Is Ripple (XRP) Too High? Early Warning Indicators According to Analysts

Jakarta, Pintu News – Ripple (XRP) has managed to keep its price at $2, but various indicators suggest that there could be instability lurking behind it.

While price consolidation is often taken as a sign of impending upside, a decline in network activity such as transactions and active users suggests a potential downside. This begs the question, is Ripple (XRP) currently overvalued?

Signs of Overvaluation

On the surface, Ripple (XRP) looks impressive with a 307% gain from the opening price on Election Day. Since November, the asset has tested the $2 support zone four times, always managing to keep the price at that level. However, the most recent price drop on April 7, triggered by the tariff-induced market correction, closed at $1.60, the lowest close in over five months.

According to AMBCrypto, this decline raises concerns about Ripple’s (XRP) vulnerability to a deeper correction. A drop in network activity and a decrease in the creation of new wallet addresses from 5,200 to 2,900, or a 44% drop, indicates a slowdown in the recruitment of new users.

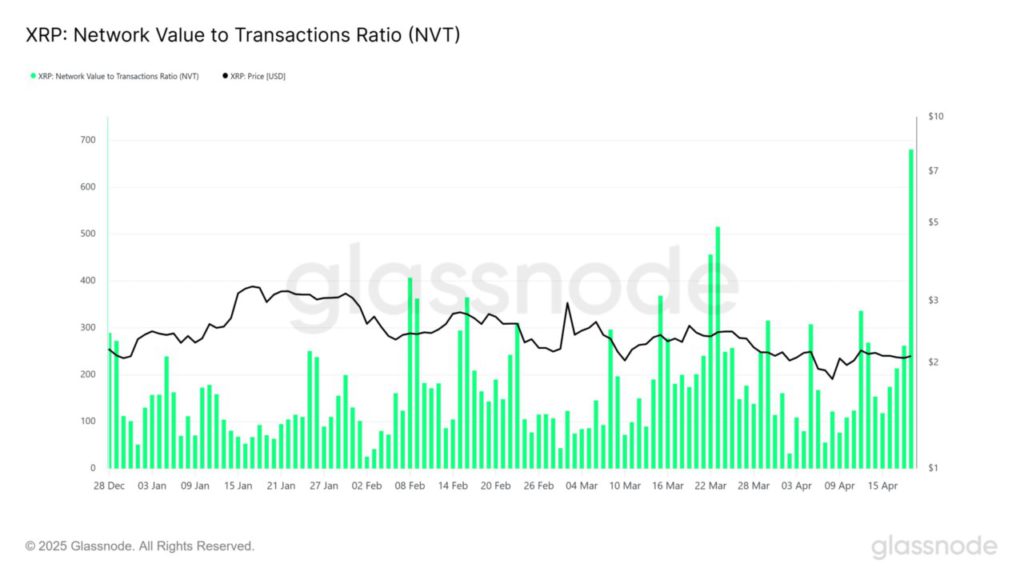

This decline was also supported by a spike in the NVT ratio (Network Value to Transactions Ratio), which often indicates that asset prices are increasing faster than actual network usage. With slowing network growth and the latest structural retraction, Ripple (XRP) seems to be trading at a premium compared to network fundamentals.

Also Read: Bitcoin Continues to Thrive Amid Crypto Market Fears: The Impact of Inflation Fears on Crypto

Weakening Bottom: A Warning for the Bulls?

The injection of fresh capital into the network is essential to trigger FOMO around critical support zones. In many cases, these inflows provide the necessary momentum to transform reactive levels into structural support.

However, accumulation by whales can also trigger rapid price reversals by absorbing liquidity at lower levels, but this also increases the risk of centralization as large holders control a larger portion of the assets. Ripple (XRP) seems to be experiencing a similar structural shift.

Early Warning Indicators

The sharp decline in new address generation and the increase in the NVT ratio indicate that there is an early warning that should not be ignored. Divergences between price and network fundamentals serve as early warning indicators, suggesting a possible return to fair value or price correction in the near future. Investors and analysts should pay attention to these indicators to anticipate possible price movements.

Conclusion

Although Ripple (XRP) has performed strongly in the past, various indicators currently suggest that this asset may be overvalued. Declining network activity and other technical indicators suggest that the current price may not be sustainable. Investors should be wary of potential price corrections that could occur if the current trend continues.

Also Read: Cardano Price Explosion Potential According to Analysts: Repeat 2021 Surge, Target $16?

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. XRP holds onto $2 for now, here’s what can cause a correction. Accessed on April 21, 2025

- Featured Image: Generated by AI

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.