Crypto Recap 2025: 5 Crypto Market Predictions from Various Analysts

Jakarta, Pintu News – The year 2025 will be one of the most crucial periods for the development of the crypto market, characterized by increased institutional attention, technological innovation, and expectations of global macro policies.

Various analysts release projections regarding the direction of movement of cryptocurrencies, especially Bitcoin (BTC) and Ethereum (ETH) as key indicators of digital market dynamics. A combination of optimism and caution forms a more structured picture of potential industry changes. This article summarizes five key predictions in a comprehensive and data-driven manner.

Elon Musk’s Prediction: Bitcoin Becomes the “King” of Digital Assets

Elon Musk reiterated his view on Bitcoin (BTC) as the most dominant digital asset in the cryptocurrency industry. According to Musk, the characteristics of decentralization and network security keep Bitcoin ahead of other digital assets. He considers that institutional interest in Bitcoin continues to increase as confidence in certain traditional assets decreases. In addition, Musk said that Bitcoin has the opportunity to expand its role as a global store of value.

Musk’s statement was also influenced by the development of regulations that are more friendly to digital assets in several major countries. He believes that regulatory clarity can accelerate the global adoption of Bitcoin. On the other hand, volatile macroeconomic conditions also encourage investors to look for alternative, more stable stores of value. In this context, Bitcoin is seen as a prime candidate for both institutional and retail investors.

Read the full news on the page Elon Musk Prediction: "Money will become extinct, Bitcoin will become king"

Bitcoin Could Hit a New ATH by the End of 2025

A number of analysts see the opportunity for Bitcoin (BTC) to print a new all-time high by the end of 2025, triggered by increased institutional capital flows and improved market sentiment. The strengthening of the market structure post-halving is one of the main factors cited as driving the upside potential. In addition, the decline in supply in the spot market also strengthens the possibility of price increases. Analysts think that more stable macro conditions could reinforce this momentum.

If Bitcoin reaches a new ATH, the implications for the crypto market are expected to be very significant. Large-cap altcoins like Ethereum (ETH) usually follow a similar trend, albeit with different volatility. The market response to increased institutional interest is also expected to result in higher liquidity. However, analysts still emphasize the risk of fluctuations that need to be anticipated.

Read the full news on the page Bitcoin (BTC) Potentially Reach New ATH at the End of 2025, Max Keiser Reveals This!

Bitcoin Breaks $220,000 in 45 Days Prediction: Extreme Sentiment Analysis

One of the most aggressive predictions came from an analyst who estimated that Bitcoin (BTC) could break $220,000 or around Rp3,665,200,000 within 45 days under certain market conditions. This prediction is based on historical data related to parabolic rallies that have occurred after large accumulation phases. According to the analyst, a combination of supply pressure and a surge in demand could create explosive momentum. However, he emphasizes that this scenario depends on a very specific market situation.

While the prediction has garnered widespread attention, a number of other analysts suggest a more cautious interpretation. A rally of such magnitude requires ideal conditions of liquidity and market sentiment. Macroeconomic fluctuations may hinder the occurrence of a parabolic scenario in a short period of time. Therefore, the prediction should be understood as an illustration of extreme potential, not a baseline of market expectations.

Read the full news on the page Bitcoin (BTC) Prediction Will Break $220,000 in 45 Days, Is it Possible?

Arthur Hayes’ view: Bitcoin Holds Above $80,000

Arthur Hayes predicts that Bitcoin (BTC) could stay above the $80,000 level in the medium term. According to Hayes, post-halving supply pressure and loose monetary policies in some countries are the main supporting factors. He believes that institutional investors will become more active in the cryptocurrency market by 2025. This momentum is seen to strengthen Bitcoin’s price stability in the high range.

In addition, Hayes emphasized that the increased use of stablecoins and digital assets in global trade will attract more liquidity to the crypto market. The strengthening of technological infrastructure and the integration of traditional financial services are also accelerating adoption. However, he cautioned that volatility remains a key characteristic of crypto markets. Short-term price movements may be mixed although the long-term direction remains positive.

