6 Shocking Facts about Bitcoin Mining: Difficulty Plummets 11%, Costs Reach Rp1.14 Billion per BTC

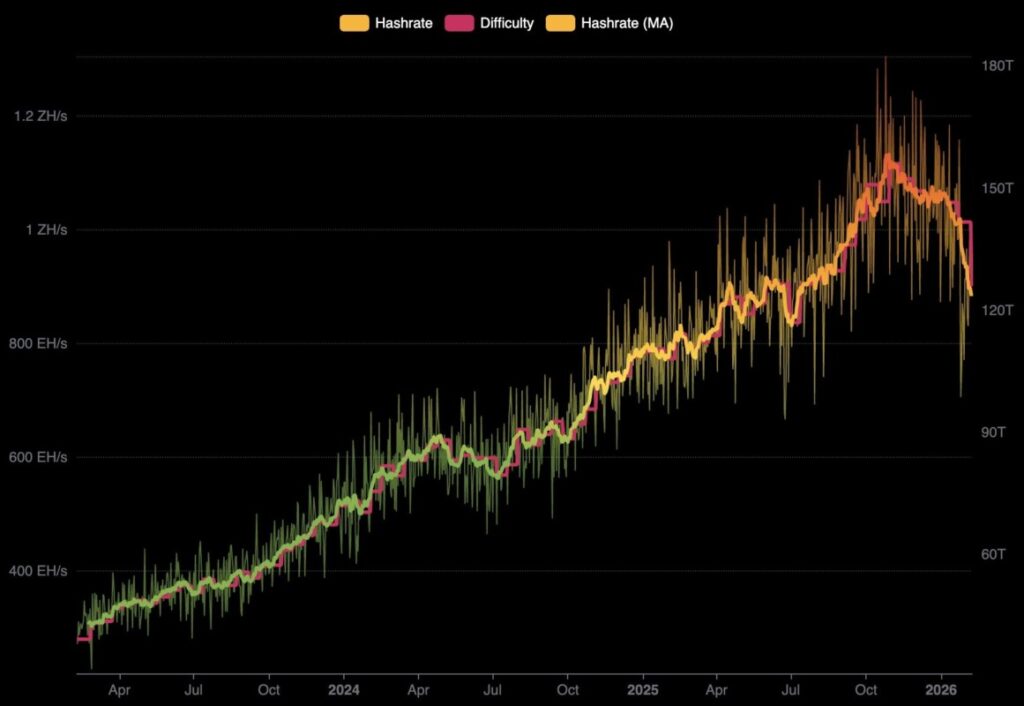

Jakarta, Pintu News – The Bitcoin crypto network experienced another major shock in early 2026. The mining difficulty recorded its sharpest drop since China’s mining ban in 2021. This event highlights the severe pressures that the cryptocurrency industry is facing, from extreme weather factors to dwindling profit margins.

1. Bitcoin Mining Difficulty Drops by Over 11%

Bitcoin’s (BTC) mining difficulty fell by about 11.16% in one adjustment period. This is the biggest drop in almost five years.

Technically, this mechanism aims to keep the block time around 10 minutes. When many miners stop operating, the system automatically lowers the difficulty to keep the network running.

Also Read: 5 Fun Facts: Bitcoin Often Rebounds in February – Lessons from Historical Data

2. Biggest Drop Since China’s 2021 Ban

The last time a decline of this magnitude occurred was in July 2021. At that time, the Chinese government banned massive Bitcoin mining activities.

But unlike the geopolitical crisis, this downturn was triggered by natural and economic factors. The combination of extreme weather and cost pressures is the main cause of the weakening crypto mining activity.

3. Extreme Weather Disrupts Miners’ Operations

Severe winter storms in North America were one of the main triggers. Power grid disruptions forced many miners to temporarily suspend operations.

In regions like Texas, Bitcoin miners participate in demand response programs. They reduce electricity consumption during peak loads to maintain the stability of the energy grid.

4. Energy Prices Rise, Old Miners Displaced

The spike in electricity prices has sharply increased operating costs. Miners with old and inefficient devices are most affected.

For them, cryptocurrency mining activities turned uneconomical. As a result, many rigs are permanently or semi-permanently shut down.

5. Bitcoin Production Costs Nearly Rp1.14 Billion

According to industry estimates, the average cost of mining one Bitcoin is USD67,704. If converted, the value is around Rp1.14 billion per BTC.

With the price of Bitcoin once below USD70,000 or around Rp1.18 billion, profit margins have become very thin. Some miners are even operating at a loss.

6. Long-term Impact on Crypto Ecosystem

A decrease in mining difficulty can give breathing room to miners who are still surviving. With a lower difficulty level, the chance of earning BTC becomes a little easier.

But broadly speaking, this reflects the structural pressure on the cryptocurrency industry. Only miners with high efficiency and strong capital are able to survive this phase.

Overview for Investors and Beginners

For crypto investors, mining dynamics are important to understand as they affect network security and Bitcoin supply. The pressure on miners often coincides with difficult market phases.

For beginners, this phenomenon shows that the cryptocurrency ecosystem is not only affected by price. Energy, weather, and operational costs also play a big role in keeping the network sustainable.

Also Read: 5 AI Perspectives: Will XRP Fall Below $1 in February 2026?

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Oluwapelumi Adejumo / BeInCrypto. Bitcoin Mining Difficulty Hits Its Biggest Drop Since 2021 China Ban. Accessed February 9, 2026.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.