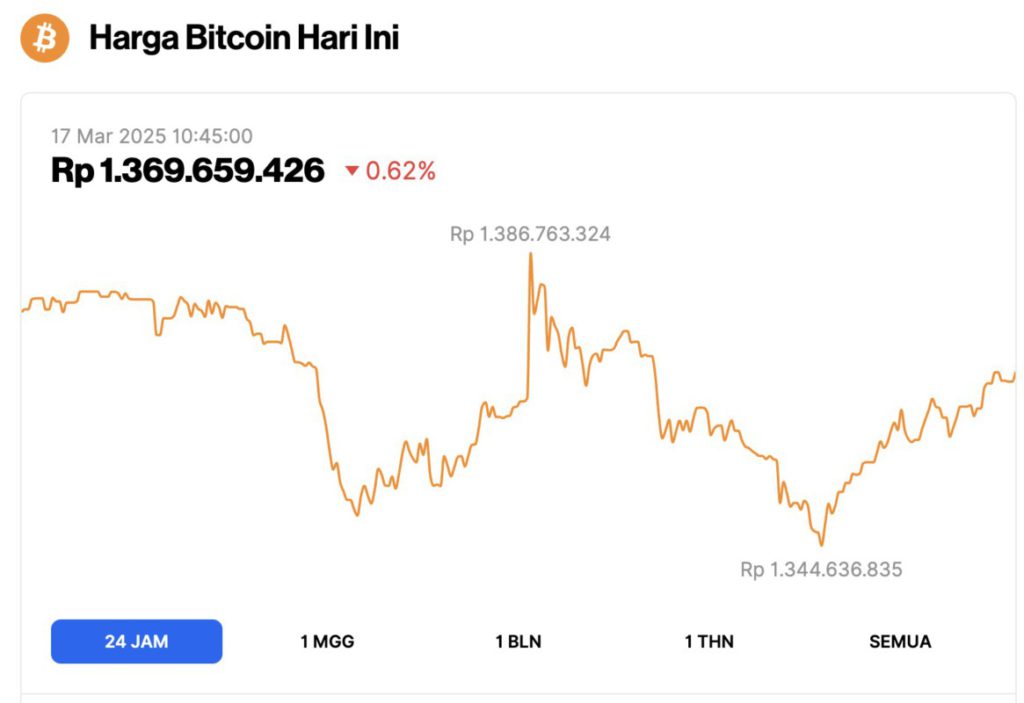

Bitcoin Price Drops 0.62% in 24 Hours

On March 17, 2025, Bitcoin (BTC) was valued at $83,537 (approximately IDR 1,369,659,426), reflecting a slight 0.62% decline over the past 24 hours. During this timeframe, BTC reached a peak of IDR 1,386,763,324 before dipping to its lowest point at IDR 1,344,636,835.

According to CoinMarketCap, Bitcoin’s market capitalization is now $1.65 trillion, with trading volume in the last 24 hours up 78% to $23.14 billion.

Read also: Pi Coin Drops 8%, Check Today’s Pi Network to Rupiah Exchange Rate (March 17, 2025)

Bitcoin (BTC) seeks to recover to $85,000 amid seller pressure

After hitting an all-time record high of $109,071 in January, Trump’s inauguration marked a downward phase for Bitcoin (BTC), which experienced a sharp correction of nearly 30% and hit a low of $76,000 last week.

This decline was attributed to various factors, including geopolitical tensions following President Trump’s intervention in early March as well as the announcement of new trade tariffs by the US.

However, positive reports from the US Consumer Price Index (CPI) and Producer Price Index (PPI) released last week boosted the recovery. On March 16, 2025, the price of BTC briefly crossed the $85,000 mark, reflecting an 11.1% increase from the previous low of $76,000 recorded on Tuesday, March 12.

This suggests that investor sentiment improved significantly since the release of the CPI data on Wednesday, March 13, with many investors choosing to hold onto their assets while looking forward to the next macroeconomic announcement.

Fed Rate Decision that Could Push BTC to $100K

The Federal Reserve’s upcoming interest rate decision is a crucial moment for Bitcoin investors. Historically, lower interest rates increase liquidity in financial markets, which often favors riskier assets like stocks and cryptocurrencies.

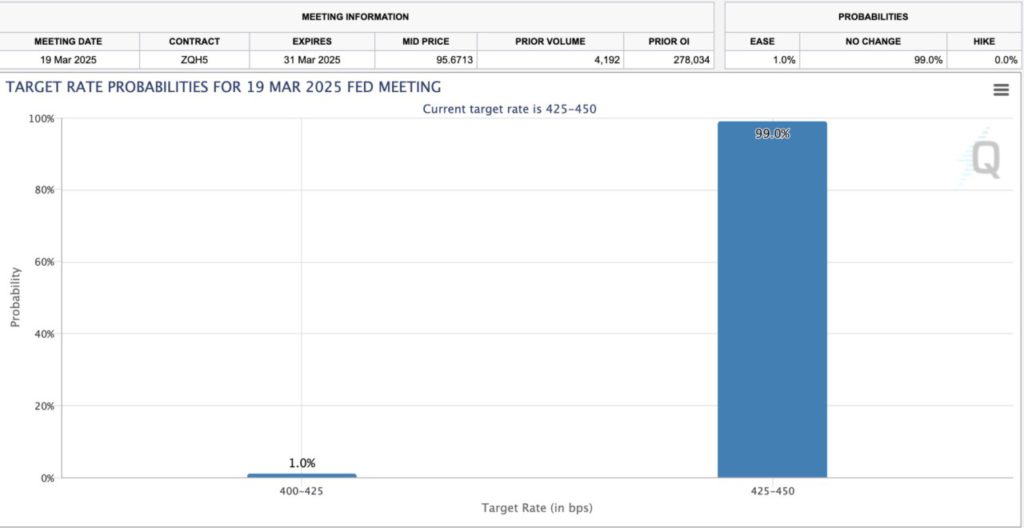

The next Federal Open Market Committee (FOMC) decision is expected to be announced on Wednesday, March 19.