Read the full story on page Arthur Hayes Forecasts Bitcoin to Stay Above $80,000 as Fed Ends Tightening

Tom Lee’s Prediction for Bitcoin and Ethereum by the End of 2025

Tom Lee expects Bitcoin (BTC) and Ethereum (ETH) to enter a phase of strong appreciation towards the end of 2025. He believes that a more mature market cycle opens up opportunities for more stable growth. In his view, institutional adoption of Bitcoin and Ethereum will increase significantly. In addition, the evolving regulatory infrastructure will strengthen the legitimacy of digital assets in various countries.

Lee also highlighted the importance of blockchain technology advancements in expanding the utility of cryptocurrencies. Ethereum, for example, benefits from increased scalability and adoption of layer-2 solutions. Such advancements are believed to drive sustained growth in on-chain activity. However, Lee cautioned against macro uncertainties that could affect market dynamics in the short term.

Read the full news on Tom Lee Predicts Bitcoin to Break $250K and Ethereum $12K Before the End of 2025!

FAQ

What does Musk mean when he calls Bitcoin the “king” of digital assets?

The term refers to his view that Bitcoin has the highest dominance and most powerful role in the cryptocurrency ecosystem, especially as a store of value.

What are the main factors driving Bitcoin’s ATH potential in 2025?

Factors cited were institutional capital flows, the halving effect, and a decrease in supply in the spot market.

Why is a prediction of $220,000 considered extreme?

Because such projections require short-term parabolic rallies that only occur under very specific and uncommon market conditions.

What is the basis for Hayes’ prediction of the $80,000 level?

The basis is a combination of the halving effect, global liquidity, and increased institutional participation in the cryptocurrency market.

What role does Ethereum play in Tom Lee’s prediction?

Ethereum is expected to gain strong support from increased scalability and layer-2 adoption that increases network utility.

Conclusion

Various predictions about Bitcoin (BTC), Ethereum (ETH), and the crypto market climate through 2025 show a combination of optimism and caution. Analysts see fundamentals, technology, and macro dynamics as important determinants of cryptocurrency’s direction. While projections vary, all highlight the crucial role of institutional adoption and the development of blockchain infrastructure. As such, 2025 is seen as a strategic year for the evolution of the global digital asset market.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Door News

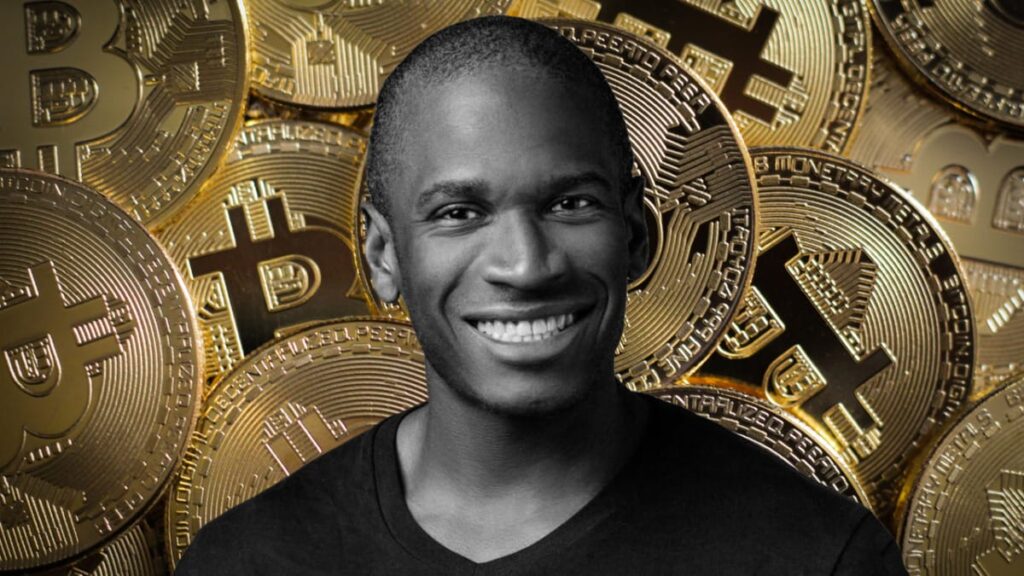

- Featured Image: Generated by Ai

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.