DeFi Adoption 2023: Trends, Potential, and Challenges

The DeFi sector is one of the largest sectors in the cryptocurrency industry. It enables financial activities that are otherwise difficult from the traditional financial perspective. Traditionally complicated financial activities such as lending and borrowing are made simple using DeFi. So, DeFi has managed to attract thousands of users with various financial products. In recent years, the DeFi adoption rate has continued to increase, including in 2023. This article will break down the current adoption rate for the DeFi sector.

Article Summary

- 📈 The DeFi sector has been able to attract thousands of users thanks to the simplification of financial activities that are usually complex, with adoption increasing every year.

- 🌏 Emerging economies such as India, Nigeria, Vietnam, and Indonesia are leading the way in the 2023 DeFi adoption index.

- ⚙️ The 2023 DeFi adoption trend reflects significant change as the sector accounts for more than 50% of total crypto transaction volumes in some regions.

- 🧠 Despite the increase, DeFi adoption faces challenges such as unclear government regulations and hacking risks, which are still a barrier for retail and institutional users.

Global DeFi Technology Adoption Index in 2023

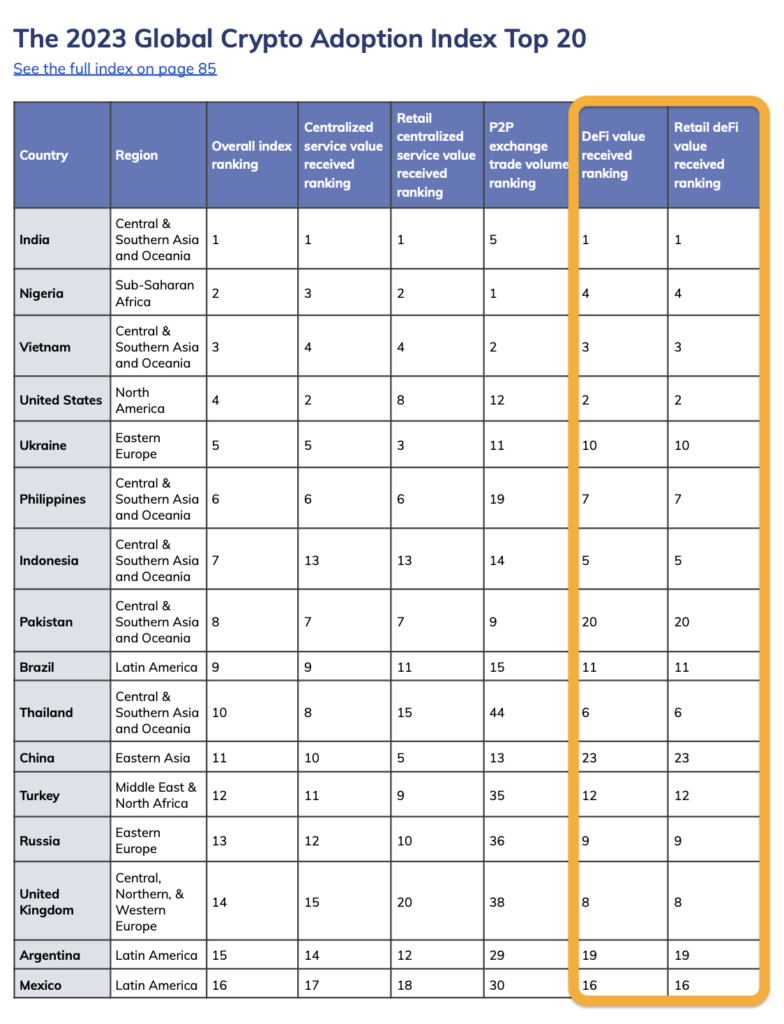

The 2023 global cryptocurrency adoption index underwent various changes. Developed countries such as the US, China, Russia, and the UK are losing ground. On the contrary, developing countries such as India, Nigeria, Vietnam, and Indonesia have risen to the top. This trend shows the rapid development of crypto adoption in many developing countries.

Recommended reading: the Global Crypto Adoption Index 2023.

However, this adoption is not evenly distributed across countries and each country has different adoption sectors. For example, Indonesia is in 7th position but has a DeFi position score of 5th. This shows that Indonesia’s DeFi sector adoption is quite high compared to its P2P and CEX adoption.

There are some anomalies in the DeFi adoption rate above. Several interesting things from the 2023 DeFi adoption index:

- Some countries such as Indonesia, the US, Thailand, Russia, and the UK have high DeFi adoption rates compared to their centralized crypto adoption.