If the Fed indicates a pause in interest rates or even signals a possible cut in the near future, this could boost investor confidence and potentially push the price of Bitcoin towards $100,000.

Conversely, if the Fed takes a hawkish stance by raising interest rates again, liquidity could tighten, which could hamper Bitcoin’s upward momentum.

However, based on the latest data from CME Group, the majority of market participants expect with a 99% probability that the Fed will maintain current interest rates.

If this scenario plays out as expected, BTC prices are likely to see a rise after the official announcement, as has often been the case in previous less hawkish Fed decisions.

Bull Traders Dominate the Bitcoin Derivatives Market with $1.9 Billion of Dominance

After the market digested the signals of easing inflation from the US CPI and PPI reports, as well as the diminishing chances of a previously feared rate cut, the majority of Bitcoin traders have anticipated the rate pause decision and adjusted their trading positions accordingly.

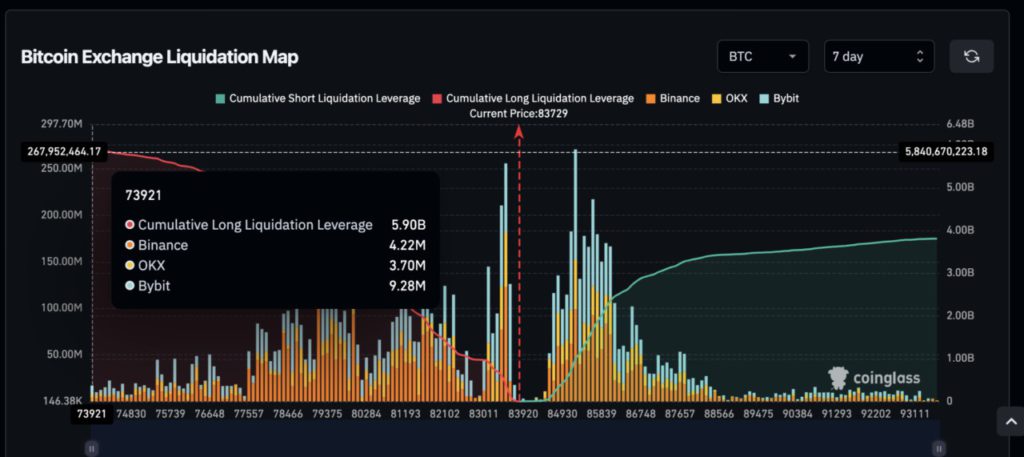

In the derivatives market, bullish sentiment is evident. In the past 7 days, bullish traders have opened leveraged long positions worth $4.9 billion, while leveraged short positions stood at only $3.8 billion. This gives bull traders a net dominance of $1.1 billion.

These significant long positions reflect the market’s strong confidence in Bitcoin’s future price appreciation. However, it is important to constantly monitor these leveraged positions, as sudden market movements could trigger massive liquidations, potentially accelerating price movements.

With BTC’s price surge of 11% in the past week, the Fed’s interest rate pause decision is likely already reflected in the current price. Many traders will probably utilize the moment of the announcement to implement a sell-the-news strategy.

If this scenario occurs, BTC could potentially experience a correction below $80,000, especially since many long traders are currently holding positions with excessive leverage.

Bitcoin Price Prediction: Recovery Continues, but $100K Target Still Elusive

Bitcoin’s price prediction chart shows further upside potential after an 11% rebound from the recent $76,000 low, reaching $83,537 at the time of writing.

Although a number of technical indicators support a bullish move for next week, the road to $100,000 is still challenging due to key resistance levels and market sentiment that is not yet fully favorable.

Technically, Elliott Wave calculations show that Bitcoin has completed its corrective phase, aligning with the Fibonacci 1.618 extension at $76,555.

A rebound from this level opens up opportunities for a recovery rally with initial targets at the 0.382 Fibonacci retracement level of $89.085, followed by $92.956 (0.5 retracement) and strong resistance at $96.827 (0.618 retracement).

Moreover, the Parabolic SAR indicator, which is currently at $97.068, further confirms that the zone could be a crucial point where the bullish momentum will face major resistance.

However, as reported by Coingape (3/17/25) there are still significant bearish risks:

- Trading volume showed declining buying momentum, indicating a lack of strong conviction from bullish investors.

- The Bear/Bull Power (BBP) indicator is still negative at -10,559, signaling that selling pressure still dominates the market.

- If Bitcoin fails to break $89,000 convincingly, the potential for a correction to $76,000 is again open, which could even trigger a further decline.

For the coming week, Bitcoin needs to reclaim the $89,000 level for the bullish momentum to persist. If it is able to close above this level, BTC has the potential to continue its rally to $97,000.

However, if it fails to break through, the price could drop back down to $80,000 or lower.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Bitcoin Price Forecast: Can BTC Reach $100K After the Upcoming US Fed Decision? Accessed on March 17, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.