Bitcoin (BTC) is on the move, is it the right time to invest? This is what analysts say!

Jakarta, Pintu News – Bitcoin (BTC) is currently in a consolidation phase after hitting a record high near $124,000. The volatility has kept investors on their toes, with prices fluctuating within a fairly tight range.

It shows resilience but also a failure to establish a clear directional trend. For many traders, this period feels like the calm before a possible big spike, as the market is at a point that analysts consider critical.

Technical Analysis: Resistance Level Test

On the 4-hour chart, Bitcoin (BTC) is seen consolidating around $115,555, with the price holding above its 50-day and 100-day moving averages, which are currently at $114,341 and $112,378. This configuration suggests short-term bullish momentum, as Bitcoin (BTC) manages to hold a higher low after rebounding in September.

This rise suggests that there is further potential for price increases if Bitcoin (BTC) can break through the existing resistance. Investors and traders should observe if Bitcoin (BTC) can maintain this support in the coming days or if there will be a drop back to lower levels.

Also Read: 5 Reasons Bitcoin Allocation on Wall Street Will Explode by the End of 2025

Bitcoin (BTC) Long Moves in Line with Fed Decision

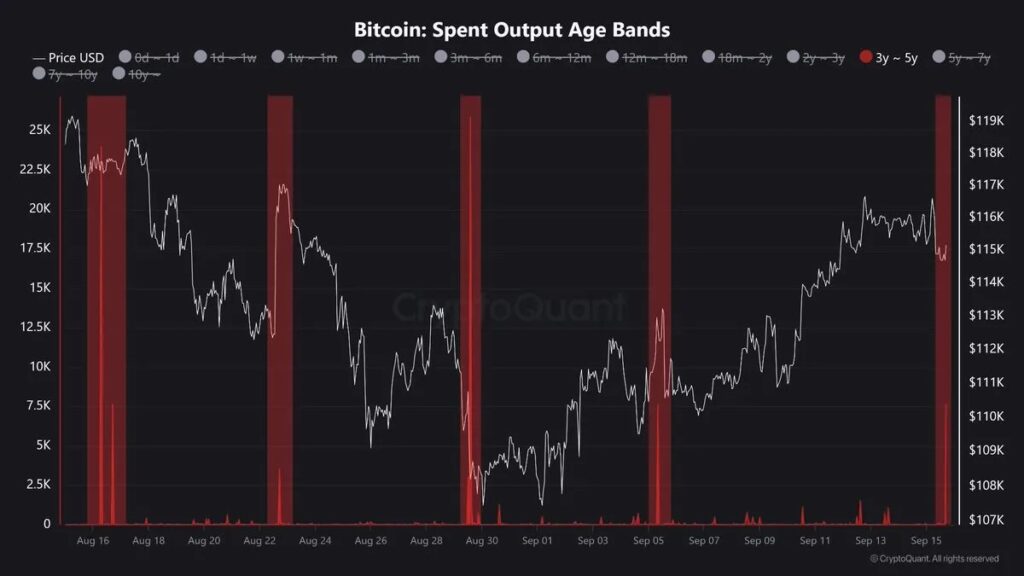

According to onchain analyst Maartunn, an important event has just taken place: 7,547 Bitcoins (BTC) that are between 3-5 years old have moved onchain. This is no small event, as coins of that age are usually held by long-term holders.

Their sudden activity has historically acted as a precursor to major market moves. Maartunn emphasized that investors should take note of how these metrics have consistently aligned with sharp price reactions in recent months. These movements could be important indicators for those looking for early signs of major changes in Bitcoin (BTC) market dynamics.

Bitcoin (BTC) is on the move, is it the right time to invest?

Bitcoin (BTC) is currently in a consolidation phase after hitting a record high near $124,000. The volatility has kept investors on their toes, with prices fluctuating within a fairly tight range.

It shows resilience but also a failure to establish a clear directional trend. For many traders, this period feels like the calm before a possible big spike, as the market is at a point that analysts consider critical.

Conclusion

With significant moves from the age-old Bitcoin (BTC) and technical analysis showing bullish potential, the market may be on the verge of a major change. Investors and traders should remain vigilant and consider all these factors in their strategies. The coming period could very well determine the long-term direction of the Bitcoin (BTC) market.

Also Read: Maartunn Analyst Says December 2024 Crypto Market Pattern Repeats, What Does It Mean?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Dormant Bitcoin Moves Align with Recent Price Reactions, 7547 BTC Awakens. Accessed on September 17, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.