- Indonesia and Nigeria saw the most dramatic rise from 2022. Nigeria takes 4th place, up 14 places from 17th in 2022. Indonesia is in 5th place, up 13 places from 18th in 2022.

- China experienced the highest decline in DeFi adoption, dropping from 6th place in 2022 to 23rd place in 2023.

- India maintains its peak position from 2022 and has equal DeFi and CEX adoption.

- Five of the 10 countries with the highest DeFi adoption are from the Asian continent (Indonesia, India, Thailand, Philippines, and Vietnam).

DeFi Adoption Trends in Some Regions

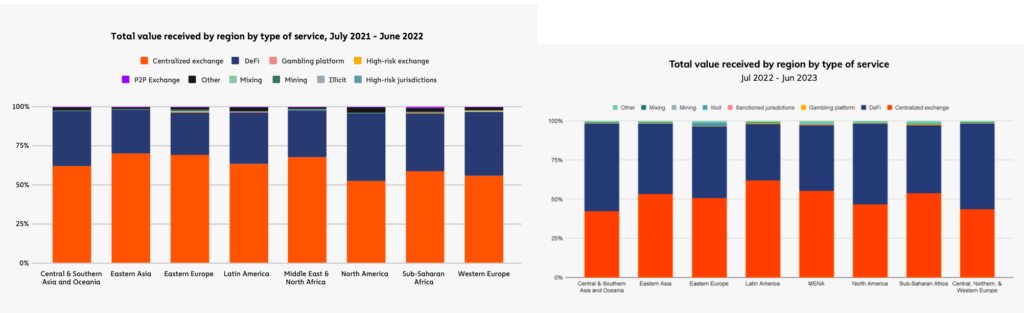

A comparison of DeFi transaction volumes from 2022 to 2023 also shows significant changes. In 2022, the value of the DeFi sector did not exceed 50% in any of the eight regions measured by Chainalysis. However, the DeFi sector accounted for more than 50% of the transaction volume in Asia (CSAO), North America, and Europe (western, northern, and central) in 2023.

In the right chart, we can see that the DeFi sector accounts for around the 50% mark in all regions except Latin America. The most significant change is shown by the CSAO region (Southeast Asia, Central, and Oceania) while the Latin America and Sub-Saharan Africa regions stagnate. East Asia, Eastern Europe, and MENA (Middle East and North Africa) experienced roughly equal increases

1. CSAO Dominates in DeFi Adoption

The growth of DeFi adoption in the CSAO (Central and Southeast Asia and Oceania) region is very high. The DeFi sector takes up 55.8% of overall crypto asset transactions in the CSAO region, up from 35.2% in 2022. However, each country in CSAO has its own unique characteristics in their adoption of DeFi and crypto as a whole.

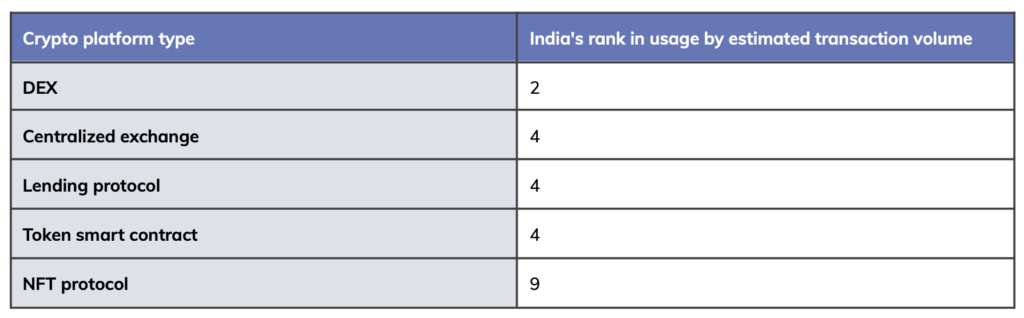

India is the country with the highest adoption of DeFi worldwide. It is also 2nd in the world in DEX transaction volume. Furthermore, India is also 4th in the use of lending protocols and smart contracts.

All of this has been achieved despite the Indian government having very punishing cryptocurrency regulations. India has a 30% tax on profits made through crypto and a 1% tax on all crypto transactions.

The adoption of the DeFi sector in various countries in CSAO is also supported by the increasing number of crypto projects from this region. The presence of Sky Mavis, Coin98, and many CEXs in the CSAO region facilitates easy access to the DeFi world and Web3 as a whole.

