5 Strong Signals the Crypto Bull Market is Ready to Return

Jakarta, Pintu News – The crypto market experienced a major decline over the past month. The total market capitalization dropped from $4.27 trillion on October 6 to $2.98 trillion on November 19 – a drop of about 30%. Although it recovered to $3.12 trillion, the debate among traders is still ongoing.

Some argue that a deeper bear market is forming. Others, however, believe that this correction signals the final phase of weakness. This article focuses on the latter group. A number of indicators now suggest that the crypto bull market could start sooner than expected.

The five reasons described below reflect one of three things: the market’s weakest point, the peak of a selling panic, or the emergence of new buying strength. Combined, these factors could form one of the strongest bull market cycle start setups ever.

Short-Term Selling Pressure Seems to Be Almost Exhausted

Short-term holders have been selling their assets at a record pace in recent months – and this is usually the case when the market is near a bottom.

Bitcoin Munger highlighted a spike in coin shipments to exchanges at a loss, while JA Maartunn noted something similar via CryptoQuant data, where over 60,000 Bitcoins were moved at a loss in just a matter of hours. Panic sell-offs like these often mark the final “clean-up” phase before market trends begin to reverse from a bearish feel.

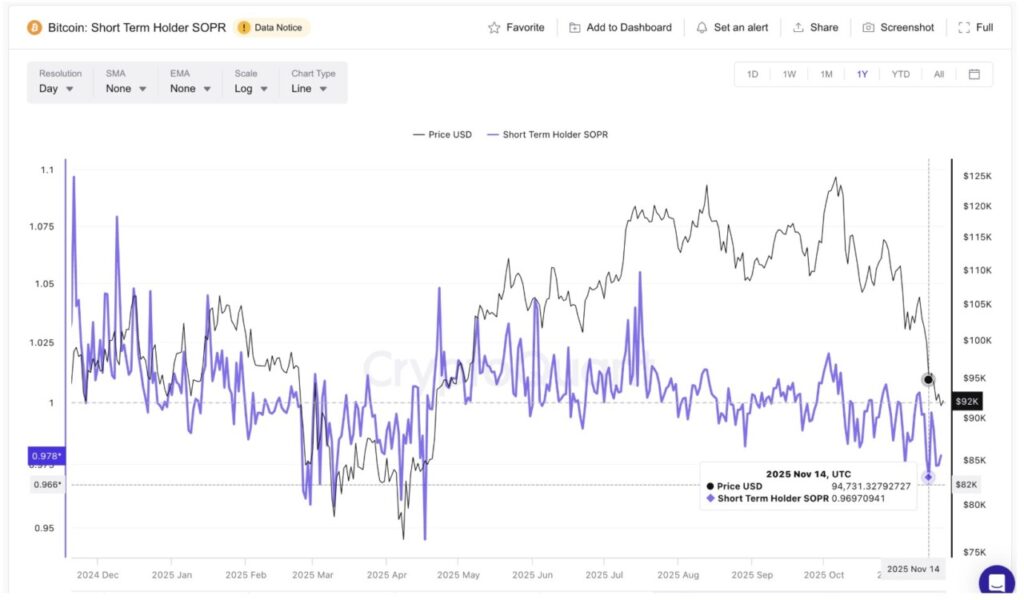

On-chain data reinforces this analysis. The SOPR (Spent Output Profit Ratio) value for short-term holders fell to 0.96 on November 15, the same level recorded on April 7. SOPR measures whether coins moved on the network are sold at a profit or loss.

When this value drops below 1 and then starts to stabilize, it is often a signal that the weak holders have capitulated.

Short-term holders play an important role as they are the group that reacts the quickest during corrections. They tend to panic and sell early, hit stop-losses sooner, and generally offload assets amid weak market conditions. This is the reason why selling pressure from short-term holders almost always peaks near market bottoms.

After a dip in April, Bitcoin price jumped from $76,270 to $123,345 in just a few months – a rise of about 62%. With the SOPR value now back at 0.97, the latest drop indicates that the selling pressure may be running out.

Next question: Is new buying strength starting to form elsewhere? This is where the next indicator comes into play.

