Pi Network Price Forecast: Momentum Slows as 121 Million Token Unlock Approaches

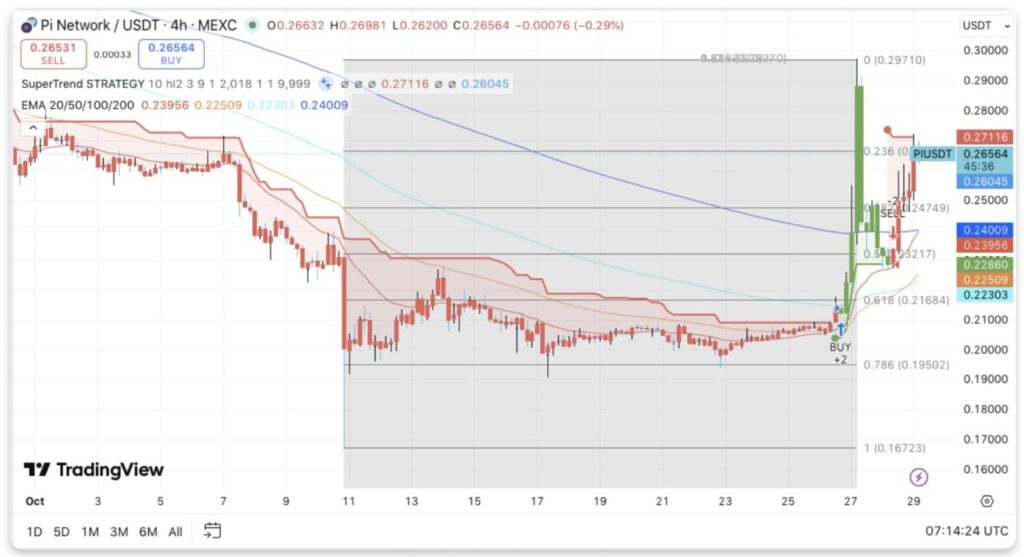

Jakarta, Pintu News – Pi Network (PI/USDT) caught the attention of market participants after experiencing a sharp rally followed by a correction in the early stages. Within two days, the token’s price jumped from $0.167 to $0.297, before eventually correcting and stabilizing at around $0.265.

This movement suggests a strong bullish reversal on the 4-hour chart (10/29). However, the appearance of smaller candlesticks and longer wicks indicates that some investors started taking profits after the rapid price surge.

Bullish Momentum Experiences a Temporary Pause

Pi Network’s latest chart pattern suggests a brief consolidation phase before a possible resumption of the upside. The $0.262 level aligned with the 0.236 Fibonacci retracement now acts as short-term support.

Read also: Pi Network Price Drops After High Spike, What Happened?

If the price stays above this level, the positive momentum is expected to continue towards the $0.271 and $0.297 targets. However, if the price breaks below $0.262, it is likely to drop to the next Fibonacci zones at $0.232 and $0.216.

The exponential moving averages (EMA 20/50/100/200) at $0.239, $0.225, $0.223, and $0.240 show that the current price is still above all these major average lines. This is an early indication of a potential medium-term uptrend.

In addition, the SuperTrend indicator, which gave a bullish signal around $0.215, recently issued a short-term “SELL” alert at $0.271. This signals a temporary resistance before the next move is formed.

Upcoming Token Release Potentially Affects Price Movement

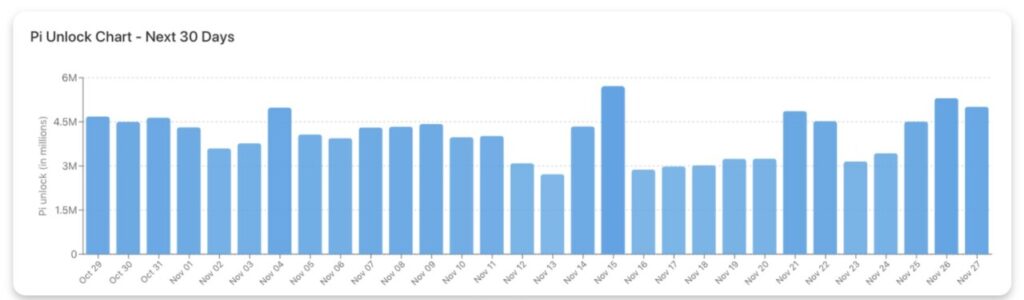

In the next few weeks, Pi Network is expected to unlock around 121.5 million tokens, which equates to about 2.39% of the total locked supply. Based on data from Piscan, the project still has around 5.07 billion Pi tokens in locked circulation, with a value of nearly $1.35 billion.

The largest release is scheduled for November 15, with a potential distribution of over 5.7 million Pi tokens, worth over $1.5 million. This release may create short-term selling pressure if the circulating supply increases sharply.

New Automated KYC Process Supports Network Growth

On the other hand, Pi Network continues to improve its user verification process with the introduction of a new automated KYC system. This update follows the launch last October, which successfully verified over 3.36 million Pioneers through artificial intelligence to handle Tentative KYC cases.

The new system is targeted to complete verification of an additional 3 million accounts, which is expected to strengthen network integrity and accelerate migration to the Mainnet.

Read also: Pi Coin Up 30% After Pi Network Joins ISO 20022 for Global Banking Integration!

Technical Outlook for Pi Network (PI/USDT)

Key levels remain clearly visible as the Pi Network enters a consolidation phase after a sharp rally.

- Upper levels: $0.271, $0.297, and $0.310 serve as immediate resistance zones. A breakout above $0.297 could open the way towards $0.330 and $0.350, reinforcing the continuation of the bullish trend.

- Lower levels: $0.262 (Fibonacci 0.236) acts as short-term support, followed by $0.232 (Fibonacci 0.382) and $0.216 (Fibonacci 0.618) as deeper correction zones. The $0.216 level also aligns with the previous accumulation base, making it crucial to maintain the overall uptrend.

- Major resistance zone: The $0.297-$0.310 area remains an important threshold to confirm the strength of the medium-term bullish trend. A price close holding above this range is likely to attract fresh buying pressure.

The technical structure shows Pi is consolidating after a nearly 78% rally, forming a potential continuation pattern.

A short-bodied candlestick with a long upper wick reflects temporary profit-taking, but momentum indicators are still in favor of the bulls. The 4-hour EMA remains positively arrayed, confirming that Pi maintains a healthy trend bias above $0.240.

Will Pi Network Continue Its Breakout?

The current direction of Pi Network’s price movement largely depends on buyers’ ability to defend the crucial support zone between $0.262-$0.232, especially amidst the ongoing token shedding phase.

If this area is successfully defended, there is a strong potential to retest the resistance at $0.297 and $0.310, as well as form a higher low that signals the continuation of the medium-term uptrend.

Conversely, if the $0.262 support fails to hold, the price is likely to correct deeper towards $0.216, which was previously an important accumulation zone. At this point, the formation of new support will probably occur before the next rally begins.

With major developments in the automated KYC system and the imminent release of new supply, price volatility is expected to increase in the near future. For now, Pi is in a critical zone, where market conviction and volume flows will determine the direction of the next breakout – whether to continue the uptrend, or enter a deeper consolidation phase.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinEdition. Pi Price Prediction: Rally Cools as 121 Million Tokens Near Unlock. Accessed on October 30, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.