2. DeFi Adoption in North America is Declining

North America in recent years has become a home for the DeFi industry. The United States took 2nd place for the second year in a row in the value of the DeFi sector from retail users. However, the US regulatory situation poses a threat to the sector.

Although the transaction value of the DeFi sector in North America is still stable, the DeFi market share in total crypto activity has decreased significantly. This is most likely related to the bear market conditions that had a major impact on the DeFi sector.

Furthermore, the highly negative climate of US crypto regulation also likely had an impact. Many crypto projects have banned or restricted the activity of users from the United States for fear of getting sued by the SEC.

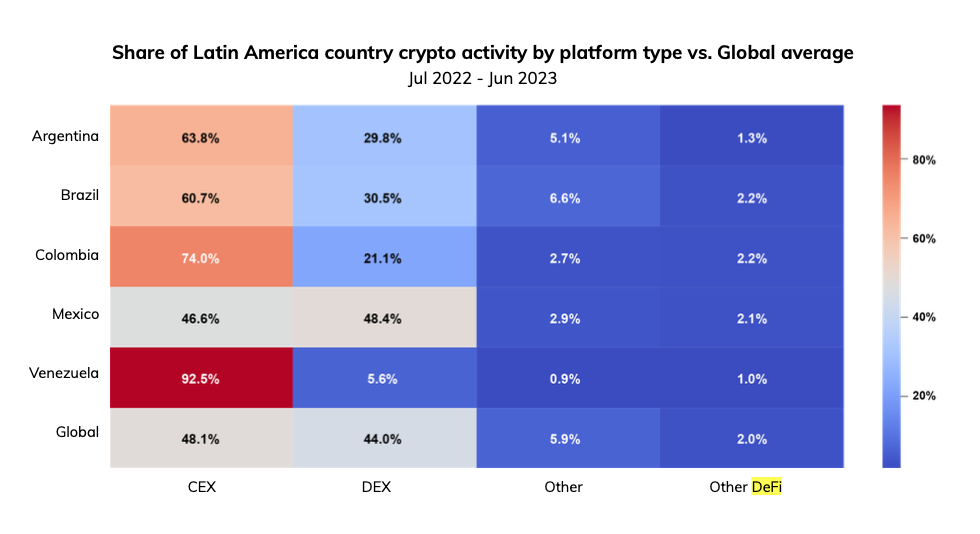

3. Low DeFi Adoption in Latin America

Latin America is the region with the second smallest transaction volume after Sub-Saharan Africa. Cryptocurrency usage in Latin America is dominated by grassroots adoption. The majority of cryptocurrency holders in Latin America use it to fight the high inflation rates of fiat currencies (Argentina and Venezuela).

In the DeFi sector, Mexico is the only Latin American country with a DeFi adoption on par with world standards. Brazil, Argentina, and Colombia follow in the 20%-30% range of DeFi activity. Finally, Venezuela has the lowest DeFi usage, at just 5.6%. As mentioned, this low number is likely related to the more common use of cryptocurrencies as a hedge against currency inflation (400% in 2023).

4. The Growing DeFi Adoption in Central, Northern, and Western Europe

DeFi accounts for the highest percentage (54.8%) of overall crypto transactions taking place in the region. DEX is the most widely used application in this sector. Furthermore, DeFi users in the CNWE (Central, North, and West Europe) region are predominantly retail. Institutional users are coming to CNWE, especially with the MiCA regulation set to be implemented in 2024.

The figure above also shows something interesting about the DeFi sector. There are only eight countries with positive capital inflows to the DeFi sector. With 58.4% of overall crypto transactions coming from DeFi, this means that these eight countries contribute a very large volume of transactions.

The UK in particular has the highest crypto adoption rate in the CNWE region. The UK ranks 14th on the crypto adoption leaderboard with the 8th DeFi adoption position in the world. With clear crypto regulation (FSMA), UK crypto adoption is likely to continue to rise.