Stablecoin Power Begins to Rebuild

If the selling pressure from short-term holders is almost exhausted, then the next question is simple: Is there enough new buying strength to push the price up?

Right now, stablecoin data shows the answer: yes.

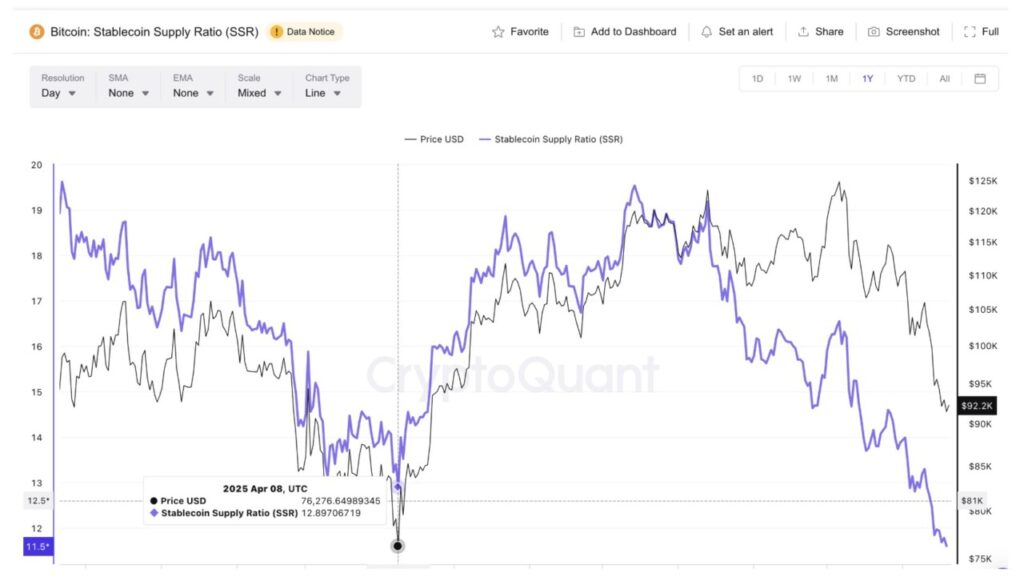

The Stablecoin Supply Ratio (SSR) has dropped to 11.59 – the lowest figure in over a year. The SSR compares Bitcoin’s market capitalization to the total supply of stablecoins. When the SSR drops, it means that stablecoins have more purchasing power than the market value of Bitcoin (BTC). Traders often refer to this as “dry powder” or spare ammunition.

This level is even lower than the 12.89 figure recorded on April 8, a period when the Bitcoin price hit a low around $76,276 before rising for several months. A low SSR means the stablecoin can buy more Bitcoin per unit of supply – a condition that usually occurs near the bottom of the market.

The second confirmation came from the SSR RSI, which was highlighted by analyst Maartunn. Its value is around 26 – a level that repeatedly appeared alongside Bitcoin’s low during the previous bear market. The low RSI here suggests that the stablecoin’s purchasing power is “oversold” relative to the size of the Bitcoin market – a rare setup that often appears before a trend shift.

Also read: XRP Price Prediction: Selling Pressure Increases Amid Outflows and Declining Open Interest

Combined, the increase in stablecoin reserves and highly compressed SSR suggests that the market has enough liquidity to trigger a rebound in the next crypto bull market cycle.

Altcoin Profit Reset Could Quietly Strengthen Crypto Bull Market Signal

Short-term capitulation and low SSRs already indicate that the selling pressure has almost reached an end point. The next layer came from altcoins, which experienced an even deeper reset.

The latest data from Glassnode shows that only about 5% of the altcoin supply is still in profit – a level that usually appears in the final capitulation phase. When almost all holders are at a loss, it means that the market is running out of assets to sell.

This situation is similar to what happened to Bitcoin, where 95% of all coins bought in the last 155 days are now underwater – even worse than during the COVID crash or FTX collapse.

This combination is important because altcoins often stabilize earlier than Bitcoin when profit ratios fall this deep. Although Bitcoin’s dominance is still close to 60%, the gap between Bitcoin’s profit decline and altcoins’ near-zero profit levels suggests that altcoins may be closer to a price bottom formation phase.

