5 Arctic Storm Impacts on Bitcoin Mining & Block Times that Exceed 12 Minutes

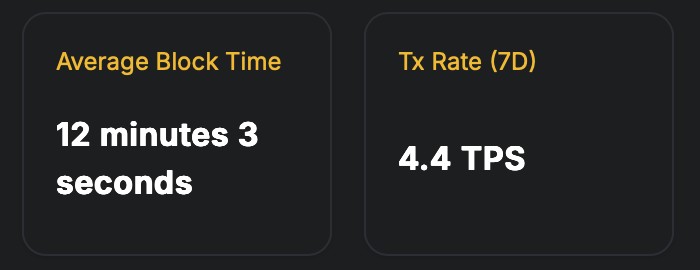

Jakarta, Pintu News – The extreme weather phenomenon of an Arctic storm in the United States recently disrupted Bitcoin (BTC) mining operations, causing the average block time on the network to exceed 12 minutes from the target of 10 minutes.

This disruption opens up a discussion on the relationship between physical external factors, proof-of-work network performance, and cryptocurrency market dynamics more broadly. This report summarizes key technically and contextually relevant facts, without melodrama or speculative predictions.

1. Extreme Weather Affects Mining Capacity

The Arctic storm that hit several mining regions in the US caused unstable power grids and disrupted cooling of mining machines. Mining foundations like Foundry USA reported significant hash rate drops during this period, meaning the total computing power validating Bitcoin decreased. As a result, the time taken to find a new block increased beyond the average of the Bitcoin protocol.

Also Read: Silver Price Prediction 2026-2030, How will it fare in the next 5 years?

2. Block Time Exceeds Protocol Target

Bitcoin was designed with a target block interval of around 10 minutes as part of its proof-of-work consensus mechanism. But when mining is disrupted, the time between blocks lengthens, clocking in at over 12 minutes in this stormy period. This variation is a technical response to the fluctuating hash rate, not a system failure.

3. Difficulty Adjustment Mechanism Will Correct

The Bitcoin network has an algorithm that adjusts the difficulty every 2,016 blocks to maintain the target block time. A temporary decrease in hash rate will trigger a block slowdown, but subsequent difficulty adjustments will lower the difficulty threshold to speed up block discovery. This process is part of the protocol’s design to deal with seasonal fluctuations or extreme events like storms.

4. Technical Implications of the Transaction

Longer block times can slow down the confirmation of transactions on the Bitcoin network.

This means users may experience a temporary delay in transaction completion or confirmation in their wallets. However, this effect is temporary and will be restored when the hash rate stabilizes.

5. Impact on the Broader Crypto Market

Mining disruptions due to physical factors highlight the relationship between energy infrastructure, weather, and the stability of major cryptocurrency networks like Bitcoin. While block time fluctuations do not directly dictate price direction, decreased hash rates and concerns about reliability can affect traders’ technical sentiment. Global crypto markets tend to respond to infrastructure disruptions with higher price volatility in the short term.

Also Read: 3 Cryptocurrencies that are Ready to Rise Again in 2026

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Report: Arctic Storm Front Disrupts US Bitcoin Mining, Block Times Stretch Past 12 Minutes. Accessed January 26, 2026.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.