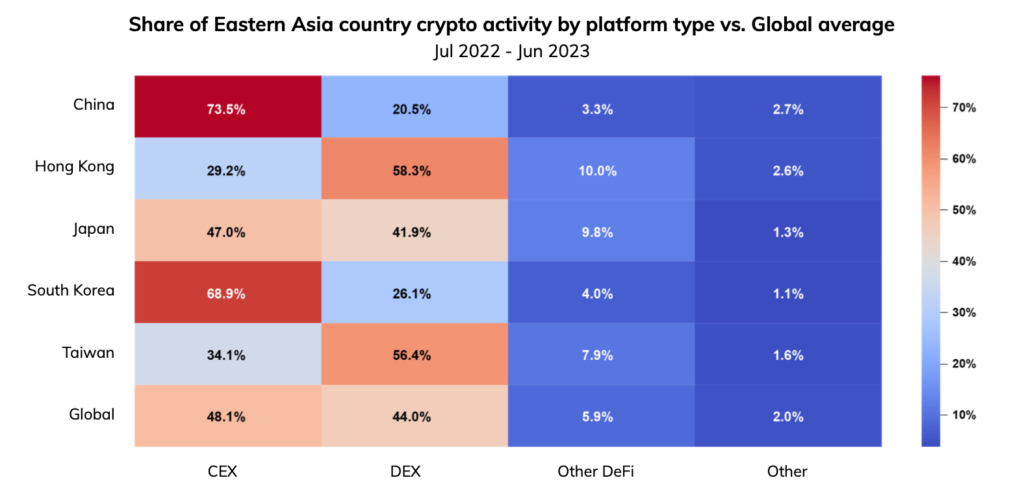

5. DeFi Adoption in East Asia Continues to Grow

The division between crypto platform activities in the East Asia region is quite diverse. Countries in the region have two axes, CEX-leaning or DeFi-leaning. The only exception is Japan, which has a fairly balanced adoption rate of centralized and DeFi platforms.

China, which legally still closed its access to crypto, has a very high usage of centralized platforms. South Korea is a similar story as it has much higher CEX users than DeFi. The Terra crash had a huge impact on South Korean crypto users and created a negative perception of the DeFi sector.

In contrast, Hong Kong and Taiwan users prefer DeFi platforms such as DEX over CEX. The high usage of DeFi in Hong Kong is not unusual given that its first CEX platform for retail has just opened.

The Future of DeFi Adoption

The DeFi sector has seen many developments in recent years. From the initial creation of UniSwap and various protocols in DeFi Summer 2020 to today being the largest sector in the crypto industry. Currently, about $43.8 billion dollars are stored in hundreds of DeFi applications.

However, the adoption of DeFi has not gone hand in hand with the adoption of crypto in general. Various hacking cases and the difficulty of using the DeFi protocol are the biggest hurdles in the slow adoption of DeFi. Both of these create huge risks for retail and institutional users.

Many DeFi protocols have recognized these two weaknesses and developed ways to overcome them. One concrete example is MakerDAO, which has managed to attract several traditional financial companies. In addition, the cooperation of various crypto projects with large financial institutions is also paving the way for DeFi adoption.

For retail, many technological developments exist to provide additional security against hacking and fraud in DeFi. A new generation of digital wallets such as Avocado and Rabby help retail users when transacting using DeFi protocols. In addition, there are now sites like Dexscreener that provide information about token security.

The number of DEX applications using advanced technology also reduces the possibility of hacking and provides many options for DeFi users. Also, there are currently many innovations in the DeFi sector that will open up new opportunities for users. As the largest sector in the crypto industry, the adoption of DeFi is slowly following the increasing adoption of crypto.

Conclusion

The DeFi sector is showing significant growth in the crypto asset industry, with adoption continuing to rise, especially in developing countries. However, there is unevenness in this adoption, depending on the region and local policies. Despite the challenges of hacking and the complexity of use, the sector continues to grow, supported by innovation and cooperation with financial institutions. With increased security and ease of use, DeFi has the potential to follow the growth of cryptoasset adoption more broadly.

How to Buy Cryptocurrency on the Pintu App

You can start investing in cryptocurrencies by buying them on the Pintu app. Here is how to buy crypto on Pintu:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for your favorite asset.

- Click buy and fill in the amount you want.

- Now you are a crypto investor!

You can trade various cryptocurrencies on Pintu such as BTC, ETH, and SOL. In addition, the Pintu application is compatible with various popular digital wallets such as Metamask to facilitate your transactions.

Go and download the Pintu cryptocurrency app on the Play Store and App Store! Pintu is regulated and supervised by Bappebti and Kominfo.

You can also learn crypto through the various Pintu Academy articles which are updated every week! All Pintu Academy articles are for educational purposes, not financial advice.

References

- Chainalysis team, “Chainalysis: The 2023 Global Crypto Adoption Index”, accessed on 6 November 2023.

- Gideon Ng, “Embracing Decentralization: Unlocking the Benefits of DeFi in Southeast Asia”, KrAsia, accessed on 7 November 2023.

Share

Related Article

See Assets in This Article

LUNA Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-