7 SHIB Facts: Open Interest Up 8% and Derivatives Activity Rising by End of 2025!

Jakarta, Pintu News – The latest cryptocurrency market report shows a significant surge in open interest (OI) for Shiba Inu (SHIB) in the derivatives market over the past 24 hours, with CoinGlass data recording OI reaching $75.76 million or 10,346,899,754,165 SHIB equivalent, marking a rise of almost 8% in the period.

This change comes after a previous downward trend in OI, and is interpreted as a signal of increased liquidity towards the end of the year as well as signaling renewed interest from market participants in SHIBs. This analysis is based on related market reports published by U.Today and Crypto Economy.

1. SHIB Open Interest Surges in the Derivatives Market

In the last 24 hours, open interest for SHIB rose to around $75.76 million, an increase of almost 8% from its previous state, according to data compiled by CoinGlass. This rise in OI figures indicates more unresolved positions being opened by derivatives traders, an important signal in crypto market dynamics. This spike could reflect increased market participation especially ahead of the turn of 2025 to 2026.

Rising OI is often interpreted as a sign that market liquidity is starting to return after a period of stagnation, helping to reflect the confidence and activity of both short-term and institutional traders.

Also Read: 7 XRP vs BNB Facts: Tight Competition for Top-3 Market-Watched Crypto Positions

2. Impact on SHIB Market Sentiment

Although technical sentiment remains mixed, the spike in OI could signal that the SHIB derivatives market is starting to attract interest again, potentially signaling a phase of broader position evaluation before entering 2026. This activity provides context that cryptocurrencies like SHIB are still the focus of derivatives speculation even though spot prices are yet to show a strong uptrend.

However, it should be noted that despite the increase in OI, SHIB prices have mixed performance; for example, there is data showing a short-term price rebound but a weekly slump.

3. Liquidity & Trader Engagement

Rising OI doesn’t always translate directly towards long-term price trends, but it can indicate that liquidity in the SHIB market is on the rise. This allows more derivative contracts to be opened, reflecting higher trader engagement compared to previous weeks.

Active derivatives traders usually look at OI along with volume and other open positions to assess market pressure and potential short-term volatility.

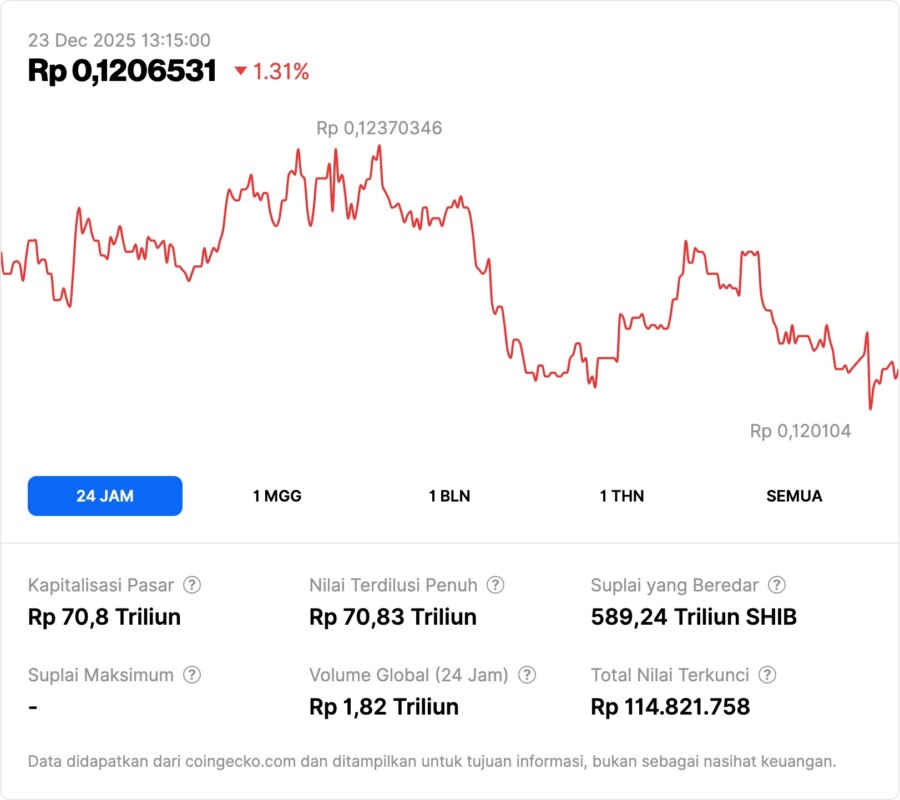

4. SHIB Current Price Performance

Based on market data at the time of the report, SHIB traded higher by around 1.83% in the last 24 hours, although the weekly trend is still negative with a decline of around 8.55%. This suggests that despite increased derivatives activity, SHIB spot price dynamics are still facing broader market pressures.

The current price range shows that SHIB remains in a consolidation zone and has not experienced a dominant price breakout despite the rising OI.

5. The Role of Derivatives in the SHIB Crypto Market

Derivatives such as futures and options contracts are an important part of the crypto market as they reflect risk expectations and investor participation that are not always fully reflected in the spot price. An increase in OI indicates that more traders are opening positions that may reflect confidence or protection against the future price direction of SHIB.

OI changes are often an early indicator before volatility increases in the spot market, although not a guarantee of price direction.

6. 2025 Year-End Market Context

This increase in SHIB OI comes amid year-end crypto market conditions that generally show liquidity is still relatively low across many segments, but derivatives trends suggest that some traders may be repositioning their portfolios ahead of the new year.

Some reports suggest that while the derivatives market is becoming active, overall capital flows still need further confirmation to assess whether this trend will continue as early as 2026.

7. SHIB On-Chain Assets & Ecosystem Activities

Other on-chain activities such as token burns and large transfers are also metrics monitored in the SHIB ecosystem, but OI spikes in particular highlight the derivatives aspect that often gets the attention of speculative market participants.

The on-chain and OI metrics together provide a more complete picture of the current technical and fundamental state of the SHIB market.

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What is open interest (OI) in the context of SHIB?

Open interest is the number of unsettled derivative positions in the market, and a spike in SHIB OI means there are more SHIB derivative contracts opened in the period.

What is the value of SHIB’s OI recorded recently?

Shiba Inu’s OI reached approximately $75.76 million in the last 24 hours, an increase of nearly 8% from before.

Does a rise in OI mean prices will rise?

An increase in OI indicates increased liquidity and market participation, but it does not guarantee that the spot price direction will increase.

How does SHIB price move when OI increases?

At the time of the report, SHIB was up about 1.83% in 24 hours but still down about 8.55% in a week, indicating a mixed trend.

Why do crypto traders pay attention to OI?

Traders pay attention to OI because it can reflect the interest and risk of the derivatives market, which is often used to measure short-term momentum.

Reference:

Tomiwabold Olajide/U.Today. Shiba Inu Reset? 10,346,899,754,165 SHIB Hit as OI Surges. Accessed December 22, 2025.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.