If a crypto bull market does start from a deep reset point, altcoins are often the first to respond as they no longer have selling pressure from investors who are still in profit. This opens up the opportunity that the initial phase of the bull market could be led by altcoins.

Sentiment Drops to “Extreme Fear”: Is This How Bull Markets Start?

After discussing altcoin losses and Bitcoin supply being below the purchase price, the next element that completes the crypto bull market narrative is market sentiment. The Bitcoin Fear & Greed Index dropped to 10 on November 15 – the lowest level since February 27, when Bitcoin was still trading around $84,718.

Back then, a similar index also fell before Bitcoin hit bottom in April and started a huge rally from $76,276 (April 8) to $123,345 (August 13), up about 62%.

The index’s drop to 10 is significant because extreme fear usually emerges after the bulk of the sell-off has occurred. Even during the price recovery in April, the index only briefly dropped to 18 and never returned to 10. Dropping the index to this level again suggests that the market may have passed the “emotional cleansing” phase.

Industry figures such as Thomas Chen, CEO of Function, have also described this phase as a time of “saturation and emotional exhaustion”:

“Investor behavior is now heavily skewed towards selling, with over $2.8 billion in outflows… It goes back to the fundamental question: do I still want to hold BTC in these conditions? With the Fear & Greed index at extreme fear levels, this situation reminds me of the 2022 Luna crash,” he said.

The emergence of this extreme fear in the wake of altcoin capitulation and a very low stablecoin ratio reinforces the argument that the basis for the next crypto bull market may be forming now.

Read also: Vitalik Buterin Warns of Quantum Threat: Ethereum Ready to Boost Cryptographic Security

The Latest Death Cross Has Formed – Will Bitcoin React?

The latest signal supporting the potential start of a crypto bull market was the formation of a new death cross on November 15. A death cross occurs when the 50-day moving average drops below the 200-day average. Since moving averages reflect the average of closing prices in a given period, this pattern more often indicates trend exhaustion, rather than the beginning of a major crash.

During this “heading towards death cross” phase, Bitcoin fell by around 17%, which is almost the same amount as the 16% drop when the death cross structure formed back in April. Back then, the pattern played its full role: it erased the weak momentum, and subsequently triggered a rally from April to August.

This time, there is a similar pattern happening behind the scenes. Bitcoin price is forming a higher low, while the RSI indicator is printing a lower low.

The RSI (Relative Strength Index) measures the strength of price momentum, and a divergence like this is called a hidden bullish divergence – a signal that selling pressure is starting to weaken. This is often the “last pressure relief valve” before the uptrend resumes. And this is in line with the peak capitulation theory discussed earlier.

Fred Thiel, CEO of MARA Holdings, emphasized that the latest decline reflects pressure from macro factors, not just a technical pattern:

“Bitcoin’s price drop below $90,000 is the result of a perfect storm – macro pressure and profit-taking. In the past month, long-term holders have distributed over 815,000 BTC – the biggest sell-off since 2024,” he explained.

If Bitcoin is able to hold above its recent low, this death cross may just be a reset moment, not a signal of collapse.

That’s exactly what happened earlier this year, and it’s one of the reasons why many traders believe that the foundations of the current crypto bull market are quietly forming. However, if Bitcoin price doesn’t react to this crossover soon, the start of the bull market could be delayed even longer.

FAQ

What is the Spent Output Profit Ratio (SOPR)?

SOPR is a metric that shows whether coins spent on the blockchain were sold at a profit or loss. Values below 1 could signal short-term holder capitulation.

Why is the Stablecoin Supply Ratio (SSR) important?

SSR measures the buying power of a stablecoin relative to the Bitcoin (BTC) market capitalization. A low SSR indicates that the stablecoin can buy more Bitcoin, often signaling a market bottom.

How can altcoins affect the crypto market recovery?

Altcoins often stabilize ahead of Bitcoin (BTC) in bear markets, as they lack significant selling pressure after massive capitulation. This can trigger a faster recovery across the market.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Crypto Bull Market Possibility: 5 Reasons. Accessed on November 21, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.