29% of Bitcoin Supply at a Loss: Warning Sign or the Beginning of the Next Bull Run?

Jakarta, Pintu News – Bitcoin (BTC) price entered November with a cautious attitude, trading around $103,000 after failing to reclaim the $112,000 level reached in early October.

The crypto market in general also showed a similar slowdown, with major altcoins moving limited as traders digested macro signals and ETF flow data. Moreover, the price drop to an intraday low below the $100,000 psychological barrier has made investors even more pessimistic.

While momentum appears to be weakening, on-chain data shows a different picture behind the scenes-reminiscent of the initial phase of every major Bitcoin rally in the past. Analysts call this the “$6 trillion endgame”-a confluence of supply shrinkage, leverage reset, and liquidity expansion that could be the start of Bitcoin’s next parabolic surge.

Hidden Signals: 29% of Bitcoin Supply is at a Loss

Since the price of Bitcoin crossed $100,000, investors and market participants have begun to expect the price to test higher levels, in the range of $150,000 to $200,000. Trading volumes have doubled since the spike in the fourth quarter of 2024, indicating strong buying pressure.

Read also: Bitcoin and Ethereum Weakened, These 5 Altcoins Rocketed Over 100% Today!

However, now that the strength of the bulls has started to weaken, some investors have started to experience losses. As a result, most of the circulating Bitcoin supply is currently at a loss. However, this could be a major bullish signal, as similar technical patterns have triggered new price spikes in the past.

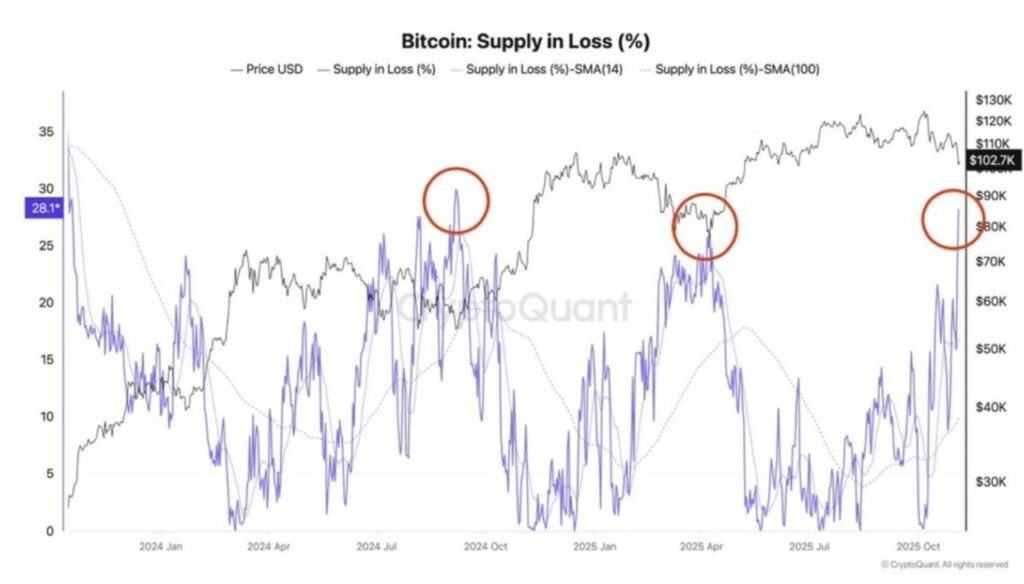

The chart above shows that around 29.2% of the total Bitcoin supply in circulation is currently held at a loss-a figure that has only appeared three times in the past decade.

Whenever this number appears, it is always followed by a big rally:

- May 2017 → BTC rises from $1,800 to $19,800

- May 2021 → from $30,000 to $69,000

- March 2024 → from $40,000 to $73,000

In all three cases, most market participants predicted deeper corrections – and they were proven wrong. This recurring pattern shows that a high percentage of “losing coins” is not a sign of a crash, but rather a signal of exhaustion from the capitulation phase, which is often the starting point for the next rally.

Leverage Clearance: Market Structure Reorganized

In the past few days, nearly $30 trillion in leveraged positions have been liquidated. Open interest for perpetual contracts fell by 42%, from a peak of over $90 trillion to around $68.6 trillion-the sharpest drop so far this year.

The funding rate has now returned to the neutral range of around 0.01%, indicating that the derivatives market is in balance. This means that there is no longer an overcrowded long position, the risk of mass liquidation has subsided, and there is no forced selling pressure. Historically, when leverage is cleared while spot demand increases, the market does not crash-but prepares for the next rally.

With the market structure now “clean”, price movements can be more directional. Derivative positions are at their lowest levels in months, creating ideal conditions for the next big move.

Read also: Bitcoin Price Touches $101,000 Today: Whale Buys 29,600 BTC in a Week

What’s Next-Will Bitcoin (BTC) Price Recover to $110,000?

Bitcoin price experienced massive selling pressure at the beginning of the month, which caused the price to drop below the $110,000 threshold. Although the bulls managed to push the price back above that range, the current selling and buying pressure is equally strong, creating uncertainty as to the next direction of price movement.

Since the beginning of the last quarter, liquidity appears to be flowing out of Bitcoin, most likely towards other altcoins. The On-Balance Volume (OBV) indicator has been steadily declining since October, indicating weak capital inflows. This trend is similar to the decline that occurred from February to March, which dropped the price from $106,000 to around $77,000.

Meanwhile, the Chaikin Money Flow (CMF) indicator is showing a bearish divergence although it is still in negative territory-a sign that selling pressure is more dominant than buying interest. These signals combined suggest that the price of BTC may lose ground and drop back below $110,000.

Currently, there are two important support levels that are likely to be tested in the near future:

- $100,618

- $98,139

Technically, the indicators are still showing a downward trend and could continue to weaken in the near future. Therefore, Bitcoin price is likely to fall back below $110,000 before finding a new foothold.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. 29% of Bitcoin Supply Is Underwater Warning Sign or the Start of a New BTC Bull Run? Accessed on November 7, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.