5 Reasons December 2025 Starts in the Red in the Crypto Market

Jakarta, Pintu News – December 2025 opened with significant pressure on the crypto market. After a long rally, major digital assets such as Bitcoin (BTC) and Ethereum (ETH) immediately fell, provoking new concerns about market stability. Here are some of the main factors causing this turmoil, sourced from the latest market data and analysis.

1. Spike in global “risk-off sentiment”

Global markets entered a risk-off mood due to macroeconomic uncertainty, which immediately weighed on risky assets including cryptocurrencies. According to reports, investor sentiment began to deteriorate, triggering a sell-off in various risky assets – including BTC and ETH.

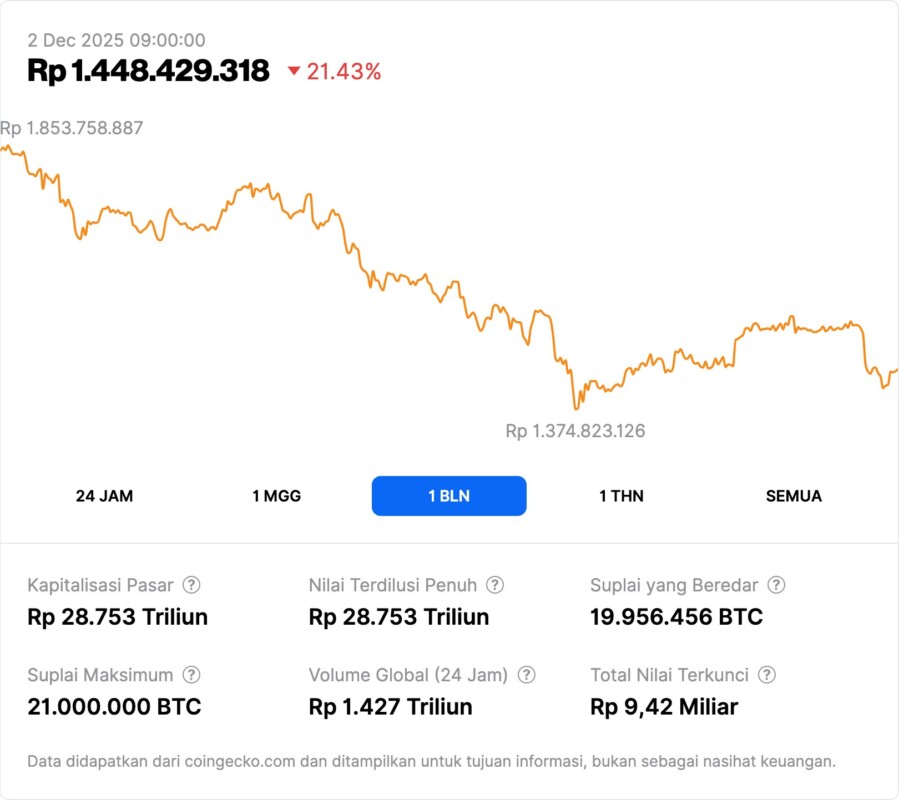

Under these conditions, Bitcoin had dropped by 4.3 percent to levels below US$88,000, while Ethereum fell about 6 percent to below US$2,900. These declines show that macro sentiment is really affecting the crypto market at large.

Also Read: 3 Stock Sectors Predicted to be Bought by Investors as the Technology Sector Weakens

2. Weak liquidity and massive long liquidation

One of the main triggers for the market weakness was depleted liquidity, exacerbated by massive liquidation of long positions. According to analysis, high funding rates and heavy long positions on futures platforms led to a simultaneous drop in the prices of Bitcoin, Ethereum, and other altcoins.

As a result, the crypto market lost a huge amount of market value – the total market valuation fell below US$3 trillion, indicating that the liquidation affected many players at once.

3. Impact of the DeFi Incident: Liquidity cases on the DeFi platform

The turmoil in the decentralized finance (DeFi) sector also worsened market conditions. Incidents on certain DeFi platforms caused liquidity concerns, affecting confidence in crypto assets.

With the added risk of this incident, many investors chose to withdraw or reduce exposure, which in turn deepened the price pressure against major assets such as BTC and ETH.

4. Pressure from macro conditions: Bond yields and potential global monetary policy

The increase in global bond yields, as well as the potential normalization of monetary policy in some countries, have also weighed on the crypto market. Rising bond yields make risky assets less attractive, so capital flows shift to instruments with a more defensive risk profile.

This situation complicates the chances of a quick recovery for the cryptocurrency market, especially when whales and institutional investors are cautious about taking new positions.

5. Technical pressure: Indicators show bearish signals

On the technical side, the momentum indicator for Bitcoin is showing negative signals. A number of analysts highlighted that the monthly MACD histogram for BTC has turned red – a pattern that in previous cycles marked the beginning of a long-term decline.

Meanwhile, Ethereum is said to have formed a “death cross”, where the short-term moving average crosses below the long-term average – a classic signal that selling pressure could continue in the coming period.

Also Read: 4 Key Risks of Cardano (ADA) in December 2025 that Crypto Investors Should Monitor

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What was the main cause of the Bitcoin and Ethereum price drop in early December 2025?

The decline was due to a combination of global “risk-off sentiment”, depleted liquidity, massive liquidation of long positions, as well as macro pressures such as rising bond yields.

How much impact will liquidation have on the crypto market?

Massive liquidations have hit the total crypto market capitalization down below US$3 trillion, with many major assets weakening simultaneously.

Are there any technical factors that exacerbate the decline?

Yes – technical indicators like MACD for Bitcoin are showing bearish signals, while Ethereum is forming a “death cross,” signaling continued selling pressure.

Is this drop related to issues on the DeFi platform?

Yes – a liquidity shortage incident on one of DeFi’s platforms helped trigger a capital exodus and increased investor caution towards crypto assets.

Did global macro conditions contribute to this decline?

That’s right – rising global bond yields and the possibility of monetary policy normalization make risky assets like crypto less desirable than defensive assets.

Reference

- Business Today Editorial. December Starts Red For Crypto As Bitcoin, Ethereum Slide. Accessed on December 2, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.