Bitcoin’s Dominance Fades — Are Altcoins About to Surge? Here’s What Crypto Analysts Are Saying

Jakarta, Pintu News – The stability of the market capitalization structure and the emergence of bullish trend reversal indicators create ideal conditions for liquidity rotation across the crypto ecosystem. The potential weakening of Bitcoin’s dominance further strengthens these conditions.

Both technical signals and market psychology suggest that a new Altseason cycle may be forming, paving the way for the next big surge in the Altcoin market.

Market Recovery and the End of the Accumulation Phase

After months of correction, the global crypto market is now showing clear signs of recovery. According to data from CoinGecko, the total market capitalization has returned to the $4 trillion mark, marking a significant resurgence after a prolonged period of stagnation.

Read also: WisdomTree Launches Stellar ETP, XLM Aims to Rise to $0.36!

However, investors’ attention is no longer entirely focused on Bitcoin (BTC). The spotlight is slowly starting to shift to altcoins, which are digital assets other than Bitcoin that are often considered the key drivers for the next market rise.

As highlighted by analyst Michael van de Poppe, the altcoin market has gone through its longest bearish cycle, lasting almost four years of continuous declines against Bitcoin. However, current technical indicators show a striking resemblance to late 2019 and early 2020 – the period before the market entered a strong uptrend.

In particular, the MACD indicator has formed a bullish divergence. Meanwhile, the RSI is in the oversold zone, signaling that selling pressure is starting to ease and a potential market reversal is approaching.

On-Chain Data Further Reinforces This View

On-chain data also reinforces this view. An analyst on platform X noted that the monthly market capitalization structure for altcoins is still intact, suggesting that the accumulation phase has not been interrupted.

The so-called “manipulation phase” – when whales and large institutions rattled retail investors – is likely over, paving the way for a broader market recovery.

Other analysts also highlighted that the market seems to be repeating the same sentiment cycle as in 2021, where most investors doubted the return of Altseason – just before altcoins experienced a huge surge in just a matter of weeks. This kind of pattern indicates that the altcoin market boom this time could again surprise the majority of market participants.

Read also: Crypto Whales Take Big Positions – Bullish Sign or Cautionary Signal?

Bitcoin’s Dominance and the Shift of Liquidity to Altcoins

One of the most widely observed signals today is Bitcoin Dominance (BTC.D), which is a ratio that measures Bitcoin’s market share against the total crypto market.

According to analyst Seth, BTC.D is currently retesting the Ichimoku Cloud area around the 59% level – an important resistance zone that was previously a turning point in past market cycles.

If Bitcoin’s dominance is rejected at this level, it could trigger a massive liquidity rotation from Bitcoin to altcoins, ultimately igniting the long-awaited Altseason.

DamiDefi’s advanced analysis adds that the strongest confirmation of a potential altcoin boom would occur if BTC.D closes below 57% on the monthly chart, while the ETH/BTC pair breaks above the 0.041 level. Both of these thresholds suggest that investors are starting to favor holding altcoins over Bitcoin – a classic pattern that always precedes every major altseason.

Currently, both indicators are approaching their critical levels, signaling that market tensions could be released soon.

In parallel, the TOTAL2 chart – which represents the overall market capitalization of altcoins, excluding Bitcoin – shows that the price is testing the eight-year long-term uptrend line that started in 2017. This line previously served as strong support when the market experienced major crashes in 2018 and 2020.

Read also: Ethereum Price Drops 3% Today: Can ETH Reach $4,500 by the End of 2025?

If this structure is successfully maintained, it could lay the groundwork for a broad altcoin market boom in the months ahead.

“Now is NOT the time to be bearish on altcoins. Legendary months are coming for this market. Timing is hard to predict, but I think we are close,” commented another analyst on X.

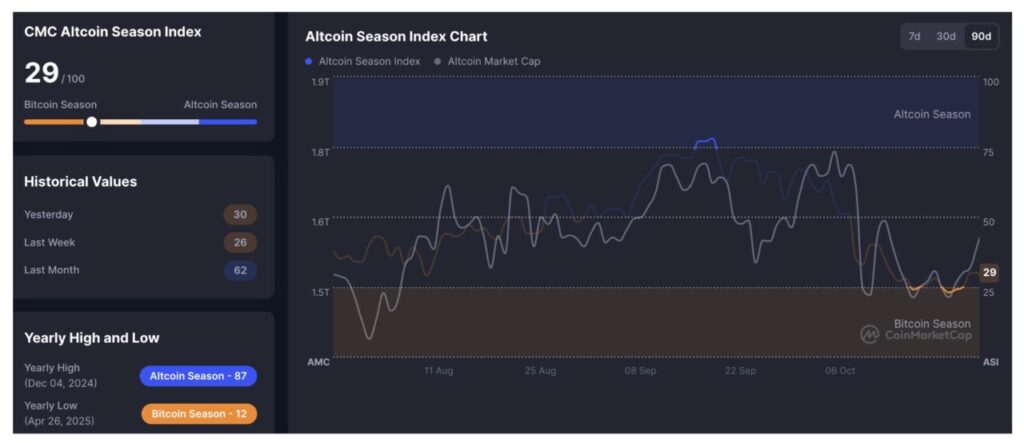

Meanwhile, the Altcoin Season Index – which measures the relative performance of altcoins against Bitcoin – is still in the same low range as the 2022 bear market bottom. This suggests that investor sentiment towards altcoins is still in a “wait and see” phase.

However, a strong trigger can quickly ignite a wave of FOMO(Fear of Missing Out), as it has in previous cycles.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Altcoin Market Breakout Looms as Bitcoin Dominance Weakens. Accessed on October 28, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.